- The Wall Street money inflow continues to be a significant factor in the bitcoin market, which saw a small rally in the early hours of Friday as we continue to test the all-time high.

- In my opinion, there is still a great deal of pressure on this, and it will remain the primary factor moving forward.

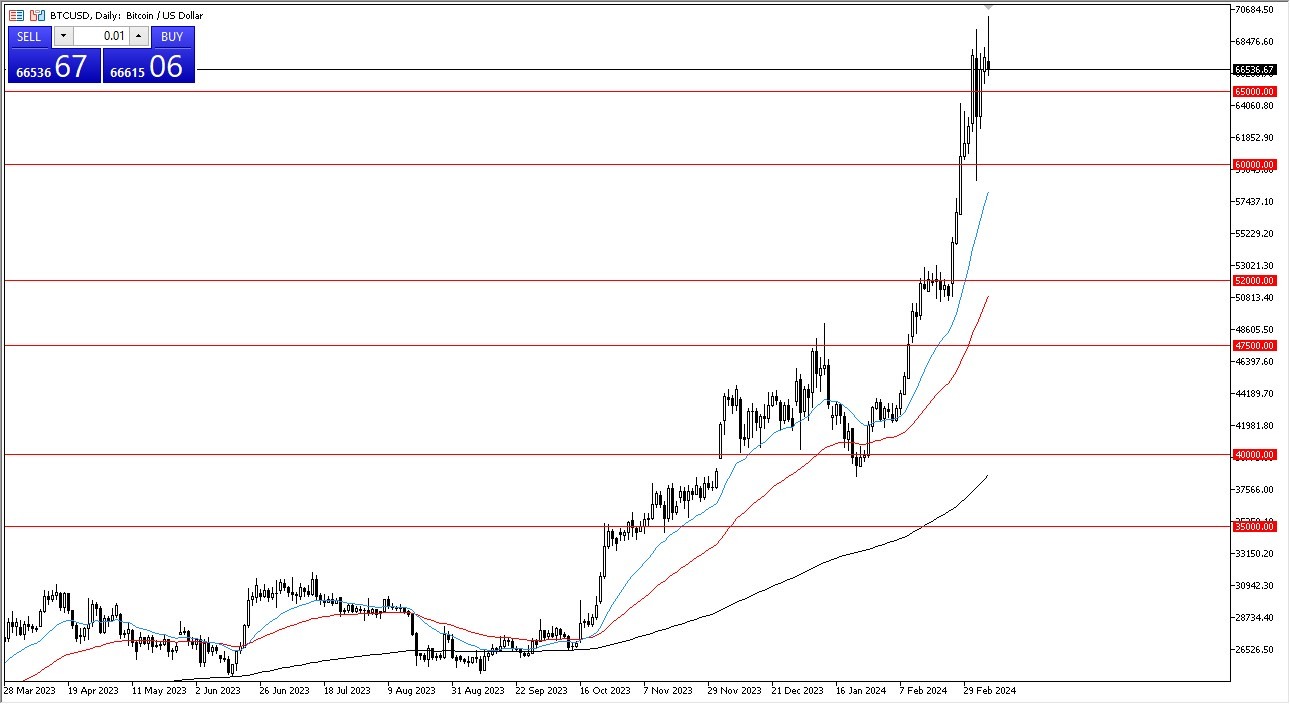

Bitcoin Threatening All-Time Highs. Again.

As you can see, we are currently facing yet another threat to these all-time highs. I predict that a lot of people will continue to buy on the dips in this market. Thus, I'm just waiting for some value to show up before I stay too long. Since this market hasn't seen a lot of value show up, I believe that a pullback is desperately needed before many people become involved. This is a situation where momentum is the biggest driver, and therefore you cannot fight it anytime soon.

To be honest, I don't particularly want to short Bitcoin because, as of right now, it's a losing strategy. I believe there's plenty of support around $65,000, maybe even down to the $60,000 level, even if we do pull back from here. I'm not even remotely interested in trying to short this market. Furthermore, I believe that whenever there is a pullback, there will be a large number of investors eager to pursue the Bitcoin market because there has been so much momentum lost that I believe some sideways movement is necessary. Remember that Wall Street has been injecting a significant amount of money into Bitcoin, which has naturally caused the price to rise. Naturally, the question is: Will it ever be put to use? Really, not much is being done with it yet.

This might be another instance of them throwing it to the general public once more. That may be the current situation. Simply put, we're not sure. Having said that, there's really nothing on the chart that indicates we can't go above the $70,000 level, which is an area of resistance that I believe many people would be observing from a psychological perspective. We're probably just a little worn out at this point, which is part of what you're witnessing. Please understand that at this point, it is still a buy on the dip market.

This might be another instance of them throwing it to the general public once more. That may be the current situation. Simply put, we're not sure. Having said that, there's really nothing on the chart that indicates we can't go above the $70,000 level, which is an area of resistance that I believe many people would be observing from a psychological perspective. We're probably just a little worn out at this point, which is part of what you're witnessing. Please understand that at this point, it is still a buy on the dip market.

Ready to trade BTC/USD? Here’s a list of some of the best crypto brokers to check out.