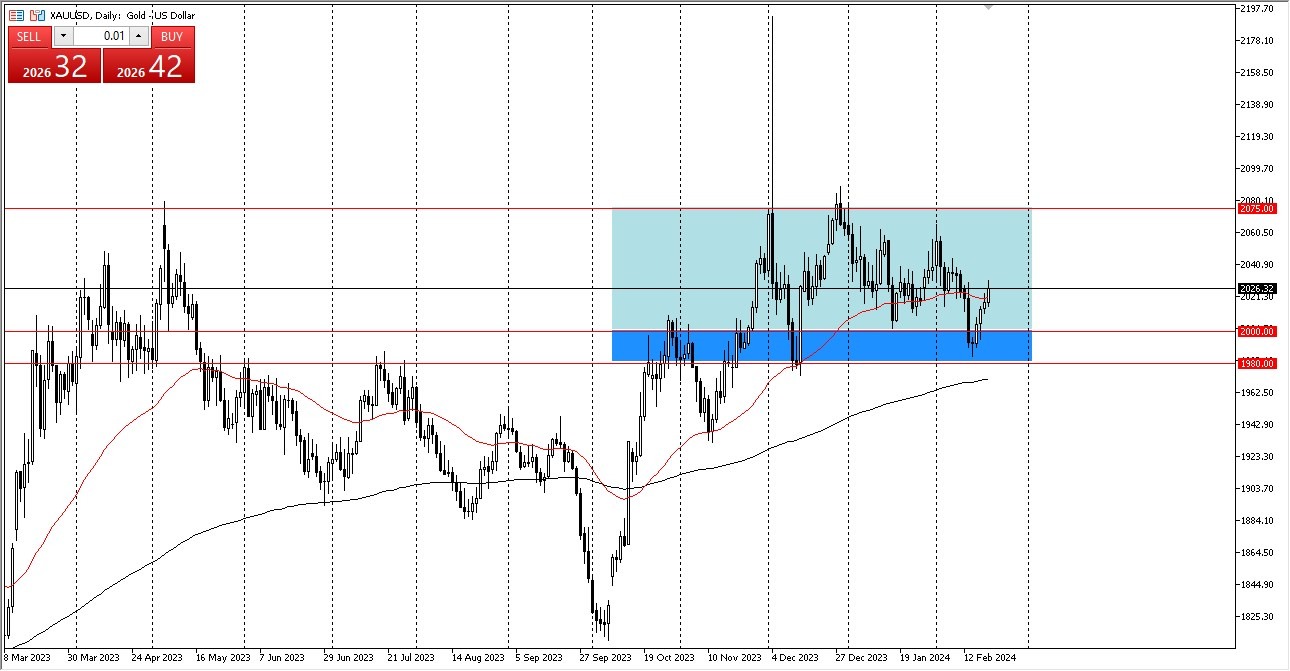

- As you can see, during the trading day, gold climbed over the 50-day EMA, and it currently appears that a significant increase is imminent.

Notwithstanding, there is a lot of noise in this market, so you should naturally exercise some caution when deciding how big of a position to take; after all, the gold market is known for its commotion. Having said that, we probably have a situation where buyers are still willing to purchase short-term declines. I think this continues to be the case going forward as gold has so many different reasons to go higher over the longer-term also.

Top Forex Brokers

I believe that you need to be very careful because the $2,000 level is a starting place of strong support that goes all the way down to $1,980. There is also the 200-day EMA positioned beneath it. Having said all of that, technical traders will need to accept that it must arrive. The $2,060 and $2,075 levels might also pose serious problems on a move higher. However, I believe that you will eventually realize in this market that you are a dip buyer.

Although I don't think you should pursue it with a large position, I have been warning you over the past few days that this is a market where buyers get involved every time it pulls back, and that's what we continue to see. See the US 10-year yields with some care. That will impact gold significantly. Gold will be significantly influenced by the US currency. Of doubt, the many geopolitical issues that exist now will continue to have a significant impact on gold prices.

Gold will soar if we can break beyond the $2075 mark. The air pocket we had on December 4th, during which there was a devious rise in early Asian trading, is visible. That said, I'm still optimistic even though I know things will be bumpy. Though I believe it is clear that there is only one path at this time, make careful to exercise caution when sizing. This is a market that can be quite rewarding, but it can also be very punishing when we get big moves, being careful is something you should always do in this market.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.