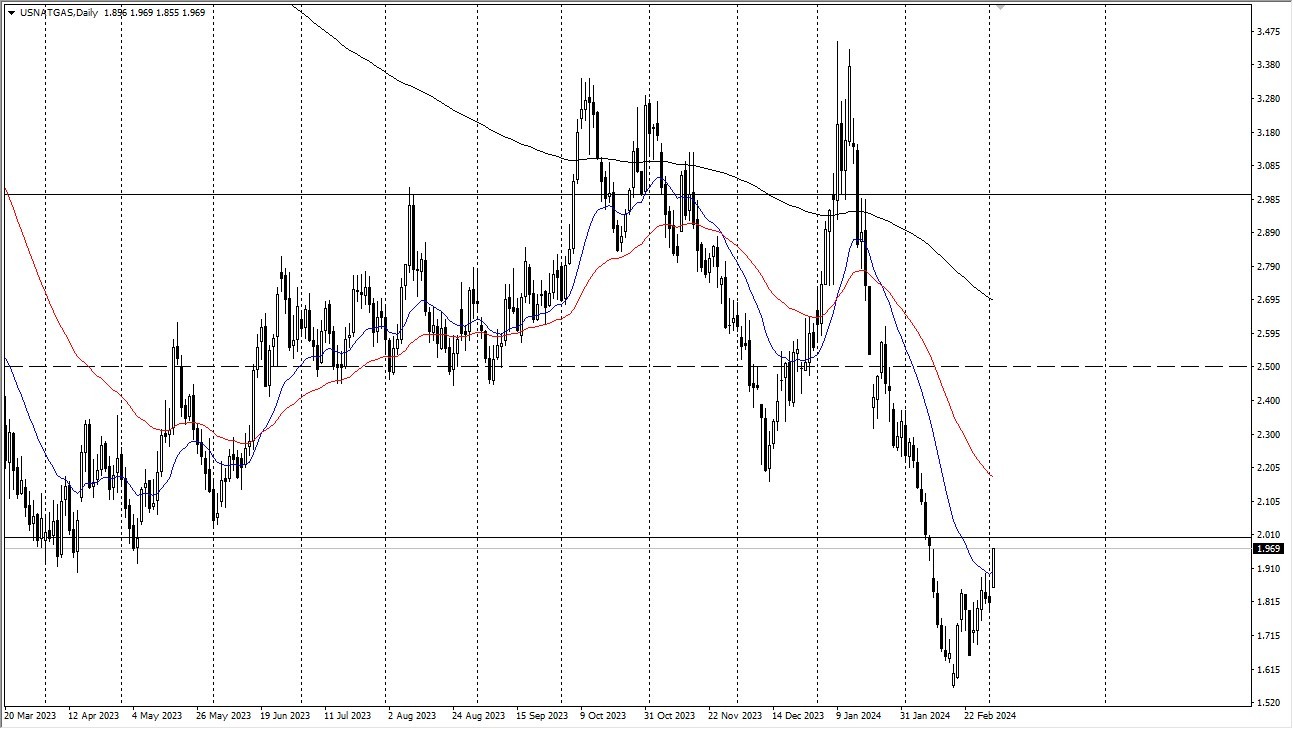

- The early hours of Monday saw some recovery in the natural gas markets as it appears that we are attempting to reclaim the $2 level, which is very important.

- It does make some sense because, all else being equal, this market had been oversold.

Natural Gas is Still Bouncin

Monday's natural gas markets saw an early morning surge as it appears that the slight rebound is still going strong. I believe that the $2 level will be quite important at this point, so keep an eye on it. It's highly likely that we move much higher and might even attempt to reach $2.50 in the long run if we can break over the $2 mark.

Having said that, there's a reason the market is depressed; quite simply, there is simply too much natural gas available. However, historically speaking, we are at an incredibly low point, and I do believe you have a situation where a great deal of short covering might be involved.

Although this isn't necessarily the best season for natural gas, the market has moved so much lower that it does make sense that we would see a substantial rebound. Right now, I just want to wait for the market to level off following this surge before maybe entering the long side. This move shouldn't come as a huge surprise because the $1.50 level below has been a significant floor in the market for several years now. It is advisable to use caution and patience when entering this market, as it has demonstrated tremendous negative volatility in a short period of time, necessitating a moment to catch one's breath.

In any case, I have no desire to short natural gas at this incredibly cheap price, and I plan to participate using little leverage or the ETF, UNG, which allows you to play it on the stock exchanges. The most important lesson is to avoid becoming too leveraged in a market that can be quite risky and turbulent at times. Essentially, this is a swing trade opportunity.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodities brokers to check out.