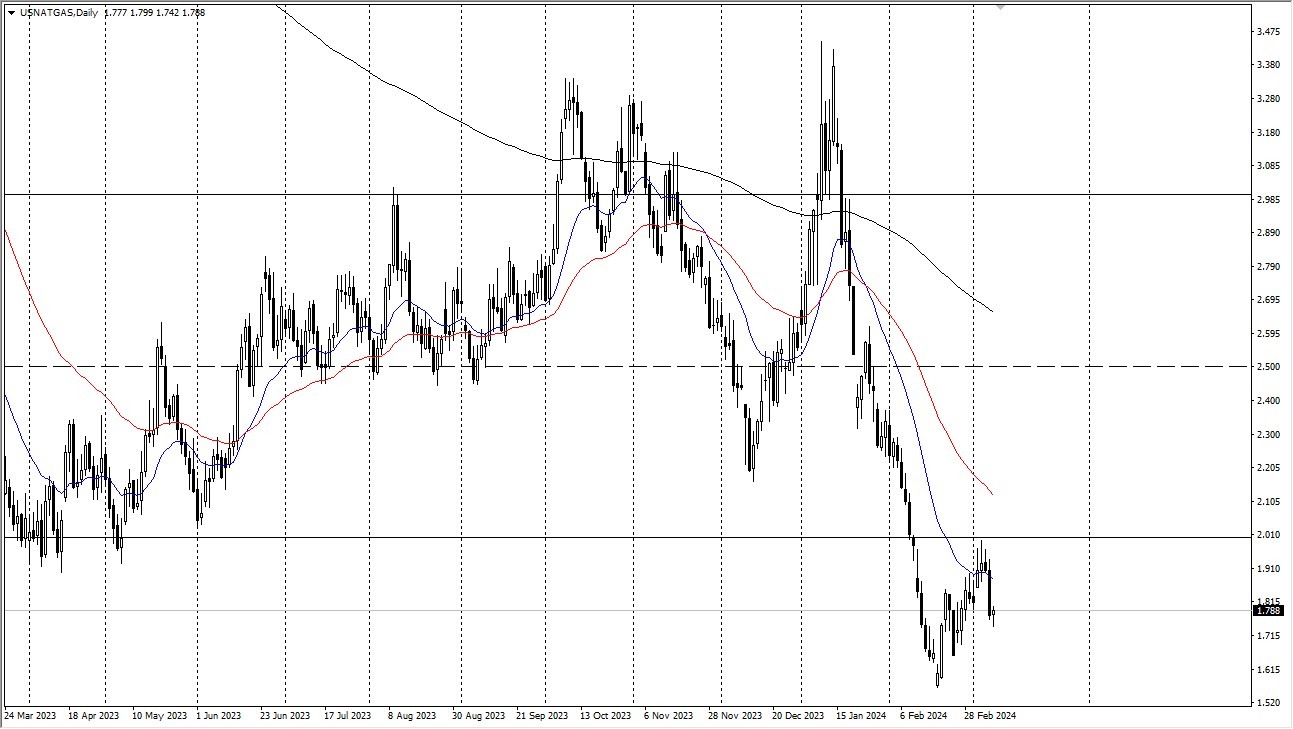

- Over the past few days, the natural gas markets have somewhat retreated; however, on Friday morning, the market appeared to have slightly stabilized.

- That being said, I think there is a lot of noise just waiting to happen, and therefore I think you have to look at this as a longer-term market.

Natural Gas

As you can see, the natural gas market really ended up being fairly quiet overnight, so we are currently in a somewhat stagnant state. Having said that, I believe we are still in the middle of a significant consolidation pattern, so it is currently challenging to take a very aggressive stance.

In any case, the $2 level, which I believe will act as a bit of a barrier, will be closely watched in this market. Just as breaking below the $1.50 mark would also be highly noteworthy, breaking above that will draw some attention. These two areas have both been significant in the past, and now that we have seen such a strong sell-off, I believe we are in a pattern where we are merely attempting to determine whether the market can turn things around from the perspective of longer-term swing trading. The natural gas markets will remain extremely challenging to trade short-term. I'm not particularly thrilled about doing that, for that reason. I add to an ETF position after watching for dips.

I use an ETF because it eliminates a significant amount of leverage, relieving me of concern about daily fluctuations. It's not really a retail type of short-term setup, so if you're looking to trade natural gas on a daily basis, you're looking to blow up your account from the start. Furthermore, you also need to stay up to date on changes in the weather patterns in the United States and the Northeast. The majority of retail traders are unaware that the natural gas contracts they trade are Henry Hub contracts, which are primarily based on domestic supply in the United States.

I use an ETF because it eliminates a significant amount of leverage, relieving me of concern about daily fluctuations. It's not really a retail type of short-term setup, so if you're looking to trade natural gas on a daily basis, you're looking to blow up your account from the start. Furthermore, you also need to stay up to date on changes in the weather patterns in the United States and the Northeast. The majority of retail traders are unaware that the natural gas contracts they trade are Henry Hub contracts, which are primarily based on domestic supply in the United States.

Although demand declines as the United States approaches spring, external markets can still have an impact. Therefore, I believe we will continue to swing around for a while. We might experience a heat wave in the middle of summer to raise prices, or we might experience the final winter storm. In essence, that's what you're relying on.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodities brokers to check out.