- Friday's gold market surge is still going strong since all of the market's moving parts appear to be pointing toward higher prices in the end.

- It looks like a lot of "big money" is betting on gold, which could be one of the biggest transactions later this year.

- It's important to remember that central banks are also significant purchasers.

Gold Continues to Look Supported and Loved

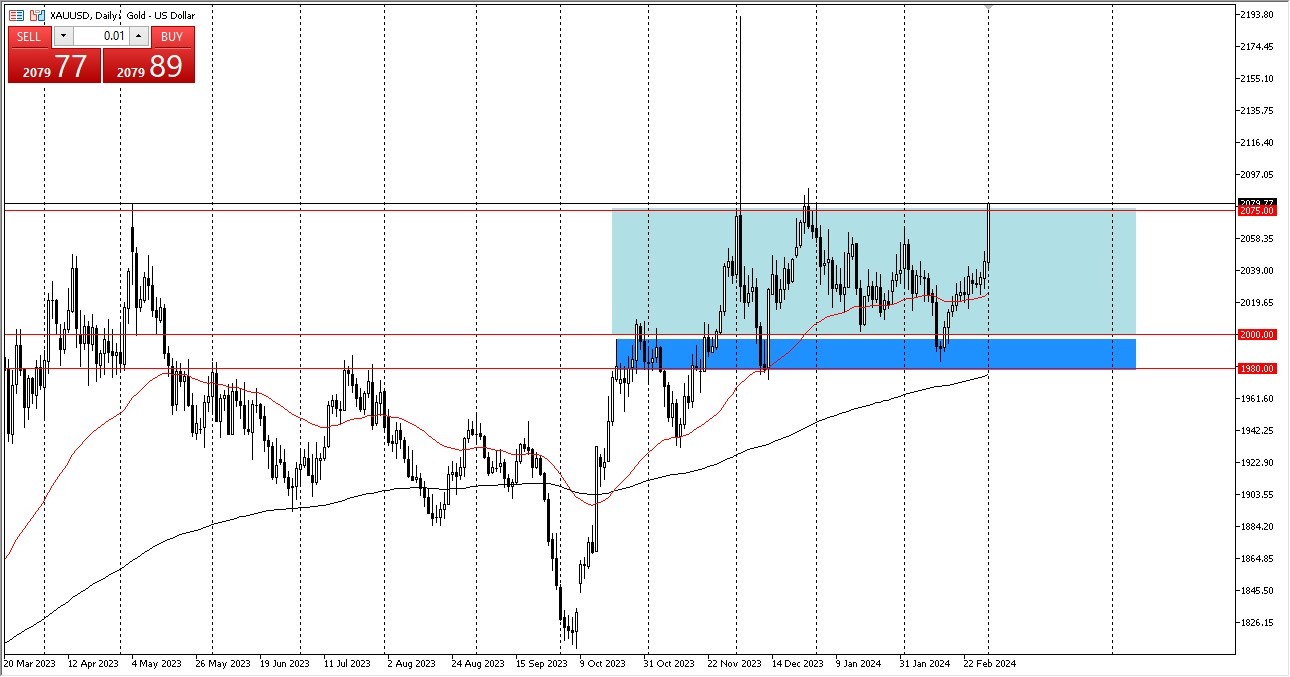

The early hours of Friday saw a slight rally in the gold market as upward pressure persisted. That being said, given that it has historically been resistance, the $2,060 mark is still a region that a lot of people will be watching. Additionally, I believe that to be essentially a resistance zone up to $2,075 in price. That being said, it looks like we are at least TRYING to break that barrier.

If we are able to break over the $2075 barrier, I believe we have a real chance to make some kind of FOMO trade. That being said, getting there will require a great deal of work. I believe that gold will really start to take off if we can reach and surpass that level. Observe closely the idea of whether the US dollar is increasing or decreasing, and whether interest rates are changing, of course. In general, gold markets benefit when US interest rates decline. It is important to keep in mind the geopolitical context as well, as it has the potential to push gold prices higher. Traders will be particularly concerned about the Middle East, possible global downturns, and inflation, among other issues. It goes without saying that the fact that central banks continue to be buyers counts.

There's a lot out there at the moment, really. I find buying gold on the decline to be a nice idea as it will offer value that you can take advantage of. I understand that the gold market may be extremely turbulent. I also see that there is a significant quantity of support located at the 2000 level. After that, it drops to the $1,980 mark, which is also catching the 200-day EMA's interest. Thus, for me, it's a buy-only market, but I'm not in a rush to pursue it either.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.