- The continued turbulence in the crude oil markets, in my opinion, is an indication that momentum is building in a market that is running out of time before we begin to break out higher.

- I think we will see an explosive move higher sooner rather than later.

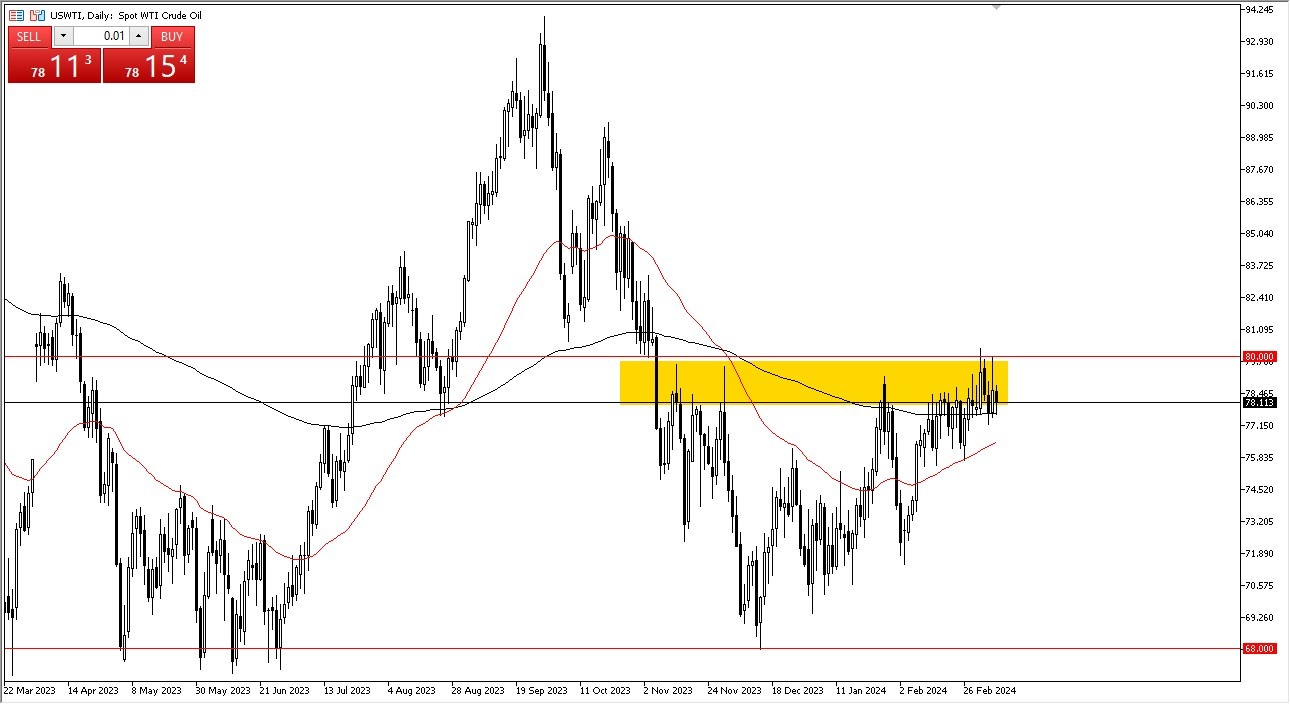

WTI Crude Oil

As you can see, we're still hopping around a little bit while we figure out our long-term goals. In any case, I do believe that buyers will almost certainly continue to enter this market when prices decline. Above the $80 mark, the WTI market faces a significant obstacle. Naturally, the $80 level is a big round number and a place where we've previously seen activity. So, if we broke above that, it would undoubtedly draw a lot of attention.

We are the owners of the 200-day EMA below; please do everything in your power to assist. Furthermore, the 50-day EMA enters the picture if we break below that level. for assistance. I am not interested in WTI shorting. I believe a major breakthrough is going to occur.

Brent

As we hover around the 200-day EMA, Brent is essentially in the same boat. We can move much higher if we can break through the $84.50 level, which is a significant barrier.

The 50 day EMA enters the picture if we break below this point, and that's where we might find a lot of additional support. Once more, this is an example of a buy on the dip situation. Furthermore, I do believe that you need to approach this with the intention of finding significance. Naturally, since supplies are somewhat limited, oil prices will rise if central banks begin to loosen monetary policy, which could increase demand by stimulating the economy.

Of course, there is also the cyclical period of the year when demand for crude oil is higher. Thus, everything fits together rather well to make a purchase on a market dip, which I still make. Once more, I have no interest in shorting crude oil, but I do believe that these markets have the potential to really take off if we can break above or even slightly above the barrier in both of these grades.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading brokers to check out.