- Although there has been a modest increase in gold markets during the early hours of Tuesday, we are currently trading within the same range, so I'm not getting too enthusiastic about either direction, as we are so indecisive at the moment. I think this is just a bit of a hiccup.

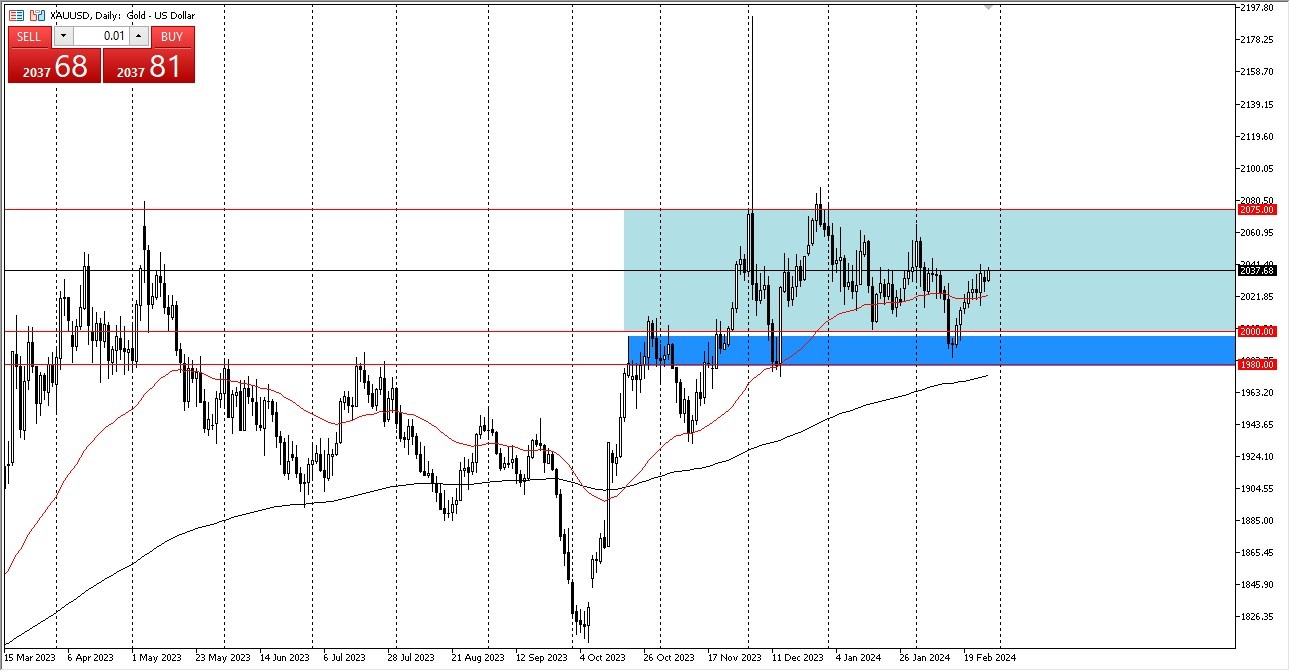

As you can see by looking at the gold market, our goal is to reach $2040. We could aim for $2060 if we can break over that level. The 50-day EMA enters the picture below and provides a small amount of additional support. Having said all of that, I do think it makes sense to purchase dips as they happen. Given that the 50-day EMA is broken, I believe there is a chance we might see a decline to the $2,000 mark, which represents the main floor in this market.

Overall Consolidation

Since gold is currently in the midst of this general consolidation, I believe that the $2,075 level above represents your ceiling. Gold can rise considerably higher if we can break over that level.

Although I don't know how long it will take, I believe that at this point the market will probably at least try to get there. It could happen quickly, or it could take more time to get things done. Based on the past three months, I predict that it will be more of a grind than anything else.

Remember, gold is being moved by the same things. In addition to geopolitical worries, we should be more concerned with the state of the bond markets and the direction of rising or dropping yields. It adds to the allure of gold as they fall.

Keep an eye on the US currency as well; it can also have an impact, though this correlation is erratic. For the past three months, the market has been rising, and it appears that we are now attempting to remove some of the froth. I anticipate a great deal of erratic and cacophonous activity in this domain, but I would not be shocked if the market reached the upper end of the range once more. In the end, I do believe that gold will become quite popular later this year, but we are not yet ready for it to happen.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.