- Silver attempted to rally during Thursday's trading session but ultimately retraced its gains, reflecting the persistently erratic behavior observed in the market.

- The impending Non-Farm Payroll announcement scheduled for Friday is expected to introduce a considerable degree of volatility into this market.

- This will obviously have a far reaching influence on silver, and I think it could be the next big event to keep the market into the consolidation region.

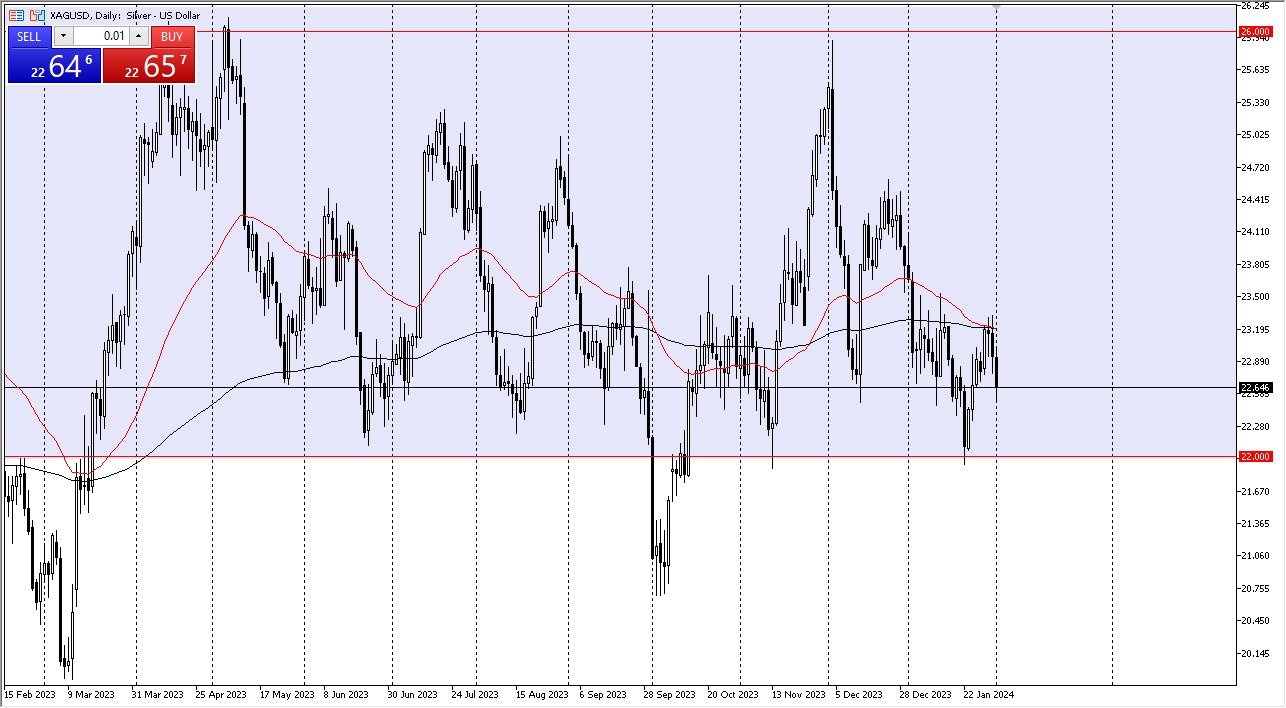

Despite the initial rally attempt, silver continues to exhibit a back-and-forth pattern. Presently, the $22 level appears to serve as a significant support floor, capturing the attention of many market participants. The outcome hinges on whether this level holds. A breakdown below $22 may lead to a targeting of the $21 level. Conversely, if the market experiences a downturn followed by a rebound, potential resistance levels to watch include $23.25, $23.50, and a possible rally to the $24.50 level. This is an area that I think there is a big fight just waiting to happen. This is a major issue at the moment, but if we get above there – we fly at that point.

Longer-Term Perspective

Taking a longer-term perspective, the $26 level stands as a formidable resistance barrier, marking the upper boundary of the consolidation range. Notably, the outcome of Friday's jobs report is anticipated to exert a substantial influence on the bond markets, consequently impacting silver prices. The performance of silver is closely tied to interest rates and the fluctuations of the US dollar. Additionally, questions regarding industrial demand arise as silver plays a pivotal role in various emerging green technologies.

Currently, it appears that silver may experience further downward movement before attracting value-oriented buyers. While there is an inclination to participate in this trend, it is prudent to await the release of the jobs report, as such a significant announcement can potentially disrupt the markets. In summary, there is a bullish sentiment for the long-term prospects of silver. However, it is essential to exercise caution due to the market's inherent volatility, which can pose substantial risks to one's trading account. Consequently, it is advisable to approach the market cautiously, especially in anticipation of significant announcements, and await a more favorable entry point based on perceived value.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best Forex trading brokers in the industry for you.