- The US dollar has exhibited a slight rebound against the Japanese yen, indicating signs of vitality.

- This resurgence can be attributed to the persisting interest rate differential between the two currencies, a prevailing dynamic that has shaped the market for some time.

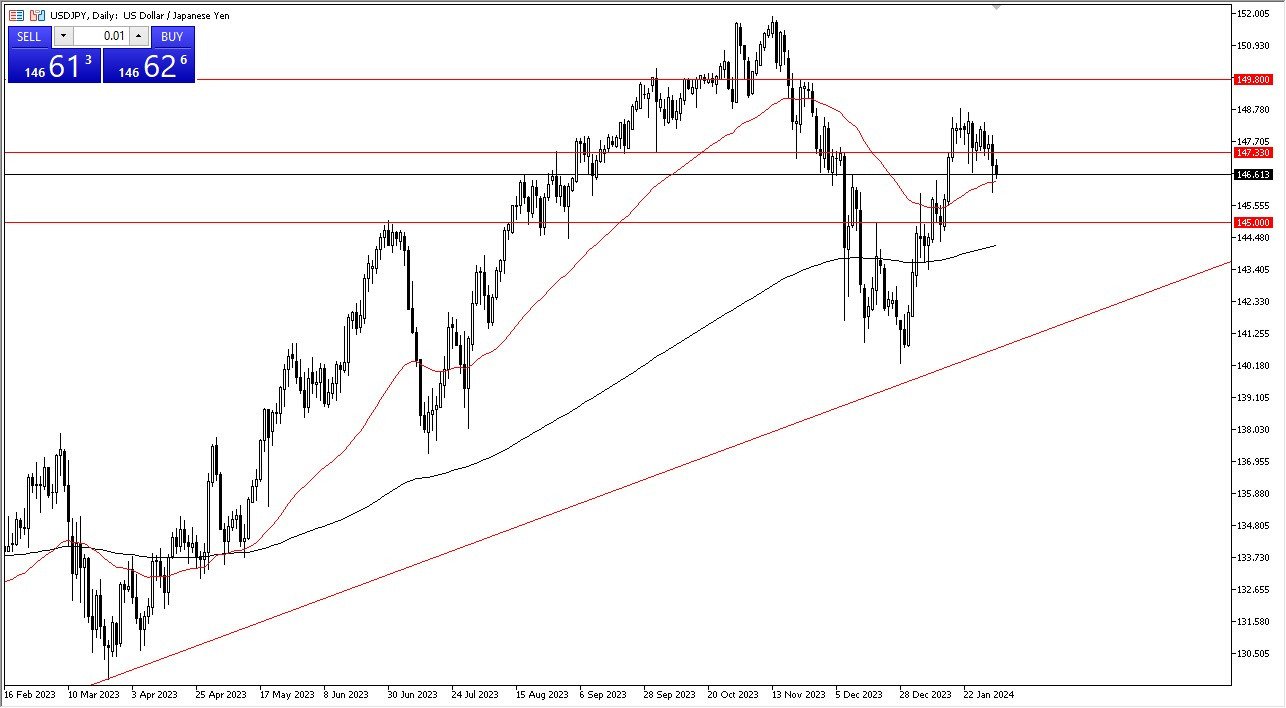

- The USD/JPY currency pair initially had a minor retracement during the trading session but subsequently rebounded from the 50-day Exponential Moving Average.

- Consequently, this development warrants close attention, particularly in light of the impending release of non-farm payroll data.

Above the 147.33 level, there is a potential move towards the 148.8 yen level, with the subsequent target being the 149.8 level. Conversely, if the market undergoes a breakdown below the 50-day EMA, it opens up the possibility of a descent towards the 145 level.

Market Conditions

The prevailing market conditions should be viewed within the context of anticipated noise, with the non-farm payroll announcement poised to exert a significant influence on the bond market. Consequently, caution remains imperative when navigating this market. Nonetheless, the overarching sentiment suggests that this represents a buy-on-dip opportunity. It is not until a breakdown beneath the 145 yen level occurs that concerns should be heightened. The primary driver in this market continues to be the interest rate differential, which retains ample magnitude to accommodate trading opportunities.

The Bank of Japan remains distant from pursuing monetary policy tightening, while the Federal Reserve is expected to enact multiple rate cuts throughout the year. The substantial disparity between the two central banks' policy stances has underpinned the appeal of holding the greenback against the yen. This interest rate differential remains a prominent factor, motivating traders to engage in this pair.

In the end, the US dollar has staged a modest recovery against the Japanese yen, underpinned by the enduring interest rate differential. The USD/JPY currency pair's performance exhibited a brief retracement before rebounding from the 50-day EMA. The impending release of non-farm payroll data is anticipated to generate market noise and heightened volatility. However, the prevailing sentiment suggests a strategic approach of seeking value and capitalizing on buying opportunities. Only a significant breach below the 145 yen level would warrant heightened concerns. Ultimately, the market dynamics continue to revolve around the substantial interest rate differential, a factor that remains conducive to trading within this pair.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.