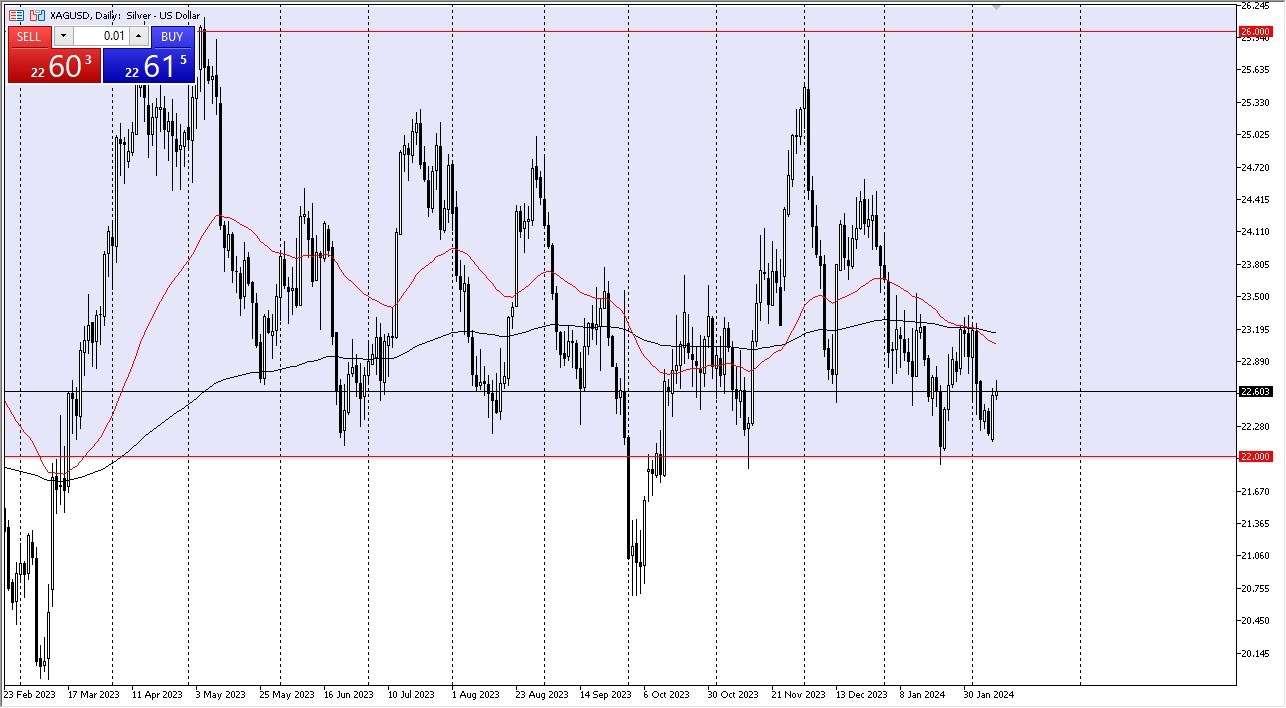

- In recent sessions, the silver market has displayed signs of seeking support just below current levels.

- Notably, the $21 mark has served as a significant support level, suggesting potential buyer interest.

- This indicates a likelihood of upward movement within the broader trading range. This is a typical move for silver, as it tends to be rangebound on the longer-term charts.

The recent trading session saw an initial rally in silver prices, albeit followed by some retracement. This pattern reflects a market attempting to establish a bottom but also hints at potential choppiness on the path upwards. Such fluctuations are reasonable given prevailing uncertainties.

Key indicators to monitor include the 50-day Exponential Moving Average and the 200-day EMA. A breakthrough above these levels could propel prices towards $24.50, or even $26 subsequently. Maintaining attention on the $22 mark as a critical support level remains prudent for market participants.

Interest Rates are Crucial

One crucial factor influencing silver's trajectory is the interest rate environment in the United States. A drop in the 10-year yield tends to enhance the appeal of precious metals, including silver. However, it's essential to recognize silver's dual nature as both a precious and industrial metal. Industrial demand plays a significant role, potentially distinguishing its behavior from that of gold, which predominantly serves as a store of value.

Despite the emphasis on $22 as a support level, there's notable support extending down to $21, forming a supportive range. This range underscores the resilience of silver prices even amidst market fluctuations.

At the end of the day, silver's price forecast remains influenced by multiple factors, including interest rates and industrial demand. While $22 stands out as a pivotal support level, the broader range of support extends to $21. Vigilance towards these levels, coupled with an understanding of market dynamics, will be essential for navigating silver's price movements in the near term.

As always, investors should exercise caution and conduct thorough analysis before making trading decisions in the silver market. Keeping abreast of developments in both economic indicators and industrial demand will be crucial for informed decision-making in the silver market. This is a market that will continue to see a lot of noise, but at the end of the day – I think this is a market that will be noisy, but it should also be approached carefully as the market can be quite volatile.

Ready to trade our daily Forex forecast? Here’s a list of some of the best online forex trading platforms to check out.