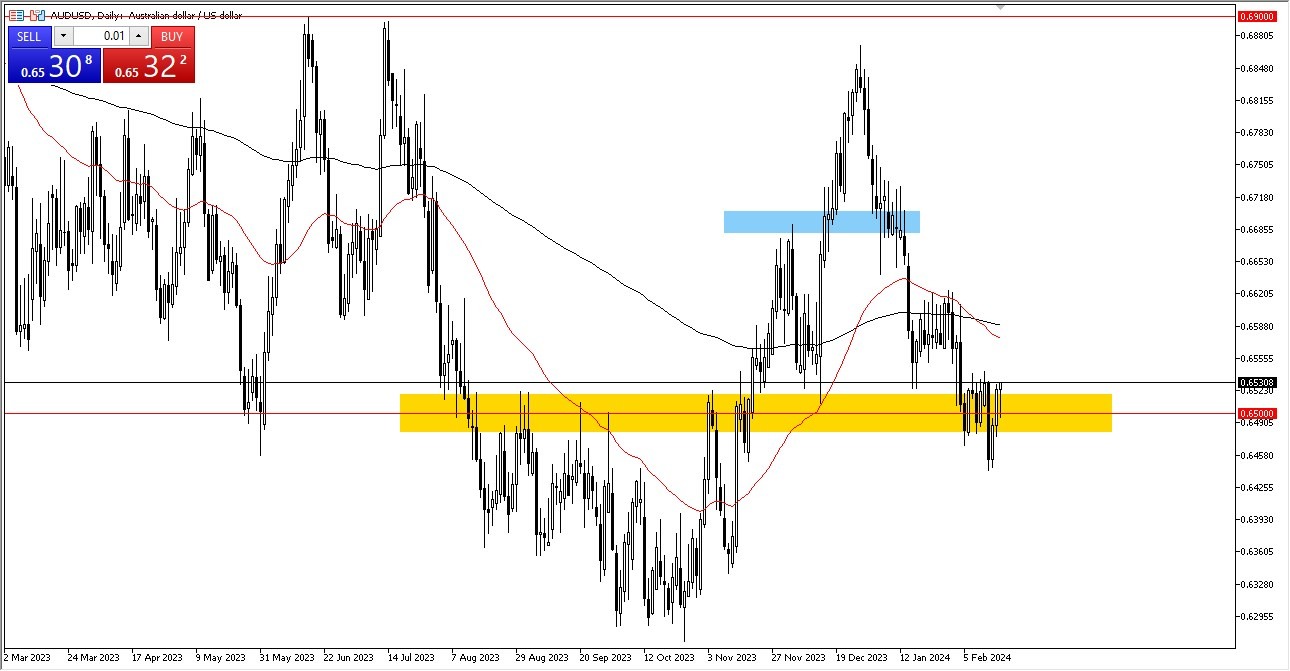

- The Australian dollar faced considerable downward pressure during Friday's trading session, although a degree of resilience was observed, particularly around the 0.65 level.

- This level has garnered attention in the past and is likely to remain a focal point for market participants as a potential fair value indicator.

- This is an area that has been visited time and time again – suggesting we will continue to do so.

Despite this brief show of strength, the AUD/USD pair remains entrenched within a tight range-bound pattern. Even in the event of a breakout, concerns linger regarding the currency's future trajectory. Immediate resistance is anticipated around the 0.6550 level, followed by the 50-day Exponential Moving Average and the 200-day EMA. Beyond these hurdles lies the 0.66 level, further complicating the outlook for the Australian dollar.

Its Busy Here.

In essence, the Australian dollar finds itself in a congested trading environment, akin to navigating through a traffic jam. While sudden movements are plausible, the presence of numerous barriers tempers expectations for a clear directional bias. Consequently, traders may encounter frustration amidst the prevailing choppiness, especially without adequate trade setups or systems in place.

A decisive breach below the 0.6433 support level could trigger a more pronounced downside move, potentially leading the Australian dollar towards the 0.63 level. Given the prevailing market dynamics, continued back-and-forth price action is expected, making it conducive for short-term range-bound trading strategies. After all, a lot of the market moves are going to be in the order of like 30 to 40 pips. This means that traders are very focused on short-term “micro moves.”

The Australian dollar's performance remains closely linked to global growth prospects, particularly in Asia, where economic conditions are somewhat subdued. Additionally, the currency's fortunes are intertwined with commodity prices, further influencing its trajectory. Meanwhile, the Federal Reserve's stance on interest rates, although hinting at potential cuts, has not yet materialized, bolstering the US dollar's strength to some extent.

At the end of the day, the Australian dollar grapples with persistent downward pressure amid a challenging market environment. While pockets of resilience are evident, the currency's trajectory remains uncertain, characterized by tight range-bound trading conditions. Traders must exercise caution and adapt their strategies accordingly to navigate the volatility in this market, which can get rough at times.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.