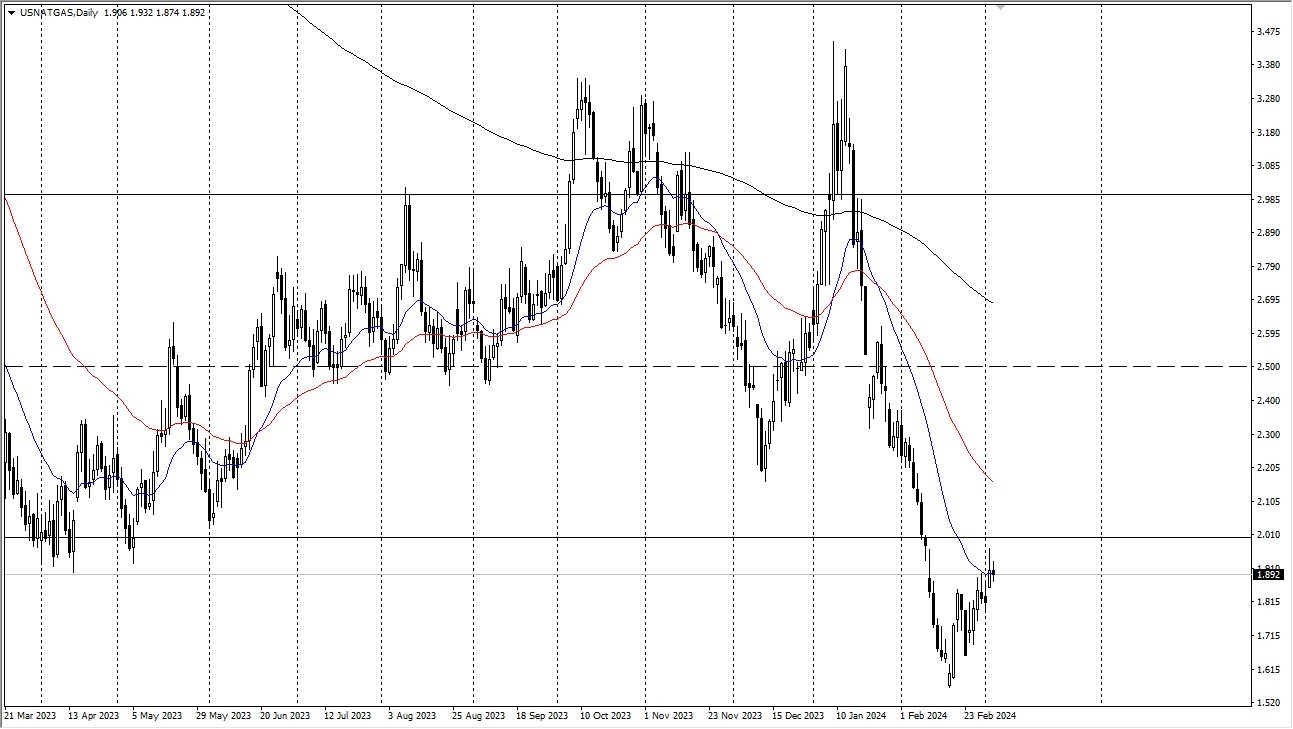

- The natural gas markets have retreated in the early hours of Tuesday as we continue to view the $2.00 level as a significant resistance barrier, given its historical significance as a point of support for a phenomena known as "market memory."

- Observing the natural gas markets during the Tuesday session, it appears that they are retreating from the $2 level, which is possibly more significant than their retreat from the 20-day EMA.

- Naturally, the $2 level is one that will draw a lot of attention from traders. In addition to its substantial value, traders view this level as psychologically significant because it has historically provided strong support.

“Market memory?”

I do believe that market players will continue to view this through the lens of market memory. I believe there's a good chance natural gas will breakout for a much larger move if we can break above the $2 mark. Although I'm not sure if that will happen, I do acknowledge that there is a chance that traders may continue to view the current price as unusually low when compared to previous prices. It is inevitable to inquire eventually about the possibility of drillers leaving the fields by merely walking away. Nobody wants to drill for natural gas and end up broke, after all. Ultimately, I believe we could investigate the $2.50 level if we are able to break above the 50-day EMA.

In the long run, this is an excellent swing trade, but you must be prepared to tolerate volatility. The only way I know to do that is to just remove the leverage; you could even consider taking a modest stake in CFDs or investing in an ETF or something similar. Right now, you don't want to be heavily leveraged in the natural gas markets. This could continue to go off course for the remainder of the summer, which would make some historical sense given that demand generally tends to decline. But whether or not that will be the case is still unknown at this point. This is a market that will continue to see a lot of volatility, but we could be setting up for a massive swing trade over the longer-term.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodity trading brokers to check out.