- All things considered, gold markets remain bullish because, despite an exciting Friday session, Monday began with traders essentially waiting for a signal of some kind.

- But it didn't take long for purchasers to arrive and swarm the market.

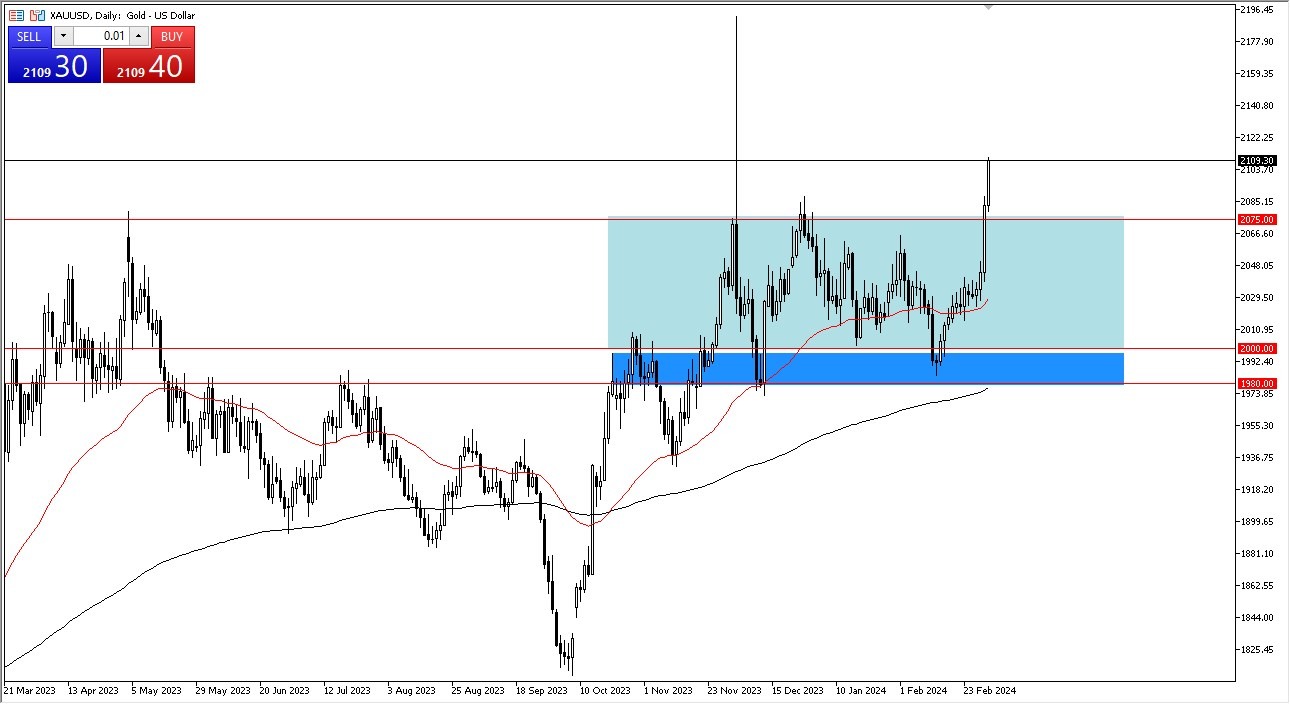

Looking at the gold market, you can see that following an exciting Friday session, the day began rather calmly at first. In light of this, it appears that the market will remain quite positive over the long run. In the current trade environment, I just don't see how this changes, and the macroeconomic circumstances also support this theory. This is particularly true now that New York entered the picture and sent the market screaming upwards through the roof.

Buying Pullbacks Remains the Way Forward

Right now, though, I do think it makes sense to buy into short-term pullbacks since traders will continue to see this through the lens of global central banks' relaxation of monetary policy, which will increase the price of gold. In addition, a lot of individuals will need to pay special attention to the numerous geopolitical issues that are out there and could become relevant.

I believe that the 2050 level below will remain a hard floor. Because it has experienced such a significant spike higher, I honestly don't know if we will ever again reach the $2,000 mark. The market is likely set to soar higher overall if we can breach the Friday session highs, which are roughly 2088. That implies that although it won't be simple or move up in a straight line, it will nonetheless rise.

Nevertheless, I think it makes sense to search for brief declines to capitalize on and obtain value in the interim. As of right now, there isn't a situation in which I could be a seller in this market. It is still powerful. To be quite honest, I also believe that you should bear in mind that central banks all over the world are buying more gold than they are selling it, which has a significant impact on this market as well. I personally purchase the dips whenever I can.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.