- The S&P 500 displayed minimal activity in Wednesday's trading session, with a focus on the upcoming Federal Open Market Committee (FOMC) meeting.

- The market's reaction largely hinges on the subsequent press conference and the interpretation of Jerome Powell's statements.

- While a slight pullback is plausible, it is likely to present an attractive buying opportunity.

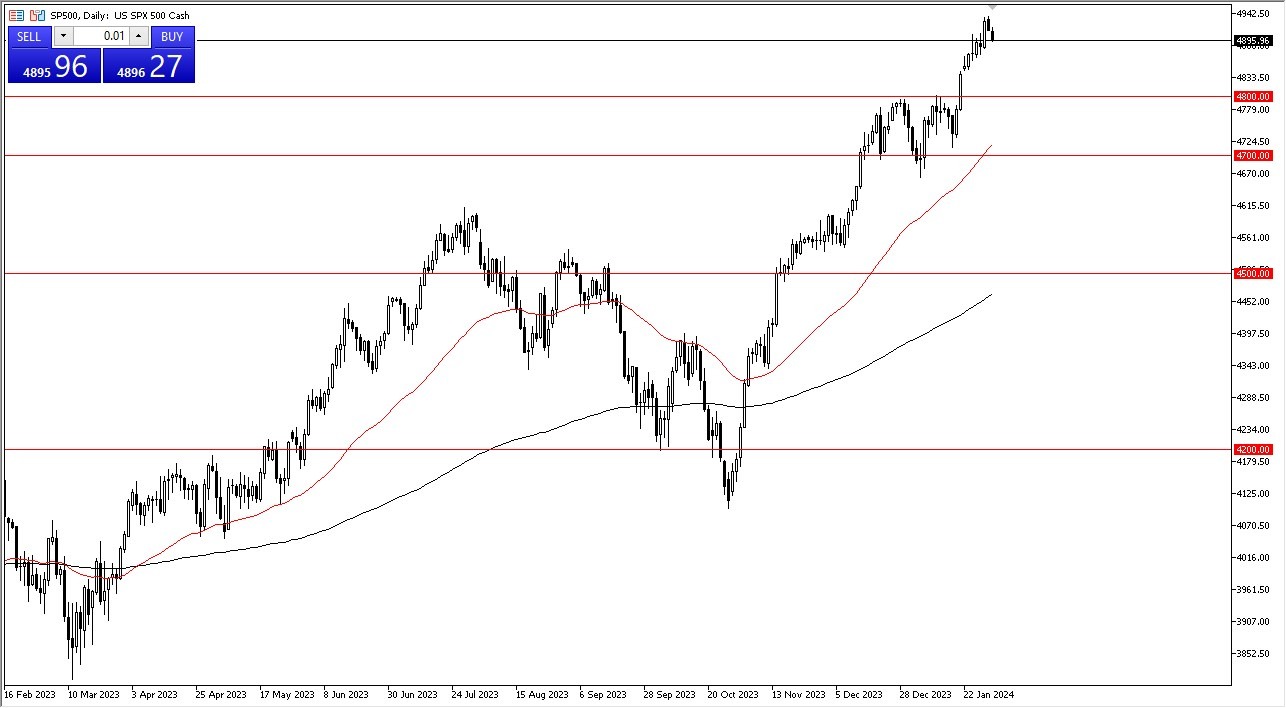

A desirable scenario would involve the S&P 500 retracing to the 4800 level, which had previously served as notable resistance. This level holds significance due to historical resistance and the influence of market memory. Additionally, the 50-day Exponential Moving Average is currently positioned just above the 4700 level, a crucial area of substantial support.

Overall, the prevailing market sentiment favors a buy-on-the-dip approach. Even in the event of a temporary shock stemming from Jerome Powell's announcements, it is noteworthy that Wall Street has exhibited a tendency to quickly recover and find new rationales for stock purchases. After all, the job of Wall Street is to sell you stocks, and they are good at it.

Not Equal-Weighted

It is essential to recognize that the S&P 500 is not an index composed of an equal-weighted selection of 500 stocks. Rather, it is influenced by a handful of prominent stocks and can be influenced through various means, including options and the actions of influential companies like Microsoft. Despite the extended duration of the current uptrend and its overextended nature, attempting to counteract this prevailing momentum is a challenging endeavor.

Ultimately, the S&P 500's trajectory is likely to continue its ascent, albeit with an eye on the psychologically significant 5,000 level. While breaching this level may pose difficulties, it remains an enticing target as the market continues to demonstrate resilience and strength.

Ultimately, the S&P 500's performance is poised to react to the developments of the FOMC meeting, with a particular emphasis on Jerome Powell's statements during the subsequent press conference. The market environment favors a buy-on-the-dip strategy, and despite the overextended nature of the current uptrend, the prevailing momentum suggests that the index may eventually target the 5,000 level. This level will be interesting to pay attention to, as I think there will be a lot of noise more than anything else. The market will have a lot of chatter in that region.

Ready to trade the S&P 500 Forex? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.