- The crude oil markets rarely cease to find buyers these days, and I believe that a true breakout is probably just a matter of time.

- My perspective on this has not changed in any way from the Wednesday session.

- This is a market that simply will not give up. If you can handle the swings, this could be a great market to trade this year.

WTI Petroleum

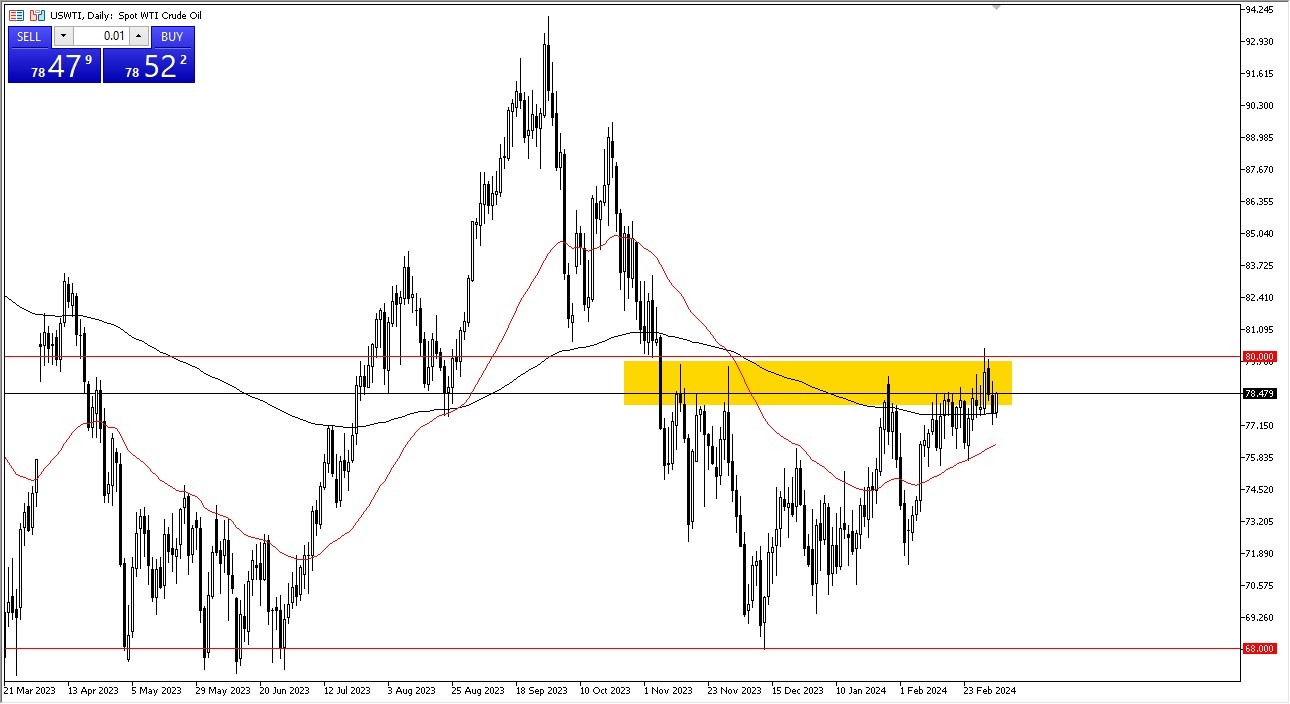

Wednesday's trading session saw a little early rise in the crude oil market, and the West Texas Intermediate grade indicates that the 200 day EMA is still supported. The market is still viewing the 80 level above as a possible resistance barrier, and if we can break above it, it's likely that the market will really take off upward and head for the 85 level. Since the 50-day and 200-day exponential moving averages are both below and provide strong support, short-term pullbacks are still being purchased. Note that I do anticipate seeing a good number of buying opportunities between now and then. Short-term trading has worked out quite well if you are patient enough to take advantage of the set ups.

Brent

During the trading day, the Brent market also saw some rallying. At this point, it appears that it has moved somewhat away from the 84.50 level of resistance, but it is still acting in the same manner. There are still plenty of people prepared to pick it up whenever it falls. Remember that there hasn't been as much supply as there once was. And the summer, which is a crucial driving season, is quickly approaching. That is something that people will continue to be really interested in.

In addition, there are other geopolitical tensions in the Middle East that may also be relevant, as is always the case with crude oil. In light of everything, I do think it makes sense to look for value at every dip, and I believe the market is beginning to share this viewpoint as well. In any case, the market is presently developing a head and shoulders pattern, and this suggests that a significant breakout is likely to occur soon. I believe that one of the most interesting markets to trade in this year will be crude oil, if and when we see that significant breakout.

In addition, there are other geopolitical tensions in the Middle East that may also be relevant, as is always the case with crude oil. In light of everything, I do think it makes sense to look for value at every dip, and I believe the market is beginning to share this viewpoint as well. In any case, the market is presently developing a head and shoulders pattern, and this suggests that a significant breakout is likely to occur soon. I believe that one of the most interesting markets to trade in this year will be crude oil, if and when we see that significant breakout.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading brokers to check out.