- Gold prices experienced a slight dip on Wednesday as the US dollar showed signs of strength across various financial markets.

- Despite this, the overall outlook for gold remains positive, with potential for further upward movement, provided investors exercise patience.

- I think this is a market that you cannot be frustrated with, rather think of it as a longer-term swing trade.

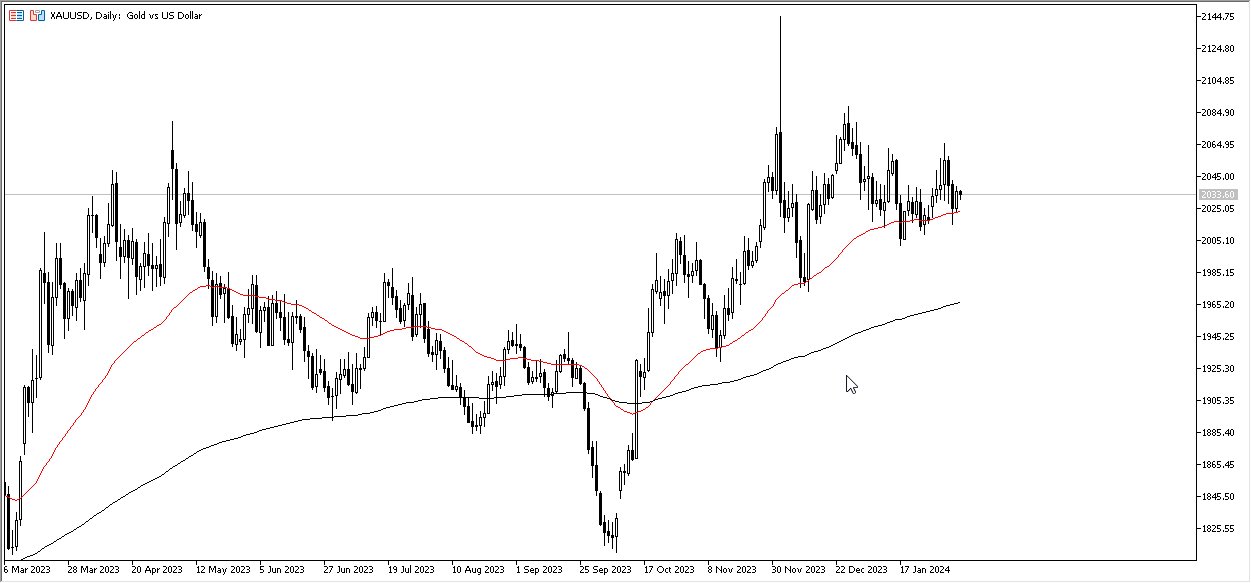

Throughout the trading session on Wednesday, gold witnessed a marginal decline, yet its overall trajectory remains largely unchanged. Short-term prospects for the market appear uncertain, but there is optimism for long-term growth. However, investors may need to adopt a patient approach in anticipation of favorable outcomes.

Key levels to monitor include the $2060 mark, which holds significant importance. A breakthrough above this level could pave the way for a target at $2075. Beyond this threshold, any price point exceeding $2075 would signal a strong buying opportunity, indicative of a bullish breakout.

On the downside, the 50-day Exponential Moving Average is expected to provide robust support. Additionally, the $2000 level serves as a critical support level, extending down to $1980. Should prices breach this floor, heightened attention from traders is anticipated. However, current market conditions suggest a trend reversal is unlikely, particularly with global central banks poised for potential rate cuts.

Various Reasons to Own Gold

The appeal of gold as an investment remains anchored in various factors, including potential rate cuts by central banks and ongoing geopolitical uncertainties. Despite these catalysts, it's advisable to exercise caution, as gold's inherent volatility necessitates a balanced portfolio approach. While holding a portion of gold can offer diversification benefits, excessive exposure may amplify risk.

In light of numerous potential catalysts, maintaining a strategic allocation to gold is advisable, albeit in moderation. However, investors should remain mindful of its volatile nature and avoid overexposure. Despite short-term fluctuations, a positive outlook for gold prevails, with expectations of further upside potential throughout the year.

At the end of the day, while gold prices experienced a minor setback on Wednesday, the broader outlook remains favorable. With patience and strategic positioning, investors can capitalize on potential opportunities for growth, albeit with an understanding of gold's inherent volatility and the need for diversification within investment portfolios.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.