- Thursday's trading session saw a sharp increase in the price of gold as the PCE numbers fluctuated and eventually came in at the predicted level.

- As a result, traders who are wagering on the expectation that the Federal Reserve would cut later are likely to continue to be seen in the market.

Gold On the Move

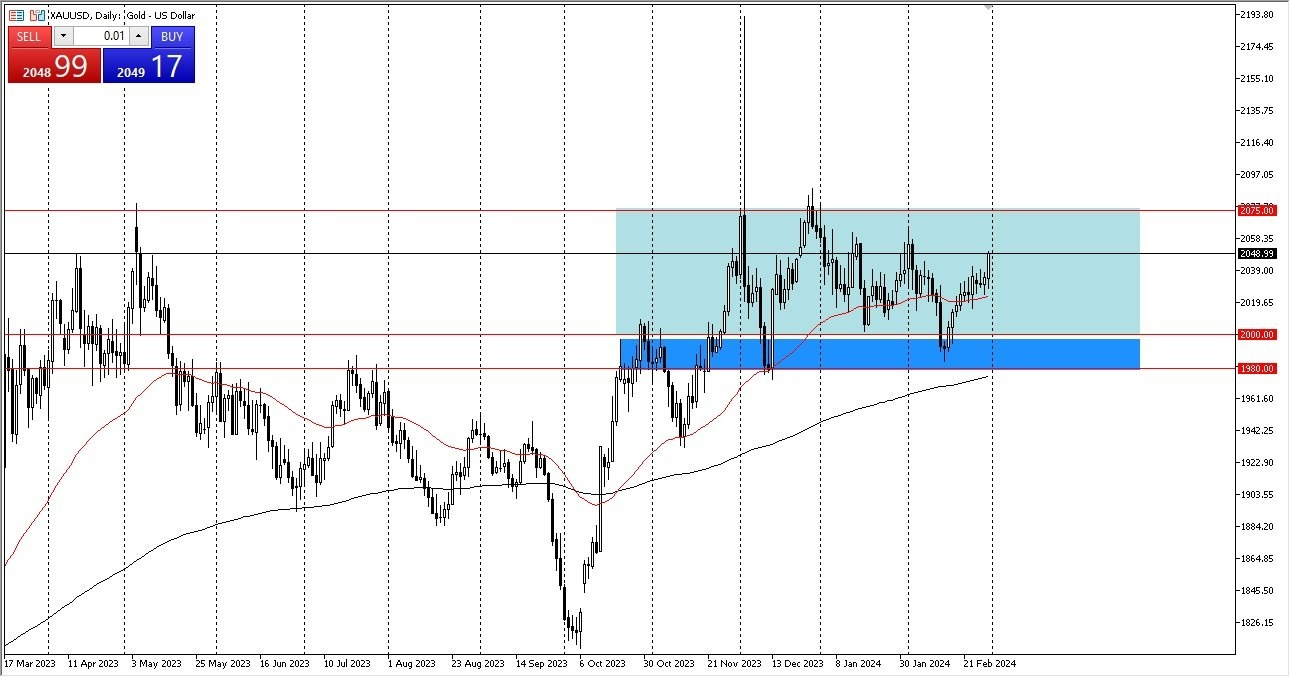

As you can see, Thursday's session was extremely positive for de gold price despite the US PCE figures coming in as expected. And since the Federal Reserve uses that as its primary inflation gauge, that naturally benefits everyone. People begin to believe that the Fed will continue to cut as a result. Should that prove to be the case, gold ought to have a respectable run at this point. Buying temporary declines is a concept that appeals to me. That has always been the situation. There should be a lot of support from the 50-day EMA. What I believe to be the market floor starts at the 2000 level below and goes all the way down to the $1,980 level.

Along with this, I would also like to mention that the $2,075 mark above represents a significant obstacle, and it will likely be challenging to break beyond it. However, as soon as we do, the market turns into one to buy and hold. I simply don't see how you could sell the gold market in such situation. You ought to seize the chance whenever you can gain a small amount of value. However, it's not necessary to leap upon it with both feet in a large stance. You want to diversify your holdings by adding gold because you think that central banks would likely cut.

However, there are also geopolitical issues that can make gold a worthwhile investment in any case. Yes, gold is usually quite noisy. It's something that you will need to manage. It is simply a reality. In the end, I believe that purchasing pullbacks is a good strategy, and I do believe that the market will eventually rise above $2075 and start to favor buy and hold positions. It's also important to note that the 200-day EMA is getting closer to that firm floor, which lends it even more support. This market should remain a favorable one to be involved in because it has a lot of built-in locations to use as resistance and support.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.