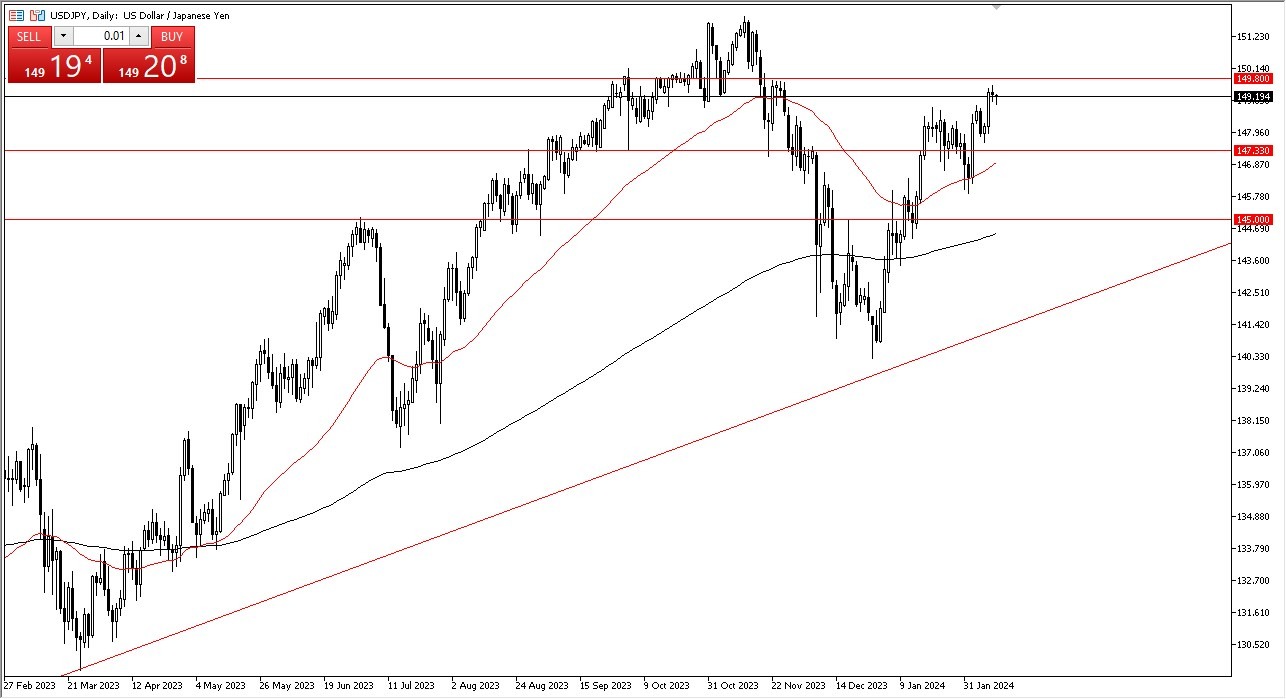

- The US dollar has been showing strength against the Japanese yen, with the USD/JPY pair aiming to reach higher levels.

- Despite a slight initial drop, the market appears to be making efforts to rally towards the 149.80 mark, with potential for a longer-term move towards 152.

- This level has previously served as a significant point of resistance, prompting considerable selling activity.

In the short term, any pullbacks are likely to attract buyers, particularly around the 147.33 support level and the 50-day EMA. Factors influencing this market include developments in US interest rates, the bond market, and the policies of the Bank of Japan. Japan's substantial debt burden restricts the ability of its central bank to implement tightening monetary policies.

Given the Federal Reserve's stance on delaying interest rate cuts and the prevailing market conditions, the trajectory for the USD/JPY pair seems skewed towards further gains. Consequently, there is limited rationale for shorting this pair in the foreseeable future. Traders are likely to seize opportunities presented by dips in the market, recognizing them as valuable buying opportunities. The potential for negative days to spur additional buying reinforces this sentiment. After all, Japan is so heavily indebted that I do not believe the Bank of Japan is anywhere near tightening monetary policy because of the excess burden.

You Get Paid in Swap

Moreover, holding onto the US dollar in this pair results in earning swap payments, enhancing the appeal of long positions. Overall, the prevailing trend favors an upward movement for the USD/JPY pair, making shorting an unattractive prospect. Instead, investors are advised to capitalize on the value offered by market dips and maintain a bullish outlook on the currency pair. This is something that retail traders fail to do most of the time, mainly due to the fact that the swap on a small account isn’t as substantial as the rush of trading momentum. That being said, you have to keep in mind that the big money gets paid quite handsomely at the end of every day. This is what drives the market.

At the end of the day, the USD/JPY pair continues to demonstrate strength, with the market striving to reach higher levels. While short-term fluctuations may occur, the overall trend favors upward momentum, driven by various market factors and monetary policies. Traders are encouraged to adopt a long-term perspective, leveraging buying opportunities and avoiding short positions in anticipation of further appreciation in the USD relative to the JPY.

Ready to trade our Forex daily analysis and predictions? Here's a list of regulated forex brokers to choose from.