- Over the past several weeks, the euro has showed signs of being rather listless and rudderless.

- I believe that this will continue as the nonfarm payroll figures, which are expected to have a significant impact on momentum and risk appetite, are released on Friday.

- Because of this, I think you have a situation where the euro simply cannot make up its mind.

We didn't do anything in the early hours of Tuesday's trading day because the Euro is still moving sideways. This is the 50-day EMA in question. And that will, naturally, provide some support in any case. However, I don't think that's actually relevant. I believe that we're basically circling around in the midst of a bigger area of consolidation, frantically trying to find some kind of momentum.

We won't receive that between now and Friday, in my opinion, because of the non-farm payroll announcement that day, which will undoubtedly demand a lot of focus. I would expect a lot of sideways bouncing around scalping type situations between now and then. If you are a short-term scalper, perhaps you utilize a trading strategy that makes use of a stochastic oscillator.

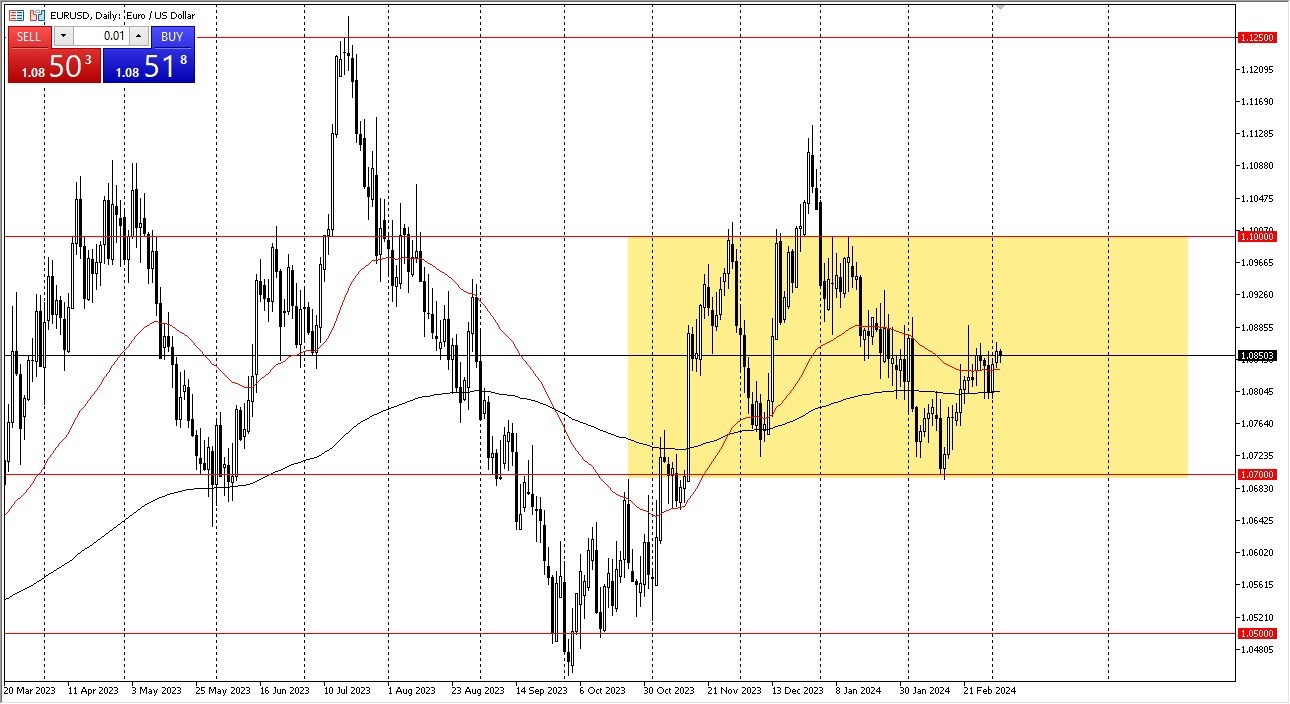

A Couple of Massive Levels

Remember that the market's main floor is located 1.07 levels below, and its main ceiling is located 1.10 levels above. Since 1.0850 is correct, we are essentially in the middle. Having said that, we're at fair value, and while the interest rate markets might have an impact on the direction of this pair, overall, I think we're just kind of stuck here. This year, the Euro is expected to be very range bound versus the Dollar, primarily because both central banks—especially the European ones dealing with Germany's recession—are expected to cut rates later this year. Which is a sizable portion of the EU economy. The last time I looked, it was around 82%, so that will undoubtedly have a significant impact on conditions across the continent. That being said, I'm still extremely neutral about this combination, but I also know that momentum of some kind will eventually return to the game. It might turn out to be one of the better trades if and when we do. It remains to be seen if that occurs anytime soon.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Europe to check out.