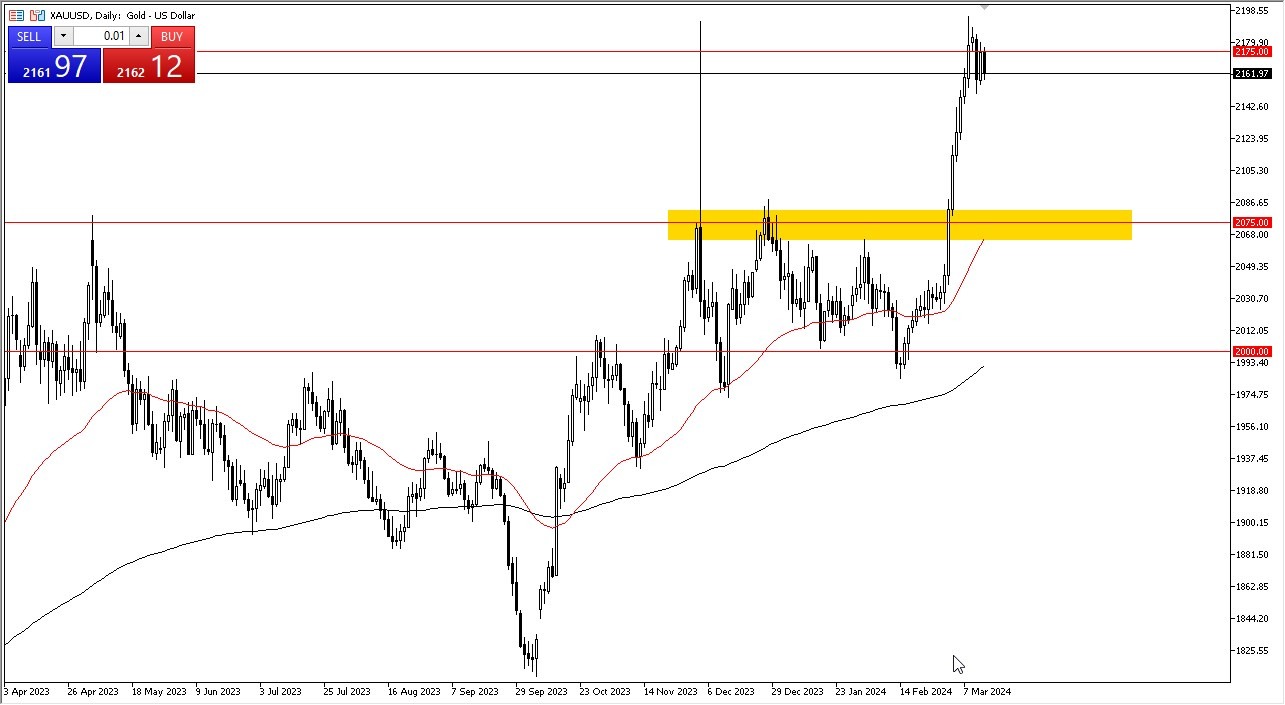

- The gold market pulled back just a bit during the trading session on Thursday, but quite frankly it still looks very strong.

Keep in mind that the $2175 level is an area that we have been paying attention to for some time and I think it’s probably only a matter of time before things turn back around. That being said, this is also what I would consider to be a very noisy market, as we have seen so much in the way of concern.

Gold of course has a lot of different things and influencing it, not the least of which is going to be geopolitical concerns, and of course the fact that the central banks around the world will be cutting rates is another thing that people will be paying close attention to. Ultimately, this is a market that given enough time will find buyers, but we may need to pull back in order to attract value hunters. After all, the market went straight up in the air rather quickly and I think you have to be cognizant of that. With that being the case, the market is likely to continue seeing a lot of noisy behavior, but ultimately there will be a time where value hunters step back in.

The $2075 level

The $2075 level has been important more than once and therefore think you have to pay close attention to it. Ultimately this is a situation where the market participants will continue to look at gold as a safe haven, but it’s also a way to get away from the loosening monetary policy that is almost certainly coming down the road. Furthermore, you have a lot of geopolitical concerns in the Middle East that people will be paying attention to, so it is certainly something that comes to mind.

The market participants will continue to weigh the value proposition of gold, but at the very least I think we need to go sideways in order to find enough value hunters to come in and join the fray. I certainly would not short gold at the moment, it has been far too strong, and I just don’t see how that changes anytime soon given the interest rate situation in the geopolitical environment.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.