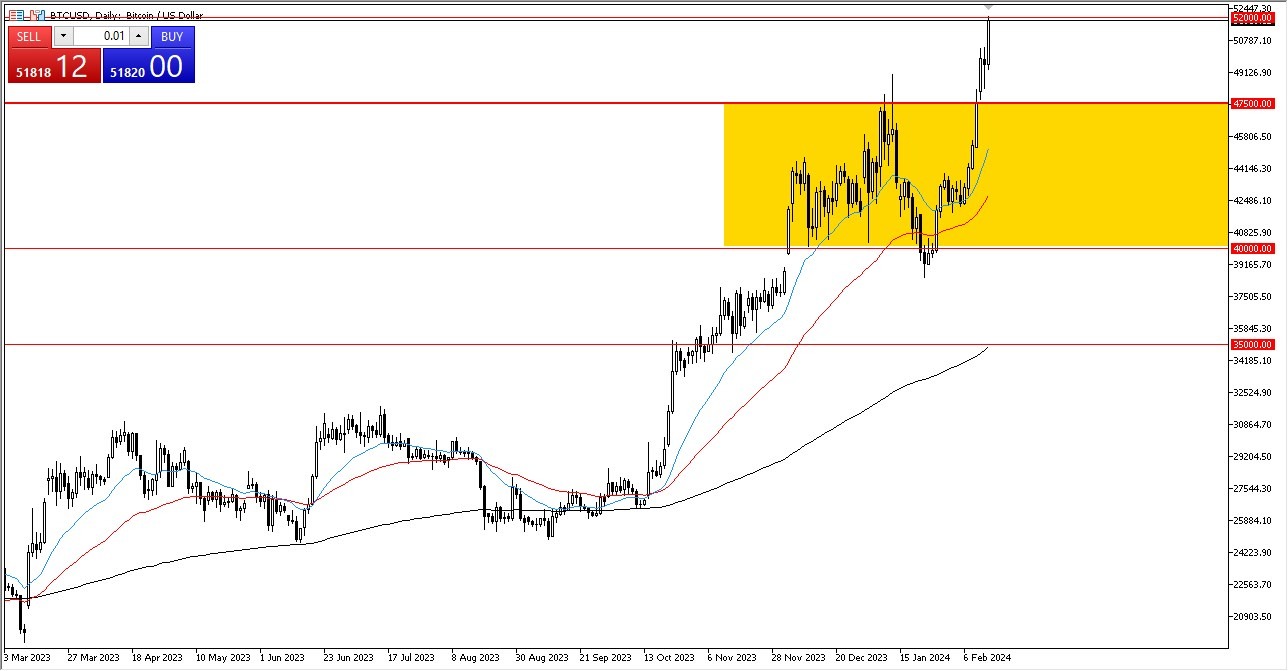

- Bitcoin continued its upward trajectory during Wednesday's trading session, with prices testing the critical $52,000 level.

- This level holds significant importance, particularly as a key resistance point on the weekly chart.

- This is an area that has shown itself to be important and therefore it looks like a major decision area.

The market's focus remains on surpassing the $52,000 threshold, which could trigger a Fear of Missing Out scenario among investors. Despite the ongoing rally, short-term pullbacks continue to garner attention, with market participants closely monitoring for potential buying opportunities.

Support is expected to hold around the $47,500 level, with inflows into the Bitcoin Exchange-Traded Fund likely contributing to this dynamic. However, the emergence of the Bitcoin ETF also introduces the possibility of increased market manipulation, given Wall Street's influence. This means that it should be just as likely to rally or fall. Wall Street will continue to manipulate the market just as they do other markets – specifically indices. Because of this, I believe that the BTC market will be much different than it has been in the past, for both good and bad reasons. This year could be very difficult.

BTC is in Long-Term Uptrend

While Bitcoin maintains a longer-term uptrend, volatility remains a defining characteristic. The future trajectory of the market hinges on whether the introduction of the Bitcoin ETF leads to stabilization or exacerbates price swings.

There is speculation that Bitcoin may evolve into a more stable asset akin to an index, which could mitigate impulsive movements in favor of a more gradual ascent. However, a breakdown below the $47,500 support level could signal a shift in sentiment, potentially leading to a decline towards the $40,000 level.

Overall, the $47,500 support level serves as a critical marker for the market's resilience. A breach below this level could trigger significant selling pressure, prompting a mass exodus of investors. This would be normal for this market, as we continue to see a lot of volatility over the longer term.

At the end of the day, Bitcoin's ascent towards the $52,000 level underscores its ongoing bullish momentum. However, the market remains susceptible to short-term fluctuations, with the introduction of the Bitcoin ETF introducing new variables. Investors should remain vigilant, closely monitoring key support and resistance levels for potential trading opportunities.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.