- Despite the market's commotion on Friday, silver appears to be consolidating and may be establishing a case for positive pressure in the longer run.

- Strange, but then again, silver may be a beast all by itself at times, as there is so much in the way of volatility.

- This market will continue to see a lot of choppiness, but I do believe that in the end, the silver bulls could be rewarded for their patience.

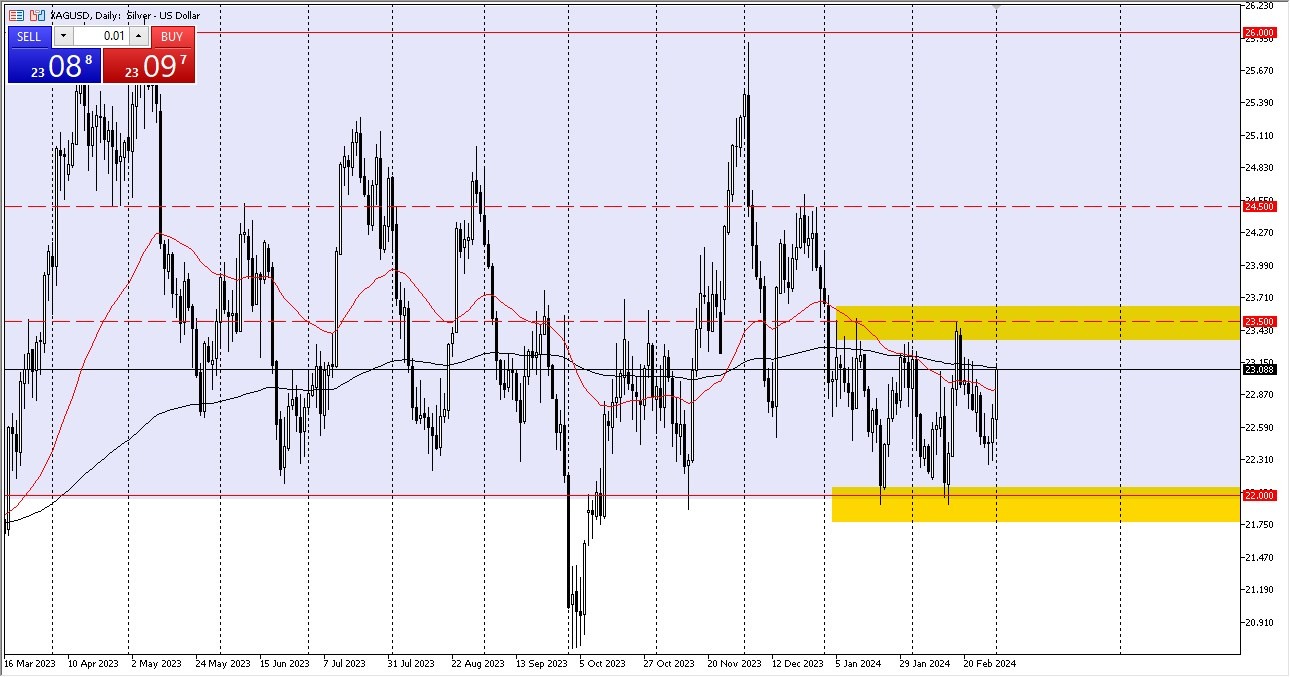

Throughout the early hours of Friday, Silver has fluctuated as we keep moving around and attempting to decide what to do next. When everything else is equal, I believe the silver market will remain inside the general consolidation area that has been between the $22 bottom and the $23.50 top. Since this location has proven to be quite dependable, I believe that many people will continue to appreciate it in the near future. But walls do ultimately come down, and this will be a significant development that is just waiting to occur.

If everything else is equal, you should also be watching the 50-day EMA, which is located slightly above. Should we be able to break the price above, we may then go at the 200-day EMA. Overall, I believe that the same factors that have been driving this market for some time will continue to do so. These factors include interest rate differentials, changes in the bond market's interest rates, the strength of the US dollar, traders' global risk appetite, and, of course, industrial demand.

Given how bullish it had been over the previous few days and the fact that we are so close to a significant support level, it appears that this is still a buy on the dip situation overall. You do, however, need to view it through that lens. Therefore, you have to consider this a situation where you're attempting to discover value as long as we can stay above $22. It is unclear whether we will be able to surpass the $23.50 mark at this time, but I am confident that we will at least attempt to get there. The chance of a move to $24.50 is there if we were to break above $23.50. At this point, I would expect noise, but ultimately I think we have some relatively reliable price points to pay attention to.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.