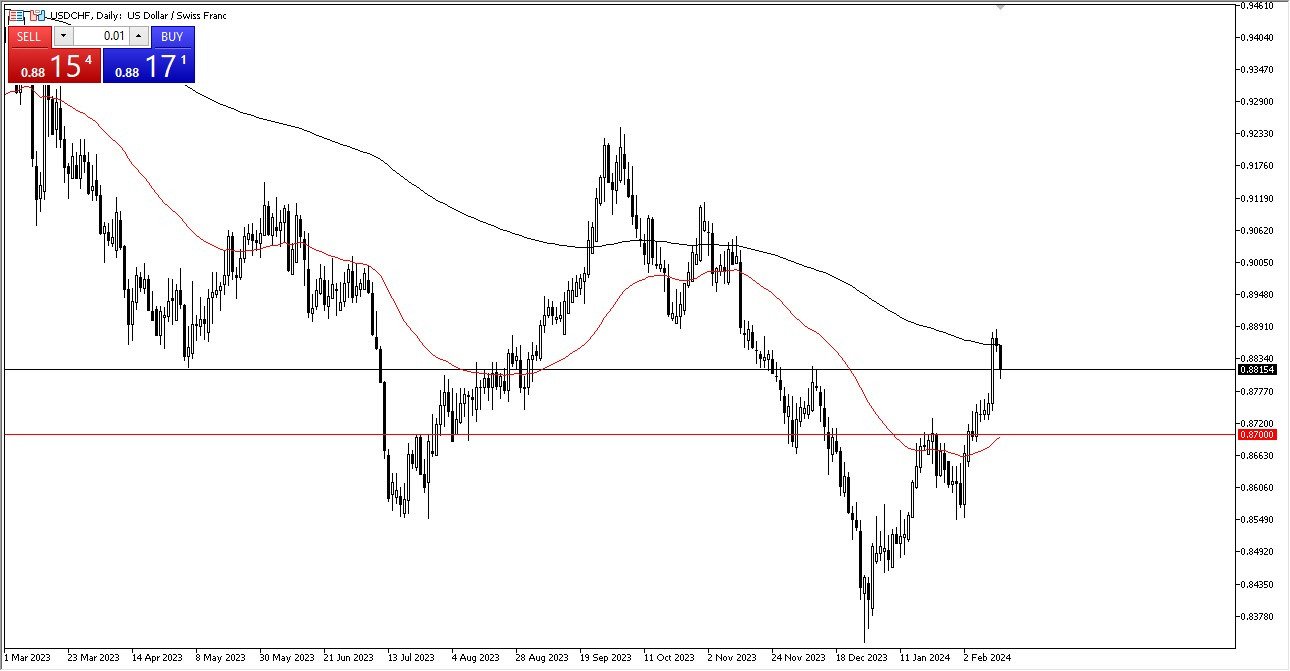

- The US dollar has fallen in early trading on Thursday against the Swiss franc as the 200 day EMA has offered significant resistance.

- At this point, I think we've got a scenario where traders will be looking to buy on dips and I do think that we are in the process of perhaps trying to change the overall trend.

- One thing is for sure, the Swiss National Bank will not be arguing with that move because they do not like the idea of a Swiss franc that is far too strong.

That being said, they typically watch the value of the Swiss franc against the euro and not necessarily the dollar, but they are all interconnected. Underneath, I see the 0.87 level as a major support level with a 50 day EMA curling towards it. However, always watch that EUR/CHF pair as an indicator for the Franc, and any potential intervention by the Swiss National Bank – which has historically been much quicker to get involved than most other central banks around the world.

Top Regulated Brokers

So, I think that is where you will determine whether or not there's any chance of a longer term rally. A breakdown below the 0.87 level would simply continue the massive negativity that we have seen. If we can take out the high of the Wednesday session, that would be very strong and could send the US dollar reaching towards the 0.90 level against the Swiss franc.

Anything Above…

Anything above there then I think brings in quite a bit of FOMO trading as traders will be looking to take advantage of that momentum. Keep in mind that both of these are considered to be safety currencies, so that of course will have its own effect as there are plenty of geopolitical concerns. However, the one big problem Switzerland has is that 85% of its exports head to the EU and the EU is heading into a recession. So that might be why the US dollar is favored at the moment. Either way, you do get paid to hang on to this pair via swap so that is also something worth paying attention to but I think we are going to be very choppy even if we were to go much higher.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.