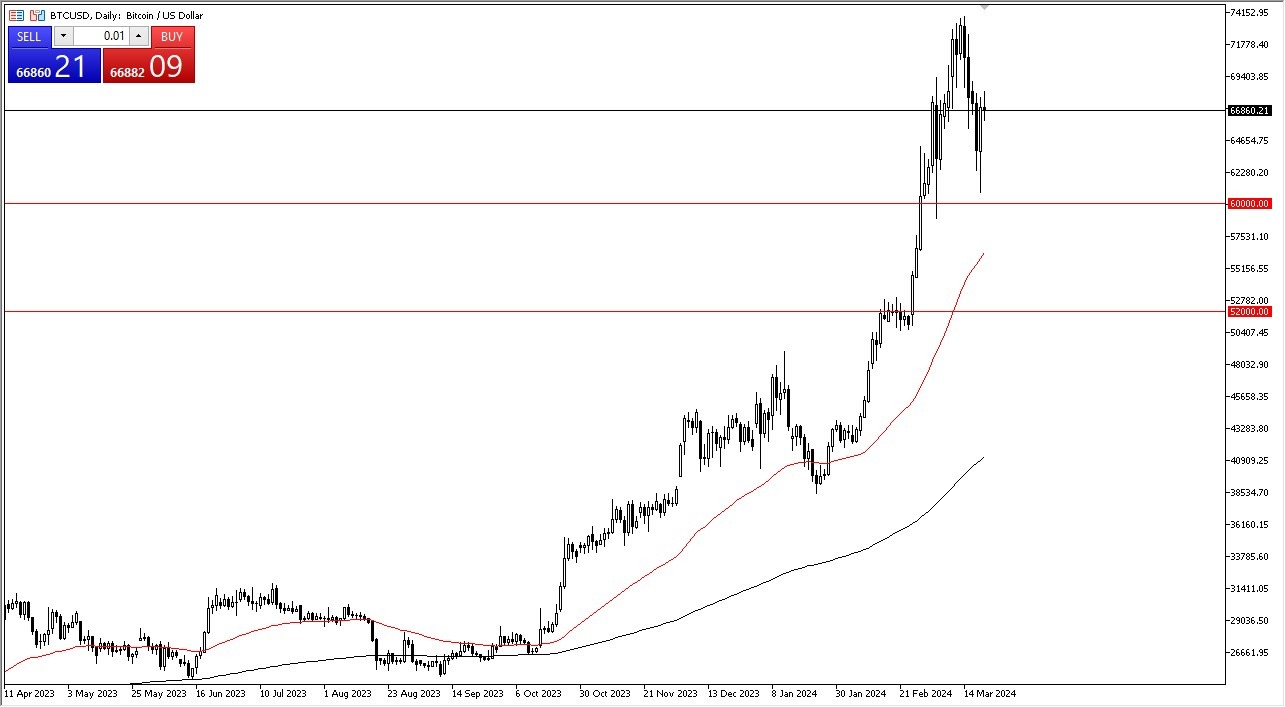

- Bitcoin has been fairly quiet during the training session on Thursday, but it is worth noting that EE is hanging onto the gains from the previous session, and that of course is a very bullish sign.

- Ultimately, this is a market that I think is still very bullish, and after the recent pullback it has been quite impressive in its recovery.

- Ultimately, I do think that we continue to go higher, but that doesn’t necessarily mean that we are going to go straight up in the air like we had done previously.

Are ETF Inflows Over?

Recently, we seen Bitcoin really take off due to the fact that there has been a massive amount of inflows into the ETF sector in the United States. All things being equal, the money flowing into that area has been a major catalyst for the market to go higher. That being said, I think we are getting close to the idea of being done with those early adopters, and therefore think you get a situation where the market calms down. That doesn’t necessarily mean that the market is going to collapse, but it also can mean that we are going to get the occasional pullback.

Underneath, the $60,000 level looks to be a support level, with the 50 day EMA reaching that area fairly soon. If we were to break through all that, then you have the $52,000 level offering even more support. All things being equal, I do believe that this remains a “buy on the dips” type of market, and you will have to continue to look at this market through that prism. In general, I think you’ve got a situation where we will eventually go look into the $75,000 level again. If we break above there, then it’s possible that we could open up a move to the $80,000 level.

Keep in mind that central banks around the world are going to continue to cut rates, and in fact the Swiss National Bank has started the process today, and therefore it’s only a matter of time before the other major central banks begin to cut as well. Remember, loose monetary policy has people looking for “hard money”, which of course Bitcoin proposes to be. In general, I do think that we continue to go much higher.

Ready to trade Bitcoin to the dollar? We’ve made a list of the best Forex crypto brokers worth trading with.