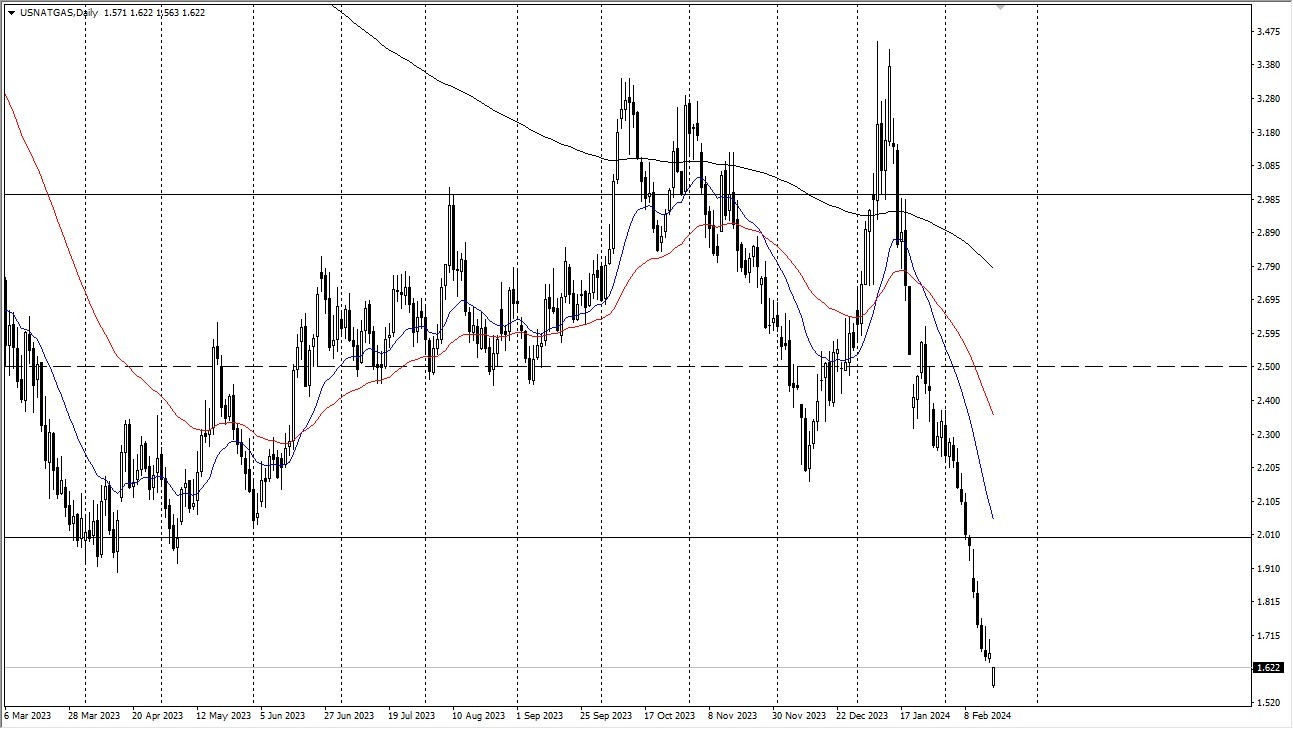

- The Monday session began with natural gas prices dropping lower, but they later recovered and showed indications of positive pressure.

- Having said that, the state of this market is currently so bad that it is very hard to see this market improving.

- For investors attempting to play the longer game, this market will present significant challenges, mostly due to the likelihood of a protracted wait as we approach the spring season in both Europe and the United States. Demand may therefore be a problem.

I believe that a cyclically significant support level that enters the picture is the $1.50 level beneath. So just give it some thought. Having said that, not much in this chart indicates that this is a reliable market. You know, it's evident how serious this problem is when you look at the weekly chart. We have reached nearly the lowest point of 2020.

Having said that, you might be able to participate if you're a longer-term investor, but I'd advise you to exercise extreme caution when sizing your stake. There's no selling on the market. You've totally missed the move, by the way, at this point. That being said, it's more likely that you'll have to hold off on getting involved until after a weekly signal. And even then, extreme caution is required. If you plan things incorrectly, this seems like a terrific opportunity to lose money.

As spring approaches, I believe that the most challenging aspect will be choosing the right date. Recall that the winter proved to be an absolute bust, leaving us with no choice but to attempt to carve out a range for the year. The supply appears to be increasing steadily, at least until drillers cease production, which they inevitably will at these prices.

All things being equal, this is a market that I think is still an absolute disaster, and therefore you will need to be very cautious about the idea of jumping into this market but sooner or later the $1.50 level will probably attract a lot of attention. Furthermore, drillers will step out, simply refusing to go to work if there’s no money in it. I do think that comes to a head sometime later this year, but right now it’s still a bit of a “bottoming process.”

Ready to trade Natural Gas Forex? We’ve made a list of the best commodity broker platforms worth trading with.