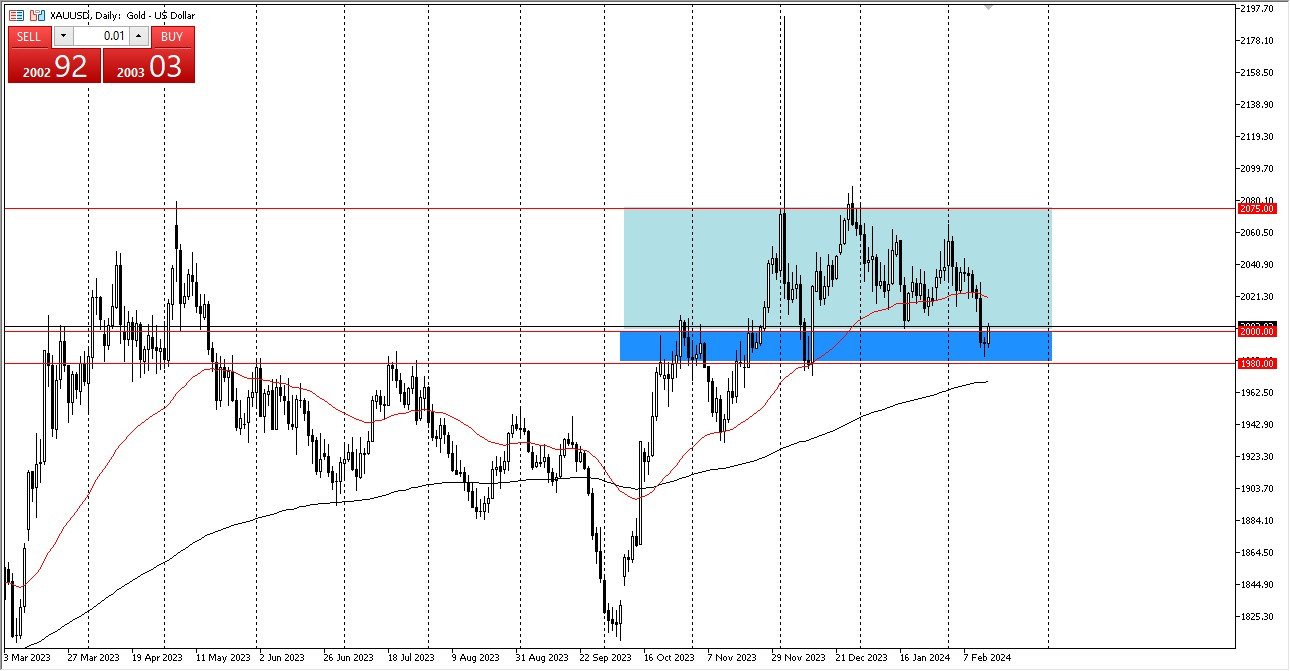

- You can see gold has had a slightly positive session during the early hours on Thursday as we have retaken the $2,000 level.

- This is an area that I think a lot of people will continue to pay attention to as it is massive support that extends from the $2,000 level all the way down to the $1,980 level.

With that being the case, I think you have to look at the gold price through the prism of a market that is at the bottom of an overall consolidation area and very well could find itself trying to sort things out as to whether or not we can continue to go higher. Things will be very noisy, but I think at this point in time it looks like the buyers are starting to assert their dominance again. This doesn’t mean it will be easy, but it’s obviously very bullish.

After all, central bank actions suggest that perhaps there is a bit of monetary policy easing coming later this year at the Federal Reserve. But I think the thing that really got things moving was the retail sales numbers coming out weaker than anticipated in the United States. If that's going to be the case, then I think really at this point it is only a matter of time before we recover a little bit further, perhaps trying to drive gold towards the 50 day EMA.

Pullback and Retest

This is a classic pullback to support and bounce setup. We'll see whether or not it holds up, but it certainly looks interesting. It's probably worth noting that the hammer from the previous session went all the way down toward the $1,980 level and then turned around quite significantly. That does suggest that perhaps we are continuing to see the $1,980 level be the floor.

The 200 day EMA is racing towards that area. So, it'll be interesting to see if that comes into the picture as well on any pullback. But right now, it looks like we are more likely to rally than to fall. Ultimately, this is a situation where I think the market is going to remain range bound, perhaps even bullish of the longer term. I have no interest in selling gold, at least not until we break down below that 200-Day EMA.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.