- The crude oil markets showed signs of recovery during Friday's trading session, marking a rebound from the extreme lows witnessed earlier in the year.

- Despite this positive momentum, various factors are contributing to market volatility, warranting caution among investors, as this market is being tossed around.

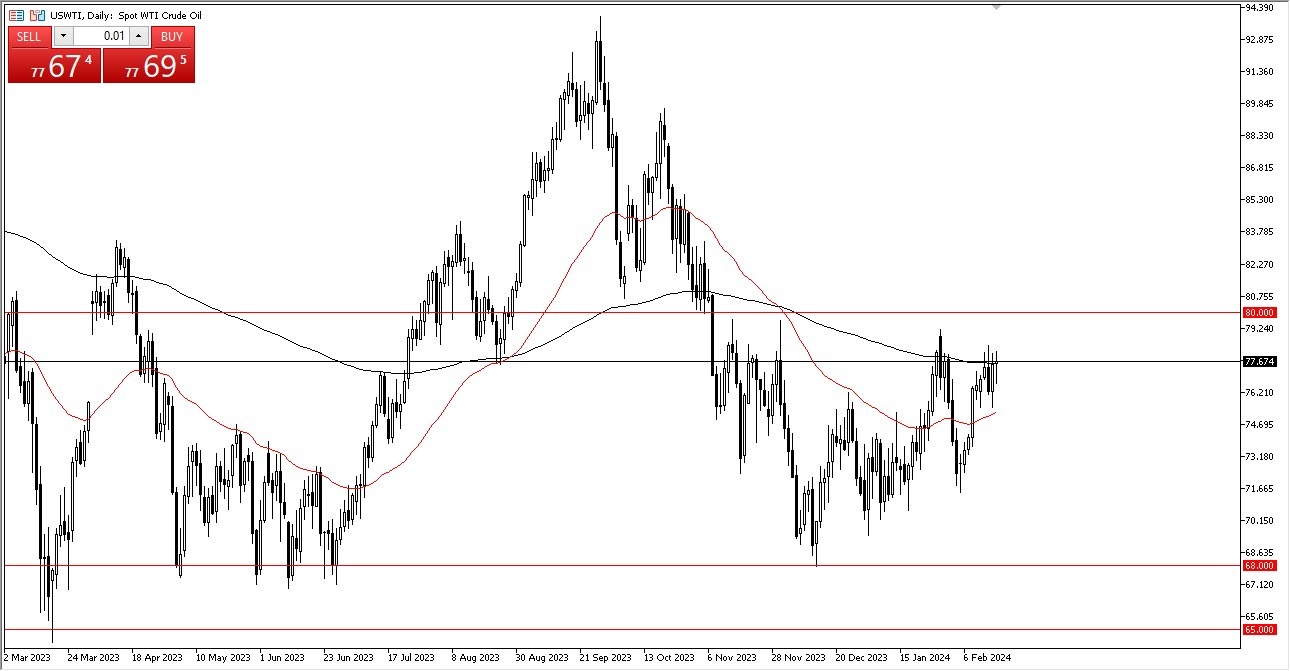

WTI Crude Oil

The West Texas Intermediate (WTI) crude oil market experienced initial declines on Friday, putting pressure on the 200-day Exponential Moving Average. This technical indicator has served as both support and resistance in recent months, underscoring the challenges of breaking above it convincingly.

Looking ahead, the $80 level emerges as a key target for market participants. While a breakthrough seems inevitable, achieving this milestone is expected to be met with significant resistance. Once breached, the $80 level could signal a shift towards a buy-and-hold strategy, potentially leading to further gains towards the $88 mark. Additionally, the 50-day EMA offers crucial support, making any dips potential buying opportunities. That has been the play for a while now, and I don’t think that changes anytime soon.

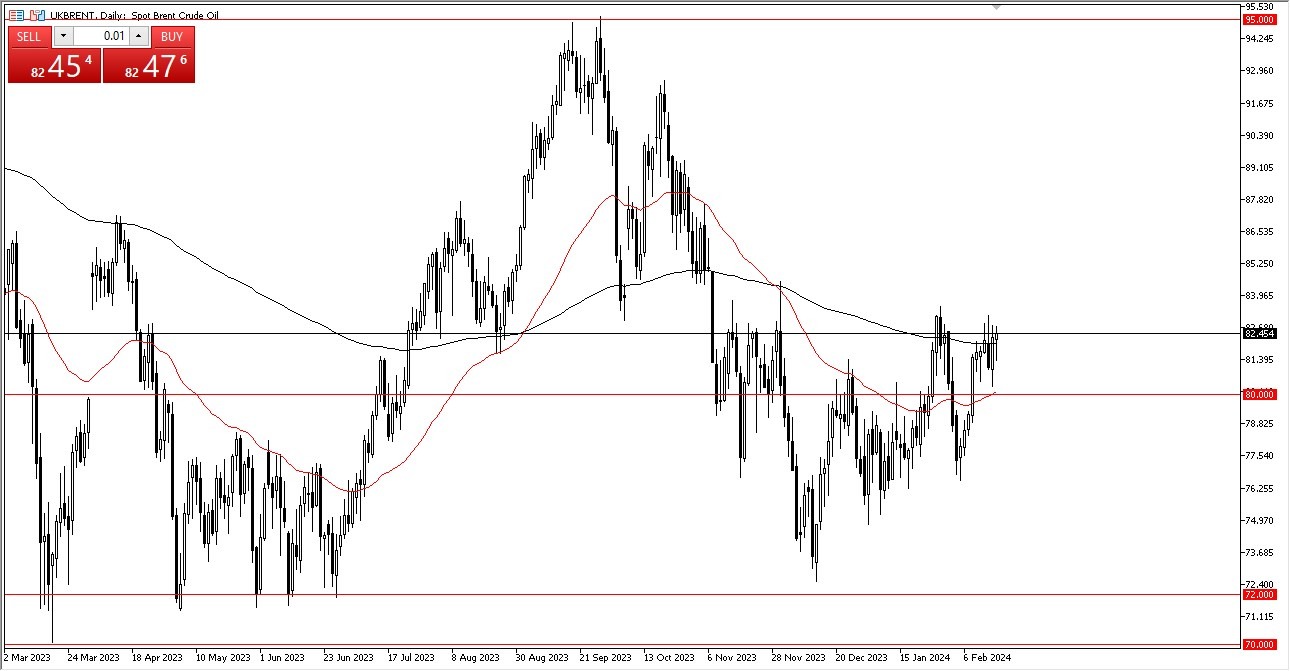

Brent

Similarly, the Brent market hovers around the 200-day EMA, with the 50-day EMA coinciding near the $80 level. A break above the $83.50 mark could catalyze a bullish trend, with targets set at $87 and $90 subsequently. That being said, it is going to be a busy and bumpy ride going forward.

Geopolitical tensions in the Middle East pose a significant risk to crude oil supply, adding to market uncertainties. Despite this, dwindling supply levels and expectations of continued monetary policy easing by central banks worldwide support bullish sentiments. The anticipation of increased energy demand amidst a potentially juiced global economy reinforces the positive outlook for crude oil prices.

At the end of the day, while crude oil markets exhibit signs of recovery, challenges persist amidst geopolitical uncertainties and supply dynamics. Buying on dips remains a favored strategy, with targets set at key resistance levels. As traders navigate the complex landscape, vigilance and positions sizing are paramount in capitalizing on potential opportunities in the crude oil market. This is a market that can cause a lot of damage to your account if you are not careful, so make sure not to overleverage any trade you put on in this environment.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.