- The USD/RUB is trading near the 92.4400 ratio as of this writing, but as always with the currency pair a large bid and ask exists, and speculators need to understand the fluctuations being seen are a normal part of the landscape.

- Traders who want to wager on the USD/RUB are urged to use entry price, stop loss and take profit orders while engaging in speculative positions.

- Volumes while light in the Russian Ruble, however certainly exist and speculators who want to engage with the USD/RUB may find the currency pair offered on various trading platforms.

Intriguingly while the Russian Ruble was said to be a non-tradable currency in the ‘West’ because of sanctions due to the war with Ukraine, the USD/RUB is being traded. And the ability to not only produce a rather stable price range, but to also correlate to the broad Forex markets is there to witness for USD/RUB traders who compare technical charts. Yes, the USD/RUB does seem to trade in a rather USD centric fashion like the major currency pairs.

USD/RUB Risks from Spikes Higher and Sudden Moves Lower

Traders trying to take advantage however of moves generated from economic data in the U.S via reports may find speculative positions rather troublesome. The nature of the USD/RUB to cause rather large reversals remains rather strong and to trade the currency pair well a speculator should have deep pockets. The currency pair may correlate to the broad Forex markets, but it also trades within its own ‘time’ movements.

It is also important for USD/RUB traders to withstand large momentary price movements. Using a rather wide stop loss in the USD/RUB to lower the danger of getting knocked out of a trade too quickly is crucial. This also means a trader will have to use very conservative leverage.

USD/RUB Technical Range with Support and Resistance Considerations

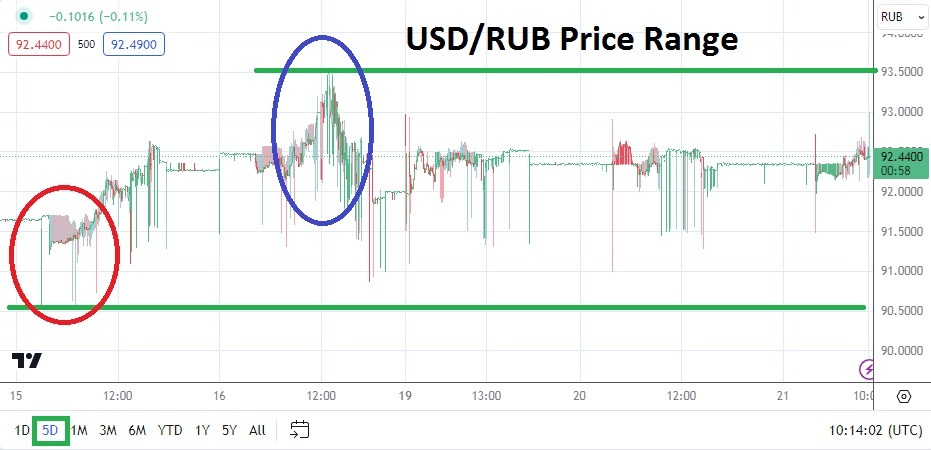

The past month has seen a rather incremental climb in the USD/RUB. However, like the broad Forex market the move higher correlates to other currency pairs. The USD/RUB has seen support look rather durable around the 91.5000 ratio near-term, but there have been outliers lower. As for higher movements the USD/RUB hit a 93.5455 briefly this past Friday. In early price action this morning the USD/RUB touched the 93.0000 level momentarily.

- The ability of the USD/RUB to range trade should be given attention by traders, and the currency pair’s ability to correlate to broad market action cannot be discounted.

- Traders may be willing to seek moves lower in the USD/RUB if resistance is hit. An entry price order above market price action may be a way of triggering a short position in the USD/RUB around the 93.0000 level.

- Speculators pursuing the USD/RUB for wagers need to be patient and use their risk management effectively.

USD/RUB Short Term Outlook:

Current Resistance: 92.9000

Current Support: 92.3800

High Target: 93.2010

Low Target: 92.1900

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.