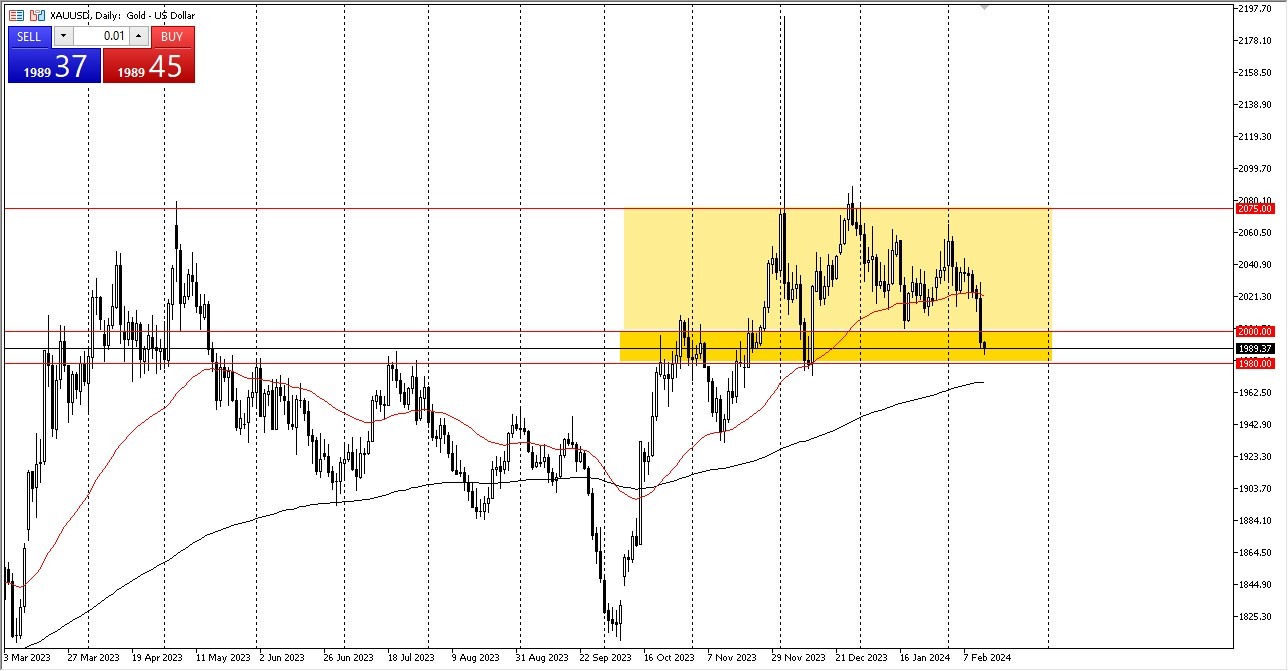

- Gold markets demonstrated stability during Wednesday's trading session, consolidating within the range of $2000 and $1980.

- This pivotal range appears to be holding firm, indicating a degree of support in the market. I am very interested in this region, and therefore you need to open your eyes at the moment.

Amidst Wednesday's trading, gold exhibited resilience within the aforementioned price range. The area between $2000 and $1980 is proving to be a significant support zone, potentially prompting a turnaround and a subsequent rally if the $2000 level is reclaimed. Such a reversal could pave the way for a climb towards the 50-day Exponential Moving Average, followed by potential resistance levels at $2040, $2060, and ultimately $2075. These levels have historically acted as formidable barriers, garnering attention from market participants.

The previous session's selloff, triggered by the CPI announcement, appears to have lost momentum, leading to a reassessment of market dynamics. While the market remains somewhat range-bound, influenced by the fluctuating dollar, such consolidation is characteristic of gold's behavior before significant movements.

The Importance of the 200-Day EMA

However, a breach below the 200-day EMA could signal a bearish turn. Presently, such an outcome seems unlikely, with a potential bounce from current levels anticipated. The sustainability of this bounce remains uncertain, but the market appears inclined towards maintaining its range-bound trajectory, a pattern observed over the past three months. I think this will continue to be the case, and therefore I will trade this market accordingly until proven otherwise.

Despite Tuesday's notable price action, the broader market landscape remains largely unchanged. Should this pattern persist, a bounce is crucial to establish a sense of fair value or equilibrium in the market. This will be important in this region, and therefore I think a lot of traders will be paying attention to the gold markets over the next day or two.

At the end of the day, gold markets exhibit signs of stability within the $2000-$1980 range, suggesting a degree of support at these levels. The potential for a reversal and subsequent rally exists if the $2000 level is regained, with notable resistance levels lying ahead. While uncertainties persist, particularly regarding the dollar's movements, gold's tendency towards consolidation before significant moves underscores the current market sentiment.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.