- The S&P 500 experienced a large increase during Thursday's early trading session.

- The market is still showing signs of bullishness, and it appears that very little will cause it to decline again.

- At this point in time, it has become a bit of an ETF and therefore you have to look at it through the prism of that type of behavior.

S&P 500 Continues to Rally

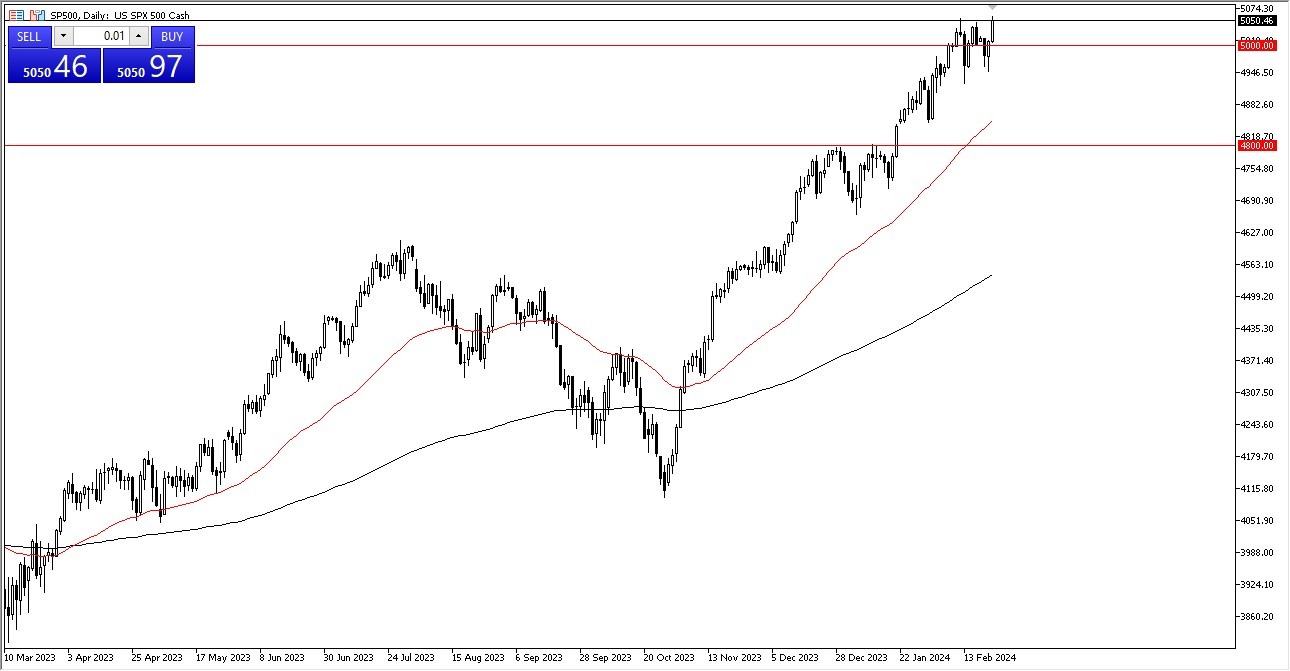

Thursday's session saw an early rally in the S&P 500 as strong upward pressure persisted. In the end, as we are posing a threat to another breakout, it is possible that we will target the 5100 level. Basically, this is a market where, in my opinion, there will always be enough buyers when we draw back. Below that, at 4950, is a significant area of support. Then, of course, there's the 4800 level and the 50-day EMA. I believe you might consider this place to be the current "hard floor" for the broader trend.

When all else is equal, we should keep in mind that the 5000 level is a place where we can keep seeing this through the lens of a price fulcrum. However, as we are currently on the rise, we will eventually remain the subject of this story. We could veer off course for a bit, and that would make some sense because you do need to burn off extra foam. But I also think that in the end, this is a market that will always be watching the bond market and the possibility that the Federal Reserve could lower interest rates this year.

It appears that individuals are eager to become involved as long as that is the case. Moreover, you need to remember that the S&P 500 has effectively turned into a massive ETF consisting of a small number of stocks. This means that the market will climb together with the correct stocks, which are the top seven or so, assuming they are all growing. Ultimately, it represents roughly 40% of the data displayed on the figure. Put another way, it's an ETF and not a real stock market. Given that, watch for dips as chances to purchase, and I do believe that $5,100 will be reached sooner rather than later.

Ready to trade our S&P 500 analysis? Here’s a list of some of the best CFD trading brokers to check out.