- Since we are still trading in the midst of the range that we have been in for some time, silver was pretty quiet during the Friday trading session.

- As a result, I believe you have a situation where silver is temporarily neutral but provides us with extremely distinct trading locations.

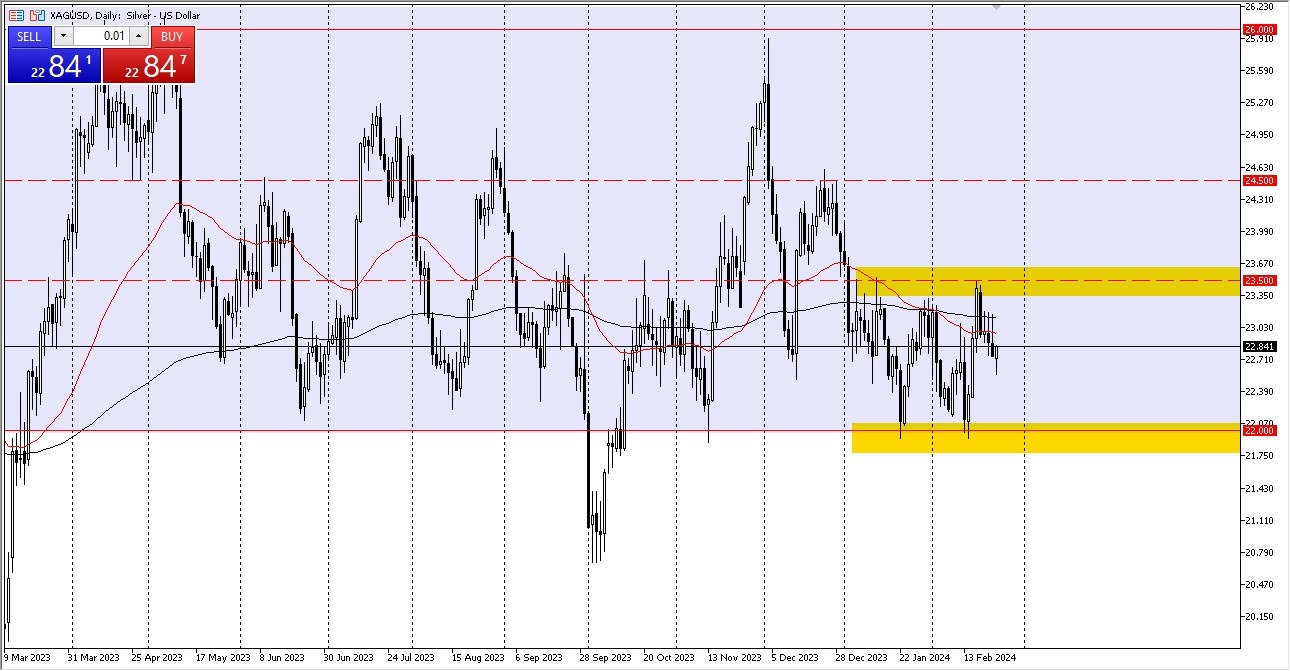

Silver Continues to See a Range

We are essentially right in the center of the consolidation range between the $22 level and the $23.50 level, so silver markets have shown themselves to be rather carefree in their trading during the Friday session. I believe that this market will continue to exhibit all of its typical characteristics, including responding to changes in interest rates, the value of the US dollar, worries about geopolitics, and, of course, industrial demand.

Given that, the question of whether we are currently touching the top or bottom of the consolidation area is effectively a coin flip. However, I do believe that the $22 level will be a significant support level in the long run. If the $23.50 mark above is broken, it would be quite bullish and, in my opinion, lead to a move to the $24.50 mark, which is where we've previously seen action. Still, I'm waiting for one of the extremes in this market before making a transaction.

I'm not really interested in shorting silver. I think silver will eventually attempt to return to the $26 level, particularly if global central banks stick to their current rate-cutting strategy this year, which seems likely by all measures. That said, I think it's a good idea to seize the opportunity to get inexpensive silver when it presents itself. We might then target the $21 level, where we broke down in September, if we drop below the $22 mark.

However, as of right moment, I believe that the purchase on the drop approach is more likely to persist. Thus, that is my strategy for entering this business. If we surpass the $23.50 mark, I'll most likely increase my current stake. But I believe it will be very challenging to overcome the $26 level above. If we were to do that, the market could rally quite drastically in a major short-covering rally. We have seen the market do that previously, and therefore it is still possible, even if unlikely at the moment.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.