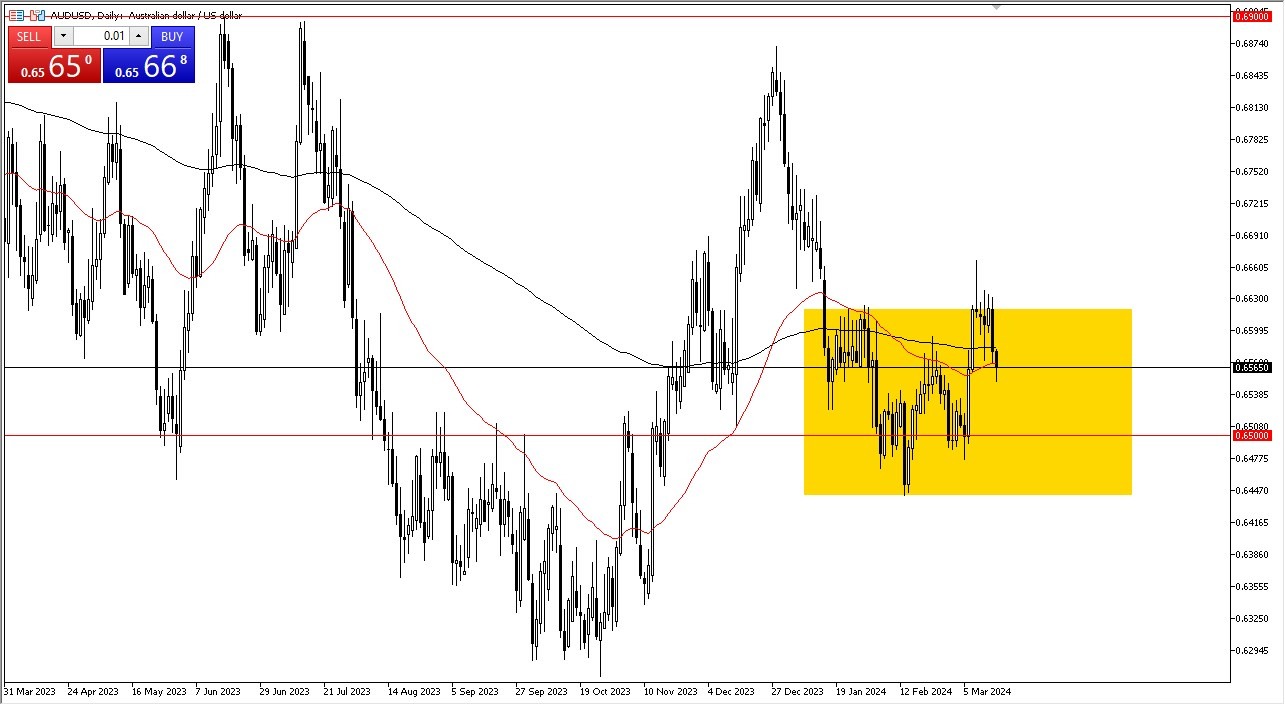

- The AUD/USD fell initially to kick off the trading session on Friday but does seem to be finding a little bit of support underneath the 50 day EMA.

- So, at this point it'll be interesting to see how the market behaves due to the fact that we are essentially in the middle of a larger consolidation area.

- This continues to be the major area of trading in this pair again.

If we continue to fall from here, then I would anticipate that the 0.65 level would offer support underneath there. Then we have the 0.6450 level, which is an area that I think a lot of people will be looking towards, and that is a major swing low. On the upside, we have the 0.6650 level offering resistance and anything above there.

Momentum Continues to be a Factor

More likely than not, we'll have people chasing the momentum in that environment. I would anticipate that the AUD/USD could go as high as 0.69 over the longer term. All of that being said, you have to be cognizant of the fact that the Australian dollar is heavily influenced by external factors. The most obvious one is risk appetite as the Aussie is so heavily influenced by commodities, but at the same time it's also heavily influenced by the Federal Reserve.

If the Federal Reserve is going to cut rates later this year, that could provide a little bit of a boost for the Australian dollar. But the Australian economy also has to worry about the Chinese economy. So it's all interconnected in a risk on risk of type of environment. Be aware of what's going on in other markets to give you an idea as to how the Australian dollar may react.

The riskier people feel like being, the better off the Australian dollar does and of course vice versa. Expect a lot of choppy noise, but right now it looks like we are still very much in the overall range that we have been in for a couple of months.

Ready to trade our Forex daily analysis and predictions? Check out the largest forex brokers in Australia worth using.