- The S&P 500 demonstrated a modest rally during Thursday's trading session, reflecting the cautious stance of traders in anticipation of the impending Non-Farm Payroll announcement set for Friday.

- The recent press conference held by Jerome Powell has prompted a reevaluation of market sentiments.

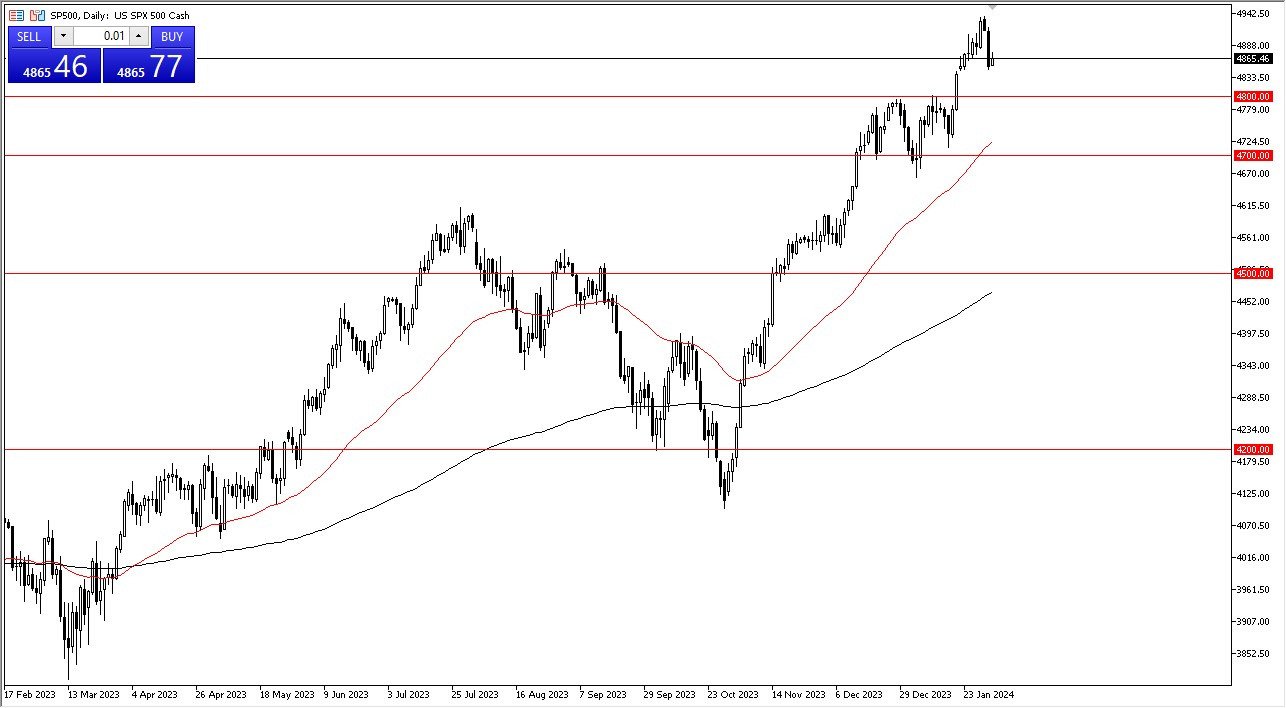

The S&P 500 Index made an initial effort to advance in the early hours of Thursday, amid an environment characterized by short-term uncertainty. This uncertainty aligns with the imminent release of non-farm payroll data, a significant driver of interest rate expectations. Jerome Powell's press conference on Wednesday did not convey an overly dovish tone, leading to an outsized market reaction. The prospect of the S&P 500 descending to the 4,800 level holds appeal, considering its historical significance as a resistance-turned-support level. Over time, this level may have ingrained itself in the collective market memory.

Support Below

Additionally, the 50-day Exponential Moving Average has broken the 4,700 level, reinforcing its role as a support point. From a longer-term perspective, it appears increasingly likely that the index will eventually surpass the 5,000 mark. The current pullback is viewed as a necessary correction, lending credence to the notion of seeking value in the market. The prevailing sentiment suggests that buying on price dips remains the preferred strategy, given the index's enduring strength.

The S&P 500 is predominantly influenced by a select group of stocks, which mirrors the contemporary landscape of most U.S. indices. In essence, it has evolved into more of an Exchange-Traded Fund (ETF) market than a traditional stock market. Consequently, tracking the performance of the prominent seven stocks is often sufficient to achieve favorable results. While a breakdown below the 4,700 level could potentially trigger a more substantial correction, the prevailing sentiment on Wall Street continues to anticipate potential interest rate cuts later in the year.

In the end, the S&P 500 exhibited a modest rally, reflecting the prevailing uncertainty among traders leading up to the Non-Farm Payroll announcement. The recent press conference by Jerome Powell has prompted a reassessment of market dynamics. Key support levels, such as 4,800 and the 50-day EMA at 4,700, remain significant points of interest. Despite the current pullback, the index's overall strength fosters a strategy of buying on price dips. The S&P 500's composition, characterized by a handful of influential stocks, has transformed it into more of an ETF market, simplifying the approach for potential investors. While the possibility of a deeper correction exists, Wall Street's outlook maintains expectations for potential interest rate cuts later in the year.

Ready to trade the Forex S&P 500? We’ve made a list of the best online CFD trading brokers worth trading with.