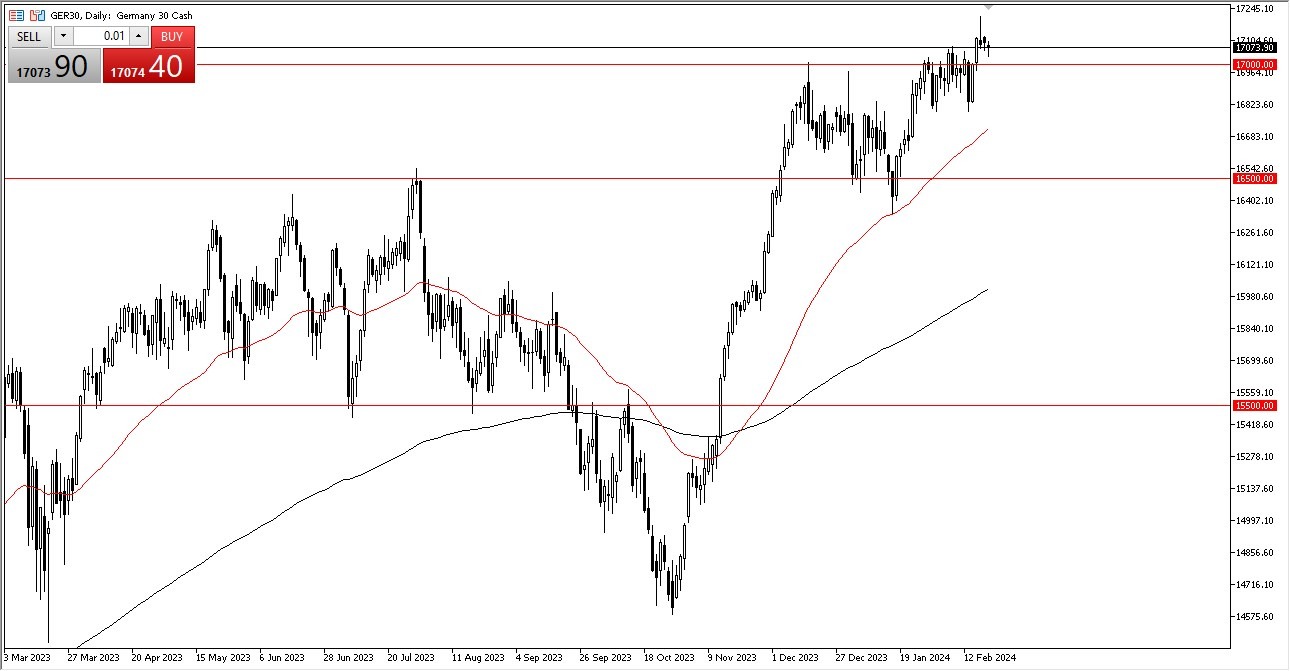

- The German DAX pulled back just a bit during the early hours on Tuesday, but it continues to see a lot of support just below.

- This is focused mainly on the €17,000 level, an area that is obviously a large, round, psychologically significant figure.

- Furthermore, this is also an area that has seen quite a bit of noise in it as of late, so I think there are plenty of buyers all the way down to at least the €16,800 level, especially now that the 50-Day EMA is racing toward that area.

By On The Dips Strategy

Although this market has been rather choppy and sideways over the last couple of weeks, the “buy on the dips” strategy should continue to work as it’s very likely that the European Central Bank will have to loosen monetary policy eventually. After all, the same disease that affects Wall Street has started to affect the European bankers and traders who are simply looking for cheap money. If that’s going to be the case, the German DAX should be the initial winter anyway, because that’s the first place money goes flowing into Europe. It’s not until we break down below the €16,000 level that I even remotely begin to worry about the uptrend, something that we are nowhere near doing.

If we can break above the €17,250 region, then I think the market has a good shot at going to the €18,000 level followed by the €20,000 level above. This would more likely than not kick off another leg of a ‘melt up’, something that we are seeing in stock indices around the world and of course the German index will be anything different. Remember, markets are basically driven by FOMO and algorithms these days, so if everybody’s buying, it just starts some type of major feedback loop. It’s not until we see a breakdown below that crucial €16,000 level that I think traders start to worry about the DAX, and perhaps start selling their positions. With that being the case, a simple matter of patience is probably all you need to start realizing profits to the upside yet again.

Ready to trade our DAX prediction? Here’s a list of some of the best CFD trading brokers to check out.