- As traders continue to bet heavily on global central bank easing, silver prices remain extremely bullish.

- Furthermore, it's possible that industrial demand will increase if they do loosen monetary policy.

- This will have a significant impact on the silver markets overall, and therefore I think you have to look for value.

Silver

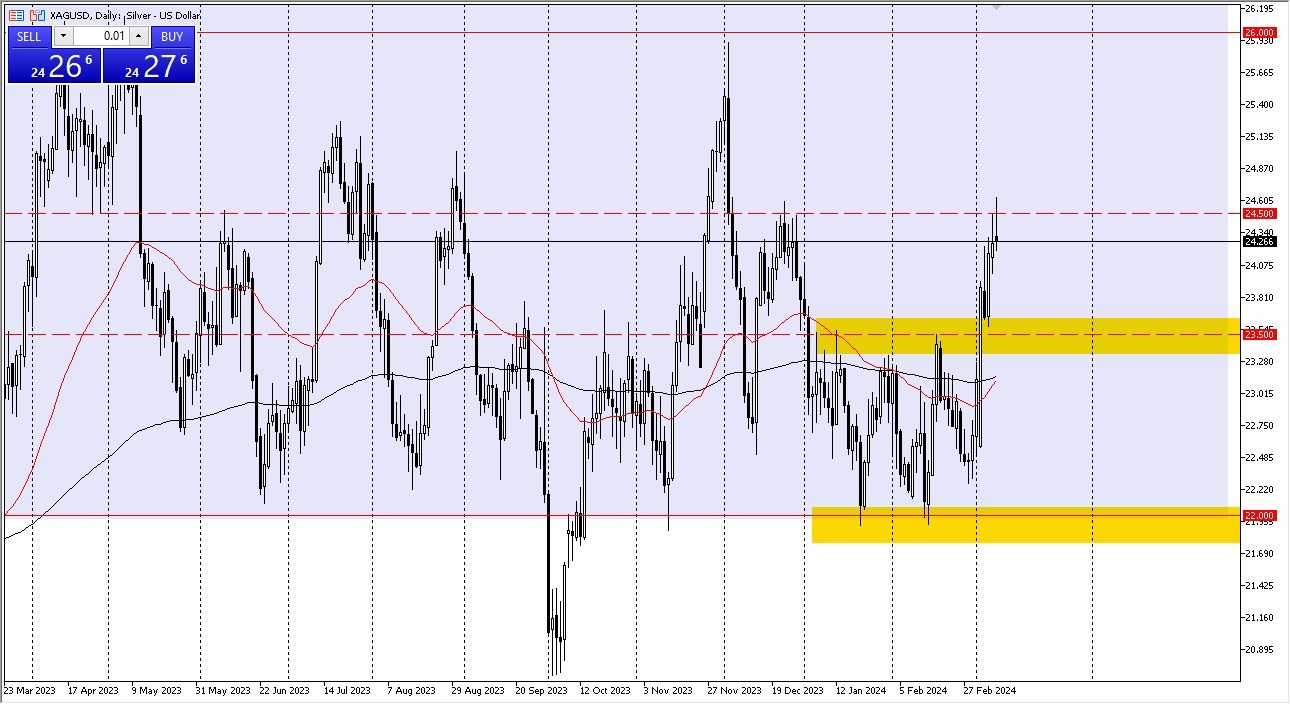

The $24.50 mark, which I believe will continue to provide a lot of resistance, has been tested by the silver market's rally. It's intriguing that after reaching that level, we reversed course and displayed life. If everything else is equal, I believe that this market will eventually peak, and you should view the brief declines as a chance to purchase. I believe there is a chance for a move to the $26 level if we are able to close above the $24.50 mark every day. I consider the $23.50 mark to be a significant support level below.

If everything else is equal, it's also important to note that some longer-term traders may want to take note of the fact that the 50-day EMA is about to make a "Golden Cross" crossing above the 200-day EMA. To be fair, there has been a significant surge in the price of gold, which will inevitably have some ripple effects on the silver market. Nevertheless, because silver is an industrial metal as well, it behaves somewhat differently.

I believe you still have a buy on the dip mentality, but you shouldn't enter the silver market with a large position because, to be honest, it is a very volatile and occasionally dangerous market. The major ceiling that silver will be testing if we break higher is $26. Observe interest rates. It does have a slight negative correlation, and the US dollar naturally has a negative correlation the majority of the time. I do, therefore, enjoy silver. Simply put, I believe it to be a little stretched right now. That being said, you will need to do just that—you can find value along the journey. To be honest, I have no interest in shorting silver because of how rapidly its price has increased. Having said that, gold appears to be the better option right now.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.