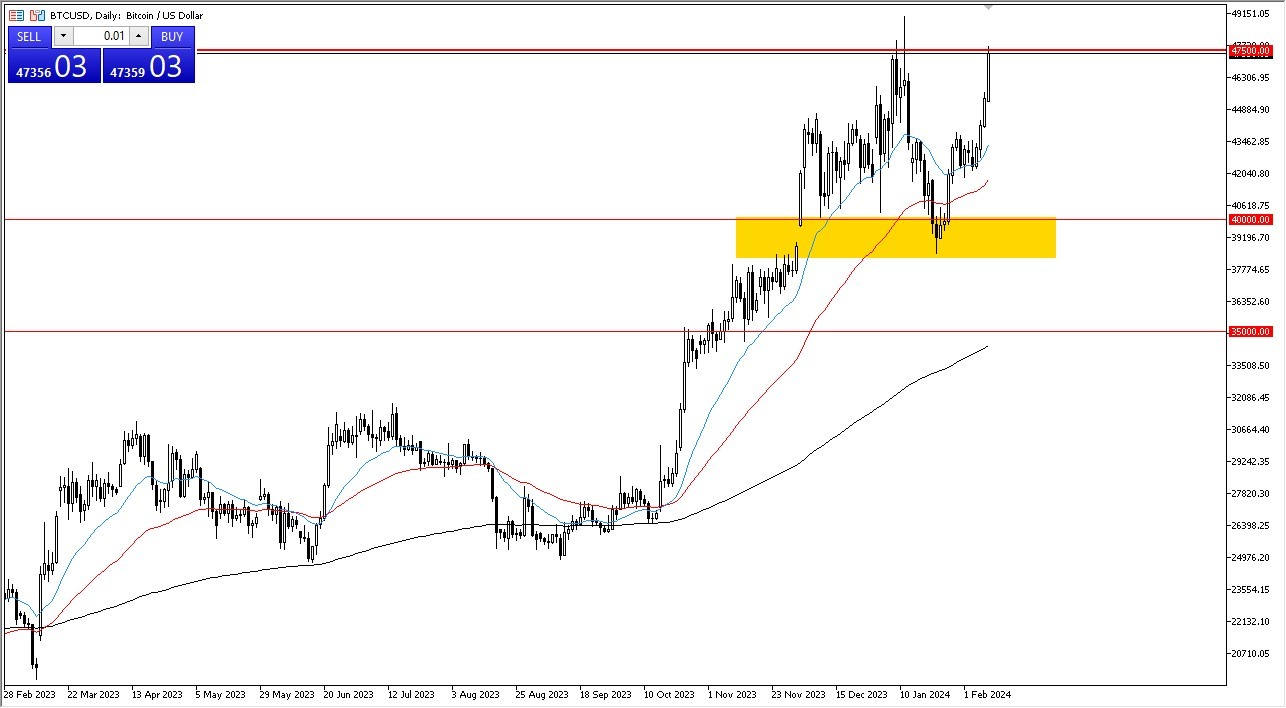

- Bitcoin's price surged during Friday's trading session, signaling a potential breakthrough of a significant resistance level at $47,500.

- The BTC/USD market swiftly ascended to the $47,500 mark, encountering resistance as expected.

- The rapid ascent prompts questions about whether the momentum is sufficient to breach this resistance decisively. A pullback seems probable, possibly retracing to the $40,000 level without altering the overall bullish sentiment.

Between the current level and $40,000, the 20-day and 50-day Exponential Moving Averages offer potential support, suggesting a search for value at this juncture. Should the market continue its upward momentum, surpassing the previous high of $49,150 could pave the way for a move towards $52,000. This is an area that has been important more than once, so I think a bit of “market memory” comes into play.

The recent rally is likely driven by expectations of central banks worldwide loosening monetary policies, coupled with the availability of Bitcoin exchange-traded funds (ETFs). However, it's essential to recognize that institutional demand, spurred by ETFs, may influence Bitcoin's spot market dynamics, including shorting strategies.

Practical Utility? Still Waiting.

Despite Bitcoin's increasing acceptance, questions persist regarding its practical utility beyond speculation. Currently, it primarily serves as a speculative instrument, with Wall Street poised to capitalize on this trend. The typical cycle involves inflating prices before offloading assets to retail traders.

A potential downturn below $38,000 could trigger a downward movement towards $35,000, where the 200-day EMA lies. However, such a scenario appears unlikely at present, given the prevailing bullish momentum. This could have traders jumping in aggressively from a longer-term standpoint.

At the end of the day, Bitcoin's recent price surge suggests continued strength in the market, with a potential breakthrough of the $47,500 resistance level. While pullbacks are expected, the presence of EMAs offers support, reinforcing the bullish sentiment. The market's dynamics, influenced by central bank policies and ETF developments, underscore Bitcoin's evolving role in the financial landscape. Despite lingering questions about its utility, Bitcoin remains a focal point for speculation, with institutional involvement adding to its allure. Nonetheless, traders should remain vigilant for any signs of reversal, particularly below key support levels, although such occurrences appear improbable in the current market environment.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.