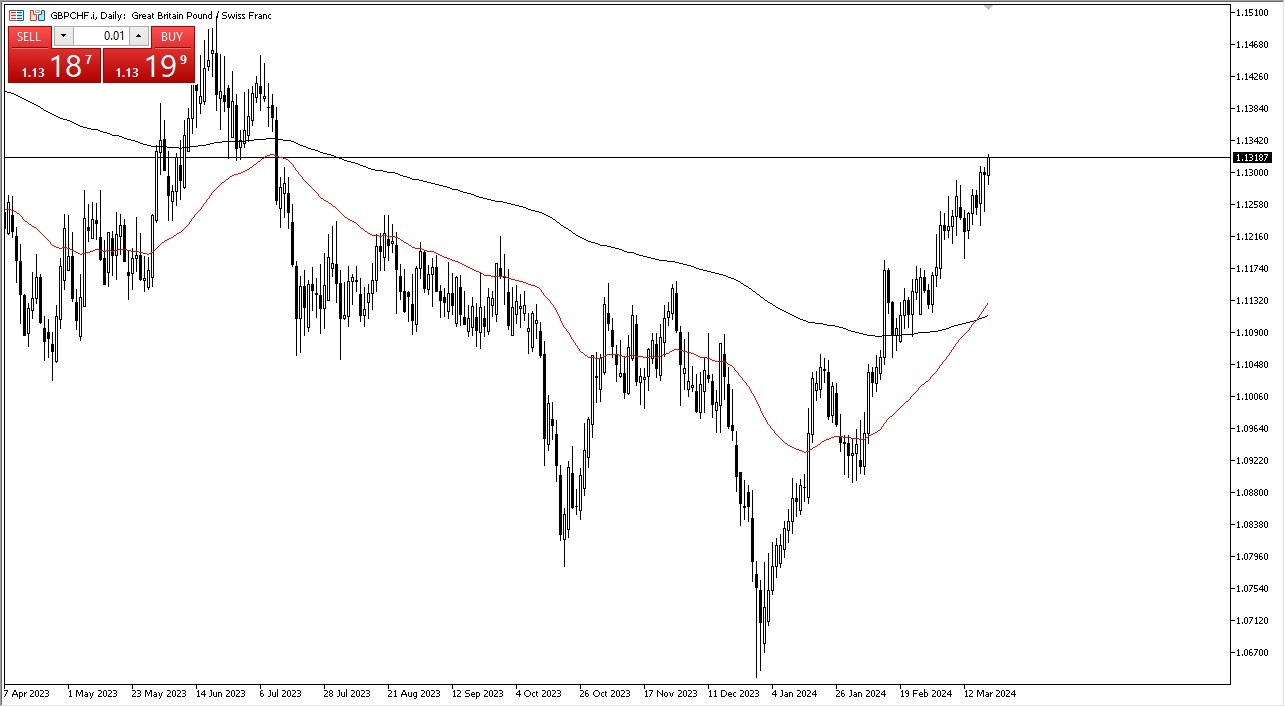

- This is a pair that you’re going to be watching tomorrow, due to the fact that both the Bank of England and the Swiss National Bank Interest rate decisions.

- Quite frankly, the Swiss are more likely to be dovish than anything else, and that’s what this chart is showing.

- The Swiss franc is getting beaten up on by multiple currencies right now, so the British pound itself is not particularly unique in that regard.

Swiss franc, funding currency

The Swiss franc is about to become a major funding currency, as we have such low interest rates in that country to begin with, and the fact that they are getting ready to drop also will put downward pressure on the value of the currency. Traders will continue to borrow in Swiss francs and put money to work in other countries. This is what is known as the “carry trade”, something that is quite popular with large institutions.

As long as the market stays above the crucial 1.1150 level, I think you have a real shot at a major turnaround. Longer-term, I fully anticipate that this market could go looking to the 1.15 level, and depending on what the Swiss say during the Thursday session, we could get there much sooner than anticipated. Ultimately, I look at every pullback as a potential buying opportunity and it is worth noting that you get paid at the end of every session via swap to hold this pair. In other words, I’m in the spare for the long term as long as we can stay above that floor that I mentioned previously. It’s also worth noting that the 200-Day EMA sits just below there, so that is part of what I am using as a measuring stick.

We have seen a lot of momentum over the last couple of weeks and it looks like Wednesday is going to be more of the same as traders try to step in front of both of the central banks. Be cautious about jumping in with huge positions if you are not a already involved, but I do feel very strongly about buying dips and adding to an already long position that I hold.

For additional & up-to-date info on brokers please see our Forex brokers list.