- The demand for crude oil on the market is still strong since traders are always ready to buy when prices fall, especially as the year's busiest season approaches and the supply naturally starts to decline.

- This is a time where a lot of oil bulls come out of hibernation.

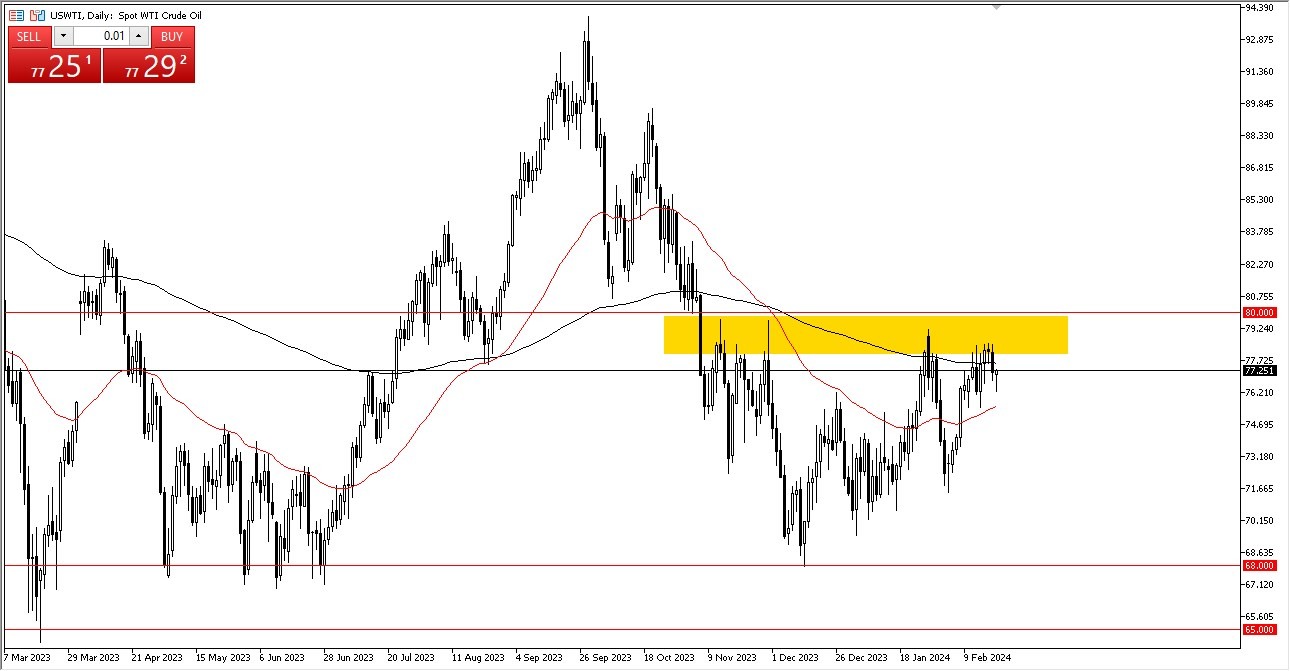

WTI Crude Oil

As you can see, during Wednesday's trading session, the crude oil market briefly declined before rising and demonstrating life once more. All else being equal, I believe there is still a lot of upward pressure on this market, and it's also worthwhile to look at the $80 level, which is a significant round number that a lot of people will be watching. The market can move considerably higher if we can break above the $80 barrier. Furthermore, it seems highly improbable that we will continue to have strong support below, particularly in the vicinity of the 50-day EMA.

In the end, this market is developing something akin to a rounded bottom, which is obviously a significant indication of a reversal. Remember that as summer approaches, demand will increase and that many people will be watching central banks throughout the world ease monetary policy, which should lead to an increase in energy prices.

Brent

As you can see, Brent appears almost exactly the same. We dropped at first, but we later turned around and showed signs of life. Naturally, the 200-day EMA is going to be a topic of great interest for many. I believe that $84 is your maximum right now. If we break over there, the $87.50 mark could become possible. The 50-day moving average below is still significant. The $80 mark is still significant. We are also witnessing a little bit of a rounded bottom, similar to the WTI market.

Once more, I believe that with the amount of economic manipulation that central banks are putting out there, it will probably only be a matter of time until we see a breakout to the upside and aim as high as $90. Given that both markets tend to follow one another, this would raise both of them. I anticipate a breakthrough with this within the next month or so, but in the meanwhile, there will be a lot of noise.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.