- The silver market showed some initial weakness during the early trading session on Wednesday, reflecting a cautious sentiment among investors as they awaited the outcome of the Federal Open Market Committee (FOMC) meeting and subsequent press conference.

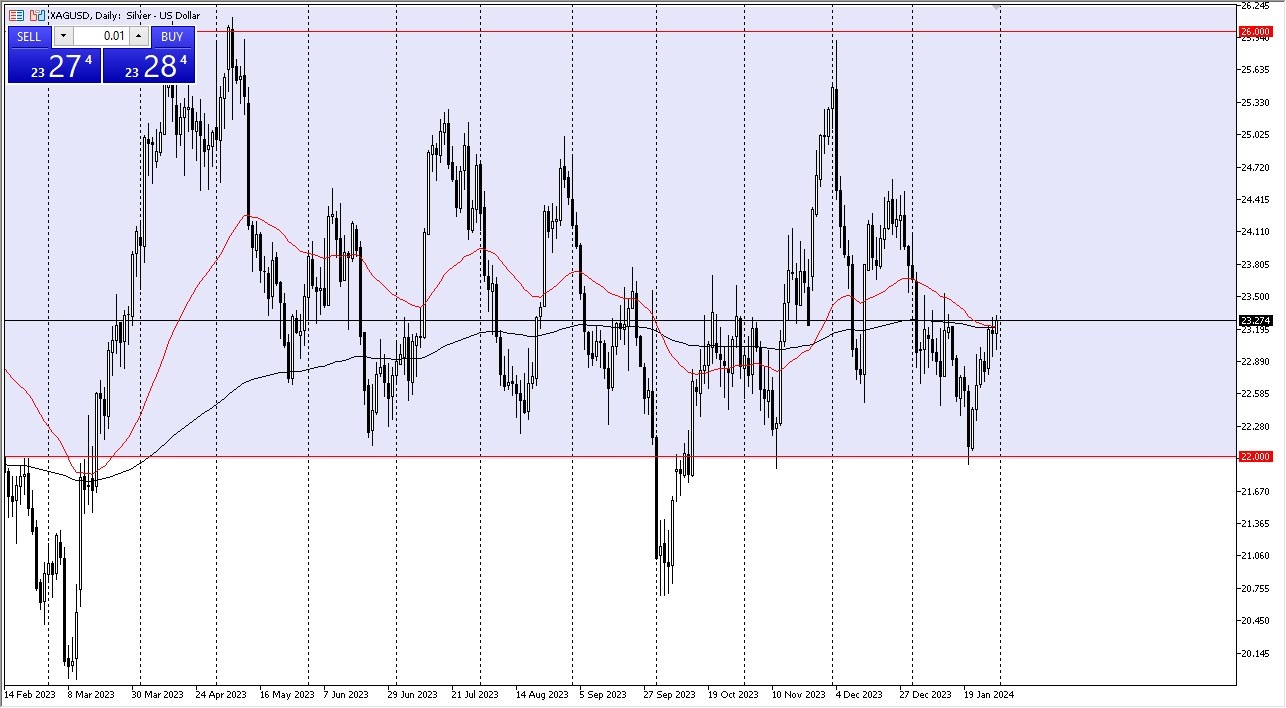

Silver prices briefly retreated, but a gradual recovery was witnessed, hinting at a potential resurgence. If the market surpasses the previous session's highs, it could set its sights on the $23.50 mark. The FOMC meeting scheduled for later in the day has been a point of keen interest for many, as it may indicate a shift towards a more accommodative monetary policy. Such a development would likely provide further impetus for a silver rally.

Conversely, a decline from the current levels could find support around the $22 threshold. This price point holds significance as a major support level and potentially marks the lower boundary of the year's overall trend. Should silver continue gaining momentum, this trend's upper bound could extend to around $26.

In the event of an upward movement, the $23.50 level becomes a plausible target, followed by $24.50. It's essential to remember that silver serves not only as a precious metal but also as an industrial one. Consequently, its performance hinges not solely on interest rates but also on industrial demand. Various factors, including interest rates, industrial utilization, geopolitical tensions, and economic uncertainties, can influence silver's price dynamics.

Buying on the Dips

In the current climate, purchasing silver during price dips appears to be a prudent strategy. Such dips have repeatedly presented opportunities for value-driven investments. However, it's crucial to exercise caution, given the inherent volatility of the silver market. Maintaining a reasonable position size is advisable, especially in this unpredictable environment.

Although a scenario where silver breaches the $22 support level seems improbable at present, it's worth noting that a fallback to $21 could provide substantial support if such a situation were to materialize.

The silver market remains subject to various influencing factors, including monetary policies, industrial demand, and geopolitical concerns. While the immediate direction of silver prices hinges on the FOMC's decisions, investors need to approach this volatile market with caution and consider buying opportunities during price downturns. Silver's inherent unpredictability necessitates prudent risk management, making it advisable to maintain a balanced position size amid the prevailing uncertainty.

Ready to trade our daily Forex analysis? We’ve made a list of the best online forex trading platform worth trading with.