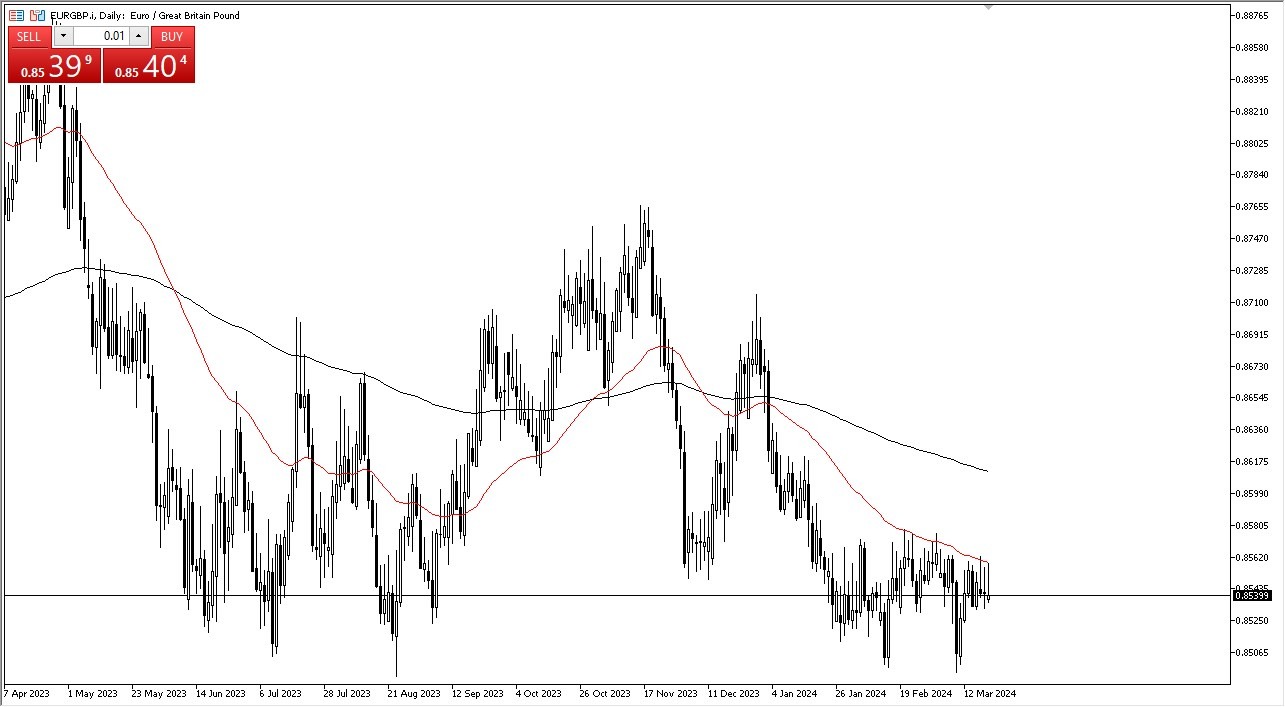

- The euro initially tried to rally during the training session on Wednesday but gave up gains near the crucial 50-Day EMA.

- This is an indicator that a lot of people pay attention to, and it has acted as a bit of a downtrend line in this pair over the last month or so.

- Ultimately, what I see the most in this pair is a market that is simply killing time and trying to figure out what the next fundamental factor moving the market will be.

The Bank of England does have an interest rate decision on Thursday, and that could provide quite a bit of clarity. Quite frankly, if they are for some reason a bit more dovish than people expect, that could send this pair higher. Ultimately, it would take a break above the 0.86 level to truly get momentum going, because at that point in time you would wipe out a lot of short sellers that have been pressuring this pair for the last 2 months or so.

On the downside, if we clear the 0.85 level, it would be a major break of support, and it would send the British pound skyrocketing against most other currencies as well. Quite frankly, the euro is going to continue to be weaker than the pound in general, just due to the fact that the UK has much more inflation than the EU does and of course the ECB has to worry about Germany.

Technical Analysis

I am a buyer of this pair only if we can break above the 0.86 level. If we break down below the 0.85 level, I am much more confident and would be a seller as I think it would be important to note that we will have just broken down below the bottom of a “double bottom” that has now failed, one of my favorite technical indications.

That being said, the last 2 months have been so choppy that most traders are looking at this through the prism of a short-term range bound market, which is perfectly fine if you have the ability to sit and watch the charts all day. Otherwise, you have to look at short-term rallies as potential selling opportunities until we can break above the previously mentioned 0.86 handle.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.