- On Monday, the British pound exhibited a drop against the US dollar as markets grapple with the prospect of a Federal Reserve adopting a more prolonged tightening stance.

- Whether or not this is true remains to be seen at this point in time.

During the early hours of Monday's trading session, the British pound experienced a modest decline against the US dollar, reflecting a recent shift in sentiment towards selling off the greenback. However, several recent developments have impacted this narrative.

Firstly, the Federal Reserve conveyed a message that hinted at a potentially less dovish stance than previously perceived. Subsequently, Friday's jobs report ignited discussions surrounding the continued strength of the US economy. Consequently, it is not surprising to observe the British pound facing challenges when juxtaposed with the US dollar.

Technicals Below

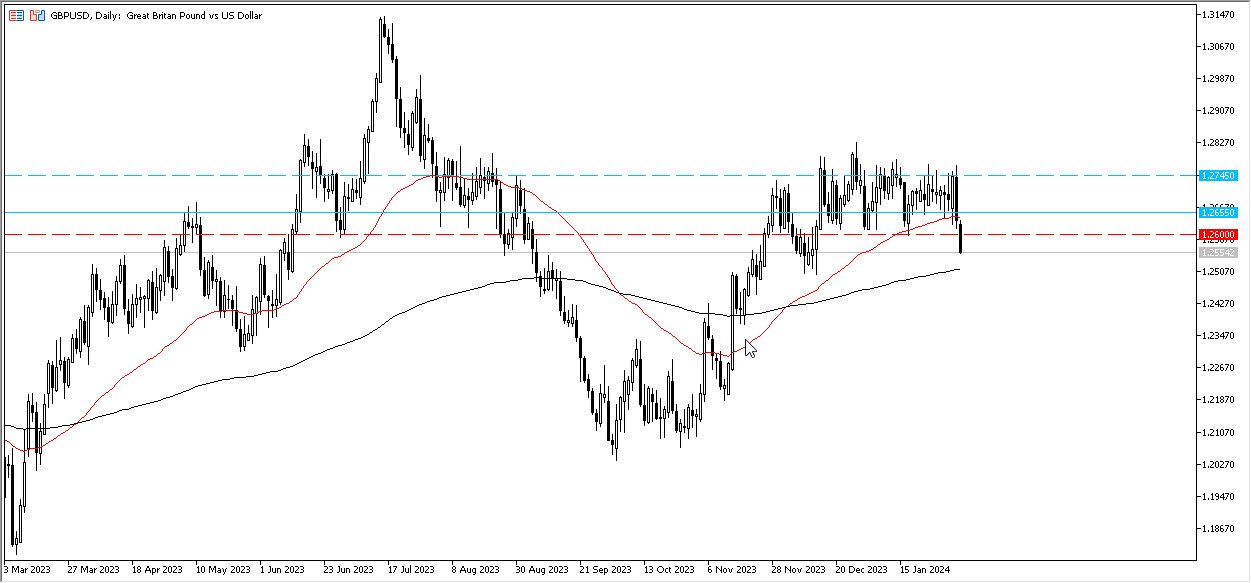

Beneath the current market conditions, we observe the presence of the 200-day Exponential Moving Average and the 1.25 level, which are likely to command significant attention. A breach below this point might intensify selling pressure and warrant close monitoring. Conversely, a resurgence in the market, particularly reclaiming the 50-day EMA, would be considered a bullish development. An even stronger bullish signal would emerge with a sustained move above the 1.2750 level, which had acted as a substantial resistance during recent weeks of consolidation.

Regarding this consolidation phase, it appears that market sentiment is evolving. Traders are advised to closely observe the 200-day EMA, as its breach may trigger algorithmic trading and attract the attention of Commodity Trading Advisors (CTAs), possibly favoring a downward trend. Such a decline may not be isolated to the pound alone but could extend to other currency pairs, indicating broader US dollar strength.

Additionally, it is worth noting that the current environment may prompt a safety-oriented demand for the US dollar, adding another layer of complexity to the market dynamics. This demand for the US dollar could manifest at any given moment, further influencing the market.

In the end, the British pound's performance against the US dollar is currently influenced by a range of factors, including central bank policies, economic indicators, and broader market sentiment. Traders should remain vigilant and adaptable in response to shifting dynamics, as the currency pair navigates its course in the coming sessions.

Ready to trade our Forex daily analysis and predictions? Here’s the best forex trading company in UK to trade with.