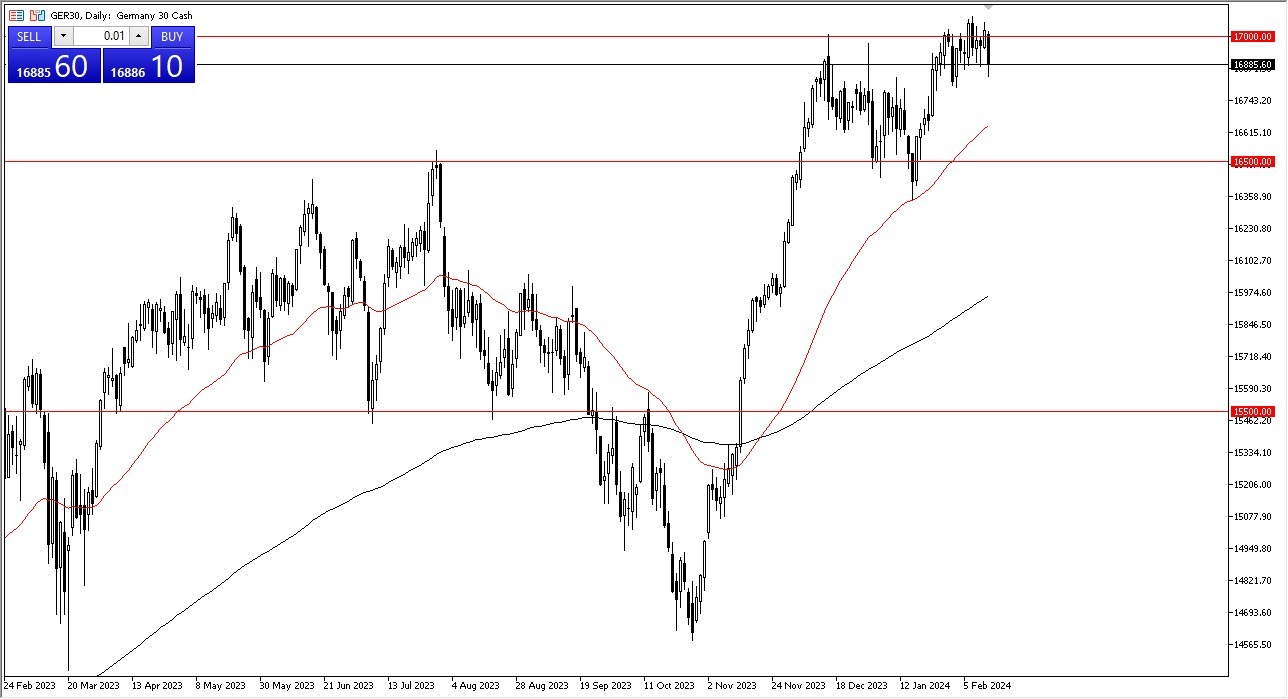

- The German DAX has fallen during the course of the trading session on Tuesday, as we continue to bounce around the same overall consolidation region.

- The 16,800 level underneath has been supported over the last couple of weeks, and I think it should continue to be so.

- The 17,000 level above has been significant resistance, and I think that will continue to be the case as well.

The Long-Term Picture

The DAX has been on an uptrend for some time, but recently we have been consolidating, perhaps working off quite a bit of froth in this market. Overall, this is a market that should continue to go higher due to the fact that the European Central Bank is more likely than not going to loosen monetary policy given enough time. Ultimately, the German economy heading into a recession gives traders the idea that perhaps the ECB is going to have to step in and loose monetary policy, which is the only thing that most stock traders care about. While this was typically a US phenomenon previously, we are starting to see this play out in Europe as well.

Underneath, the 50-Day EMA is closer to the 16,700 level and is rising, and therefore I think that could be dynamic support on the way down, assuming that we even break down from here. Underneath there, we have the 16,500 level offering support as well. On the other hand, if we turn around and break to the upside, clearing the 17,100 level, then I think the DAX will continue to go much higher, continuing the overall momentum that we have seen for quite some time.

Either way, this is like a benchmark for the entire European Union, as Germany is over 80% of the general economy and the DAX is more likely than not going to continue to be the first place most foreign traders put money to work as well. With that being said, I think the DAX will lead the rest of Europe higher, or lower if it does start to break down. Ultimately, even if you are not trading the DAX, the market is one worth watching, because it will lead the other indices around Europe such as Spain, the Netherlands, Italy, and so on.

Ready to trade our DAX forecast? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.