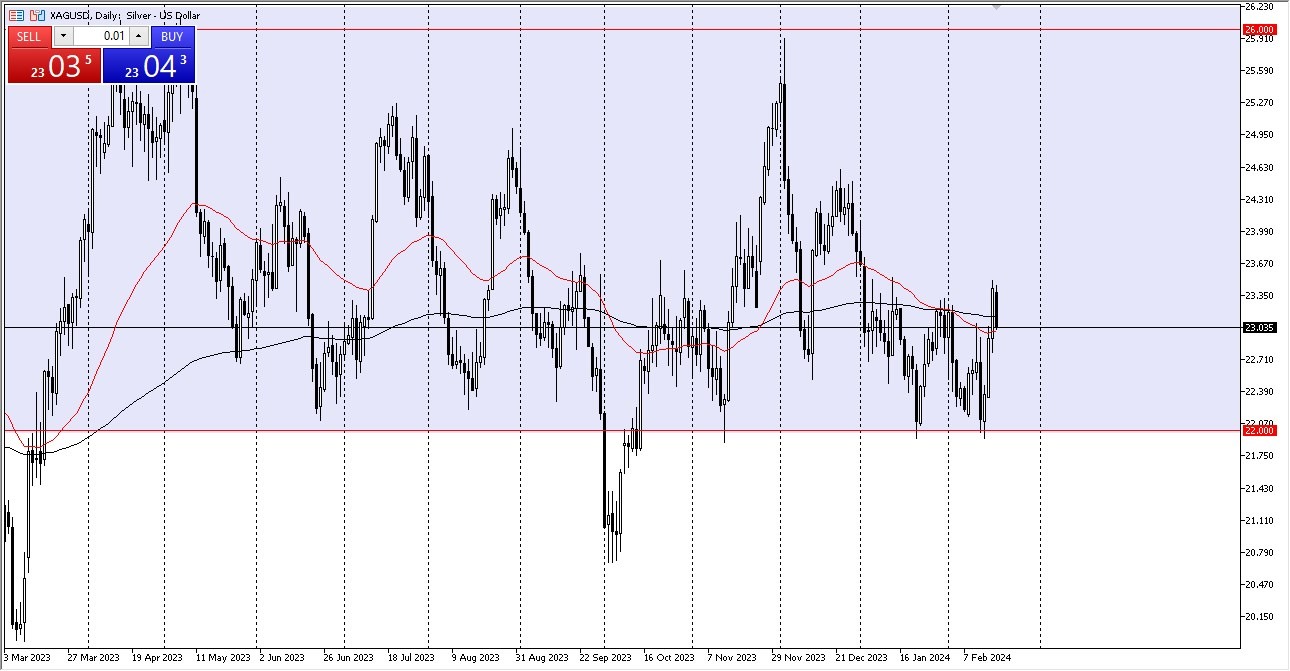

- Silver has repeatedly offered resistance, so it withdrew a little from the critical $23.50 level.

- The 50-day EMA probably provides some support if we retreat from this level, but a fall below it might lead to a decline to the $22 mark.

- If all else is equal, I believe that we will merely keep asking questions about silver itself in this market.

Regarding pricing, a number of factors have a role in the silver market, the interest rate market being one of the most important. Major factors include the US dollars’ worth, the interest rate market, and industrial demand, of course.

Although silver has a tendency to be somewhat noisy, it generally moves in tandem with gold over the long run. Thus, pay attention to that market as well. A move to the $24.50 level and ultimately the $26 level above is possible if we can break above the $23.50 level. A move down to $21, where we had previously broken through the support and reach, could be possible if silver were to drop below the $22 mark.

Turbulence Ahead for Silver

I believe the only thing you can be sure of is that it will be quite turbulent and noisy, so you need to exercise caution when investing a large sum of money in the market at once. Only add when circumstances move in your favor. Having said that, if you examine the longer term charts, you will notice that many traders appear to be extremely comfortable trading back and forth around the region between $22 and $26, which has historically been a region of consolidation. Should that prove to be the case, you should closely monitor these levels because swing trading relies heavily on them. In fact, there are traders that do quite well just going back and forth.

Ultimately, silver is going to be extraordinarily noisy in general, but with that being said, I think this is a situation where you will have a lot of things to pay close attention to and therefore you need to be very cautious with your position sizing, as silver can completely wreck your trading account if you are not cognizant of risk appetite parameters and of course very diligent with your position sizing.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.