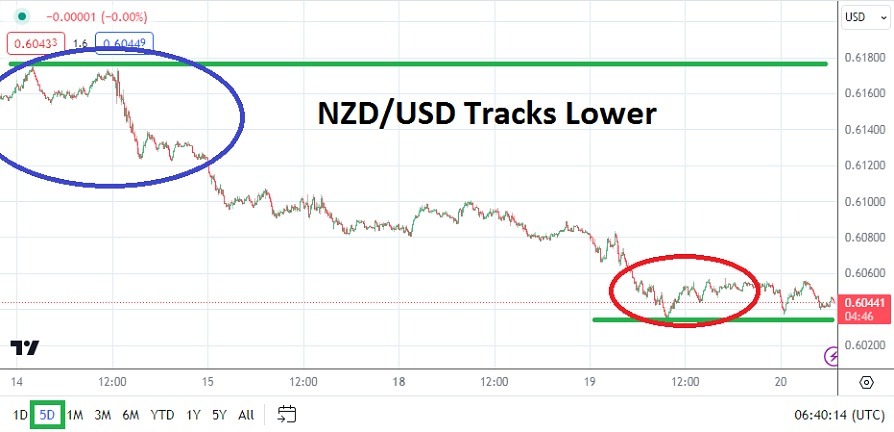

- The NZD/USD is trading near the 0.60480 ratio as of this morning. A low of 0.60350 was challenged yesterday.

- The flirtation with higher values in the NZD/USD in February and the hope that December 2023 bullish prices would be challenged again has become problematic for speculators who have remained buyers of the currency pair.

Last week’s stronger than expected inflation data from the U.S served as a warning for financial institutions that global central banks are being confronted with rather lackluster economic growth, but higher consumer prices. The U.S Federal Reserve will announce its FOMC Statement later today and no change to the Federal Funds Rate will be seen.

Optimism versus Patience in the NZD/USD

Support levels in the NZD/USD have become vulnerable, yesterday’s and this morning’s trading in the NZD/USD have not been able to perform a strong reversal higher, which highlights that financial institutions remain nervous going into the Fed’s pronouncements. The Fed was widely expected to become dovish during 2024, but CPI and PPI data from the States has created the realization that prices remain sticky, and it is unlikely the U.S central bank will be able to cut interest rates more than twice the remainder of the year. Yes, economic metrics can change, but optimism about the Fed changing monetary policy aggressively will need more patience.

The ability of the NZD/USD to fall below the 0.60500 and provide sustained trading could cause additional worries for bullish speculators. Traders looking for a sudden move upwards to be generated based on the belief the New Zealand Dollar is oversold should be cautious. Support levels being tested in the short-term may appear durable because of six month technical charts, but it is clear the NZD/USD has also traded below its current values.

Volatility Today and More Tests in the NZD/USD

Bias is an important component of trading, but it is not a welcome characteristic. Bias can be quite dangerous. Traders need to be able to change their thinking quickly. While it may prove wise to think the NZD/USD is oversold and will recover, for the moment selling has been rather strong. If the 0.60200 level is penetrated lower this would be dramatic for the NZD/USD but is within the realm of possibility.

- Short-term traders should expect volatility to build later today as the U.S Federal Reserve is about to release their monetary policy rhetoric.

- The Fed is likely to sound cautious, but also remain politically optimistic and say they see signs of ‘improving’ conditions.

Financial institutions will likely still have unclear outlooks regarding monetary policy from the U.S after today’s FOMC Statement. The double-speak from the Fed is likely to cause choppy trading later today and into tomorrow.

NZD/USD Short Term Outlook:

Current Resistance: 0.60545

Current Support: 0.60420

High Target: 0.60755

Low Target: 0.60185

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.