- The US dollar continues to demonstrate strength against various global currencies in early Tuesday trading, and this trend is also evident in the GBP/USD pair.

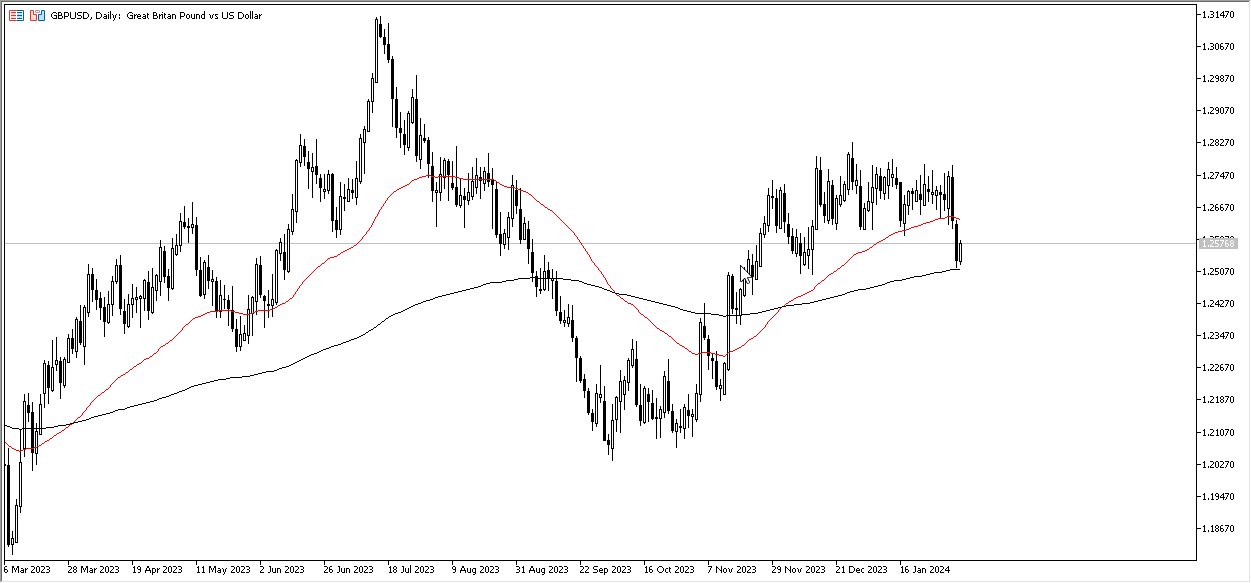

In the case of the British pound, there has been a slight rebound during the early hours of Tuesday, suggesting a temporary alleviation of selling pressure. The 200-day Exponential Moving Average is positioned to provide a certain level of support, coinciding with the current trading level above 1.25. For those favoring a bullish stance on the British pound, this offers some grounds for optimism.

However, it is crucial to monitor the situation closely, as a break below the 1.25 level could trigger further declines for the British pound, potentially leading it towards the 1.2350 level. Conversely, if market dynamics shift, there may be an attempt to reach the 50-day EMA, situated just above the 1.26 level. This is an area that I will be watching closely, truth be told.

Fed to Postpone Rate Cuts?

The recent strength of the US dollar can be attributed to the expectation that the Federal Reserve will likely postpone any immediate interest rate cuts. It appears that market anticipation regarding the timing of rate cuts may have been overly optimistic. Nevertheless, the Federal Reserve has acknowledged its intention to implement rate cuts in 2024, which suggests a potential path for recovery for the British pound in the long run.

However, it's important to consider that the current market sentiment favors the US dollar in a risk-off scenario, impacting not only the pound but also other currency pairs denominated in USD. This is a trend observed across various currency pairs against the US dollar.

At the end of the day, the British pound is currently facing headwinds, with the US dollar gaining strength against it and other currencies. The 200-day EMA and the 1.25 level offer temporary support, but a sustained breakdown could lead to further declines. While the Federal Reserve's rate cut timeline may have been adjusted, the overall outlook for the pound remains uncertain, and market conditions should be closely monitored. The potential for a Fed rate cut in the future may play a role in the pound's recovery, but short-term challenges persist for the currency.

Ready to trade our daily Forex forecast? Here’s some of the best forex broker UK reviews to check out.