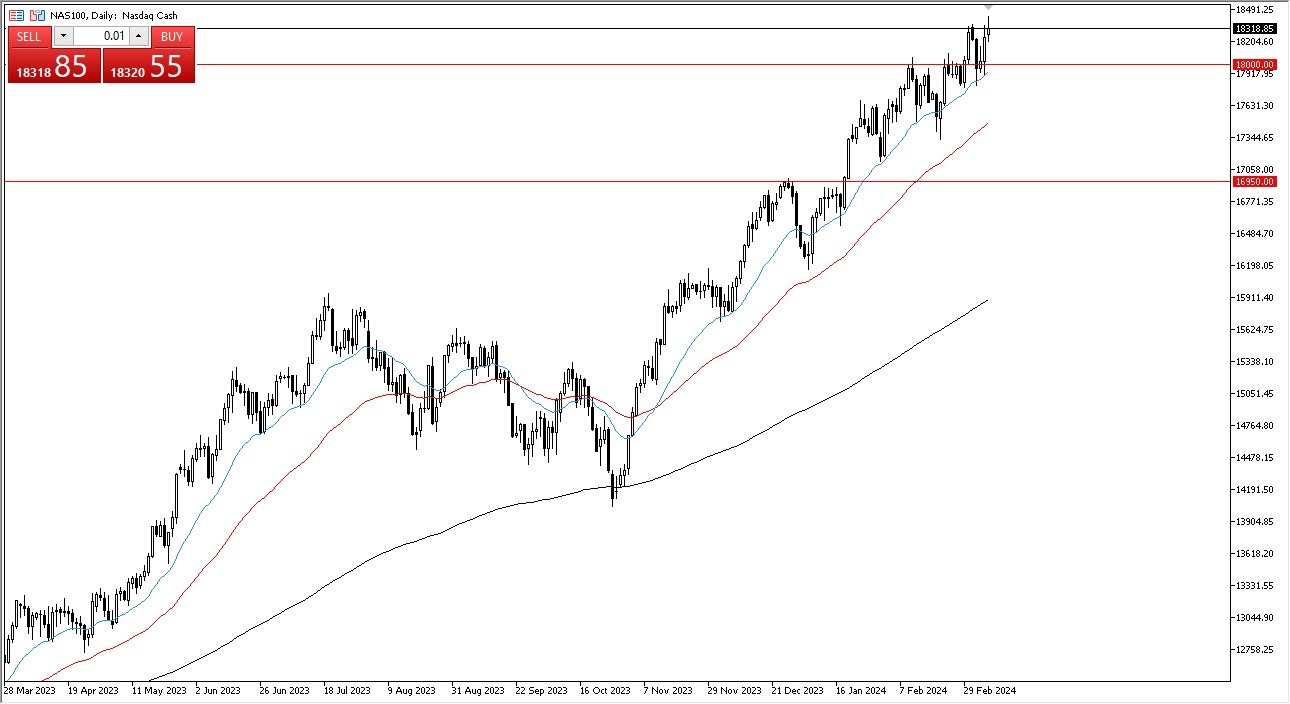

- Since there is still a lot of momentum chasing, the NASDAQ 100 continues to attract buyers on dips.

- Having said that, I believe you should approach this through the lens of always looking for value when you have the chance, as the market is likely to see significant volatility.

- Because of this, you need to be cognizant of the idea of the position sizing.

NASDAQ 100 Continues to See Buyers on Dips in General

As you can see, this market is still under a lot of upward pressure. Furthermore, I believe that it will probably not be long before we break even higher. Due to the significant amount of erratic upward momentum. Remember that Jerome Powell recently said that rate cuts by the Federal Reserve are expected later this year, which naturally keeps stocks rising. The jobs report on Friday was somewhat lower than expected, which only serves to validate that as a very real possibility. A weakening economy will, of course, be welcomed by Wall Street as it means lower interest rates.

As always, it's important to keep in mind that the Nasdaq 100 is led by a small number of stocks, so if the typical stocks are all rising, the index will follow suit. Short-term pullbacks continue to be buying opportunities. I trade this market as one that views dips as chances to acquire value. Before we look at the 18,500 level, or perhaps even the 19,000 level, it's probably only a matter of time. I consider the 18,000 level and the 20-day EMA, which are located immediately below it, to be important support levels below.

Stock market shorting is not something that interests me. Quite frankly, at this point, the momentum is just too strong to resist. Therefore, until something fundamentally changes, I believe there will be plenty of people willing to enter the market and chase it every time it pulls back. I don't think that will occur. In light of all of that, I believe we are looking at a situation where we simply continue upward. However, the lesson we have learned over the last few weeks is that anytime we pull back, the market is likely to witness a lot of value hunting.

Ready to trade the NASDAQ 100 Index? Here are the best CFD brokers to choose from.