- During the Wednesday training session, the gold market was optimistic as we continue to witness a notable rally.

- Having said that, I believe there will be a lot of buyers out there in the long run, even though the market is going to remain quite volatile.

- This is going to be exasperated by the FOMC Meeting Minutes later in the Wednesday session, as trader will try to get a feel on what the Fed might do.

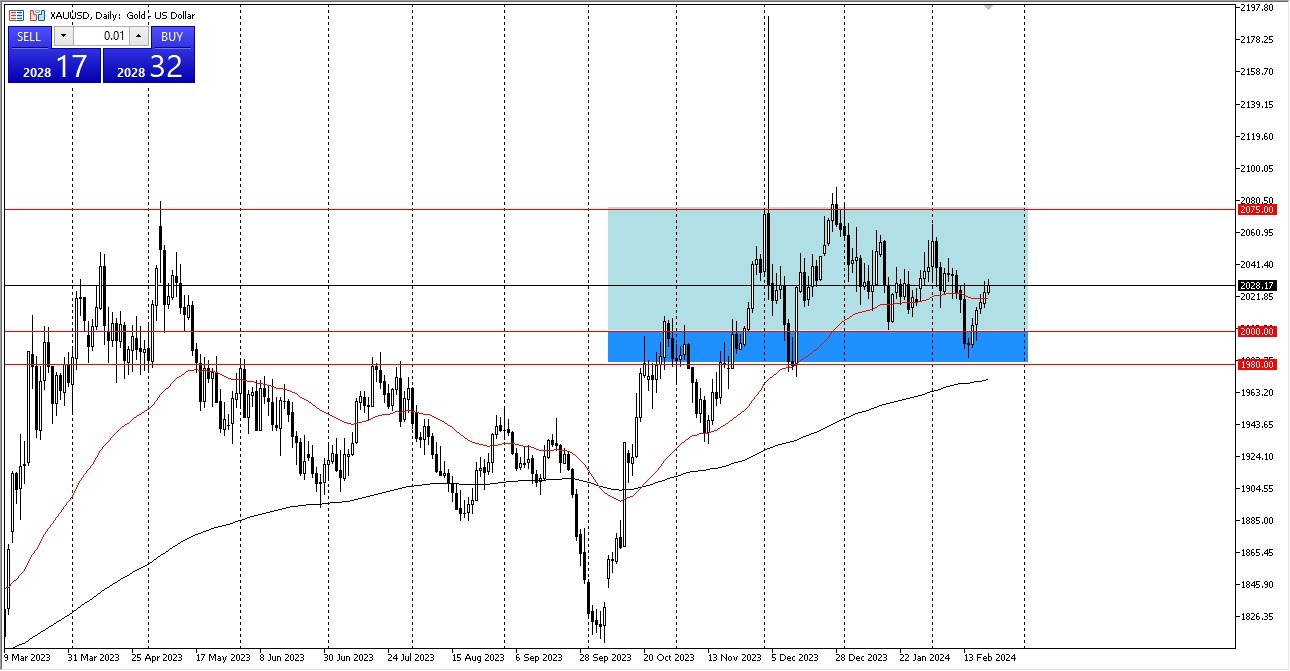

As you can see, the gold market is getting closer to $2,030, or around the center of the general consolidation range that we had been in for a while. The market appears to be trying to move higher now that it is well above the 50-day EMA, and any brief decline in price that occur could be opportunities for purchasing. Furthermore, I do anticipate that pullbacks will present buying opportunities, with the $2,000 level below providing a strong support level that descends to the $1,980 level, which is likewise supported by the 200-day EMA.

Top Forex Brokers

Be Careful with Gold

Remember that gold is quite erratic, so it makes some sense that we are just bouncing back and forth. If everything else is equal, a brief retreat may present a chance to go long once again. However, if we simply continue up from here, our target is the $2,050 level, and we may even reach the $2,075 level, which is the upper limit of the longer-term consolidation area. On the longer-term charts, this is without a doubt one of the most significant levels.

The market turns into much more of a buy and hold scenario where FOMO takes over and moves your position higher if we can break above that level. Short-term, I believe there will be buyers every time this market retreats, and you should monitor the US currency, US interest rate conditions, and, of course, global central bank movements. Remember that this year will see a loosening of monetary policy by central banks. Furthermore, the fact that central banks worldwide—some of them quite significantly so—are net buyers of gold is another positive factor. Given that, I believe there is a demand for.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.