- The gold markets fluctuated during Friday's trading session.

- Since the market is still fluctuating, we should begin to view it from the perspective of intermediate trading and possibly swing trading.

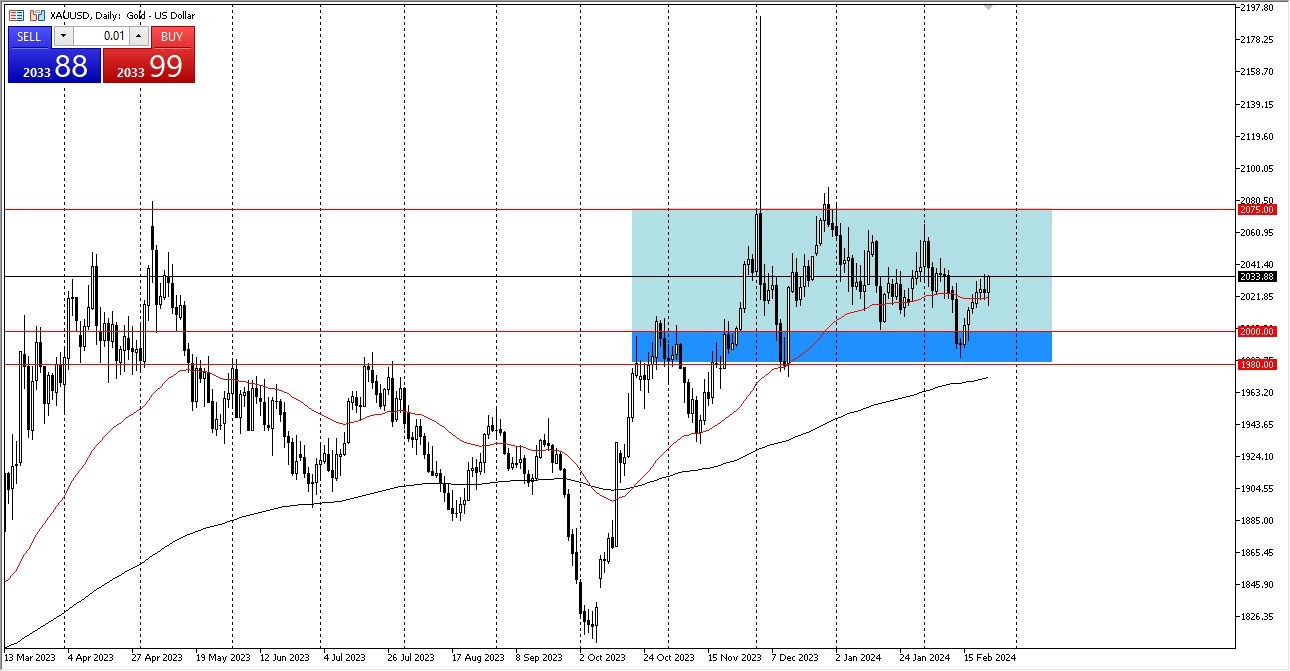

Gold Continues to Hang Around the Same Region

Observing the gold market, which is, naturally, fluctuating slightly over the 50-day EMA. Naturally, a lot of people will pay attention to the 50-day EMA as an indicator, and it appears that the past few days have supported this. We can't seem to take off in either direction, at least not very readily, after all.

There is the important $2,000 level below, which is going to be a lot of people's attention, in my opinion, because of how resilient its support is. Since it goes all the way down to $1,980, I believe the most likely scenario is that we will see more upward pressure than anything else. To put it simply, there are several reasons why gold will remain a popular commodity among traders as we are looking for some kind of momentum to get going forward.

In the end, the $2060 mark is a potential target if we manage to break higher. and ultimately the $2075 mark. There used to be a firm ceiling on the market at the $2075 level. I believe that many people will be closely watching it as a result. Anything above that, and gold really begins to run, maybe more in a "buy-and-hold" kind of situation that many will recognize as a longer-term trade more than anything else. Because of this, the market will continue to be one that investors look to the longer-term, as there are going to be a lot of value and protection to be had.

The standard variables that affect gold include interest rates, the strength or weakness of the US dollar, and naturally, geopolitical concerns. Given all else being equal, the market is still one that we should purchase on dips, and this has been the case for most of the year as well as the whole week. Finding inexpensive gold to safeguard a portion of my assets appeals to me. Although I don't think I should invest all of my money in gold, I do believe it should be a part of any portfolio. Furthermore, I believe that we will continue to trade in the same range that we have been in since November of last year.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.