- The Aussie dollar has plunged after the Consumer Price Index in the United States came out hotter than anticipated.

- By doing so, this has people worried that the Federal Reserve may or may not cut rates this year, but quite frankly I still think that they do and more likely than not we will see some type of recovery.

- However, we also have to worry about inflation in America and therefore the short term might be very pro-US dollar.

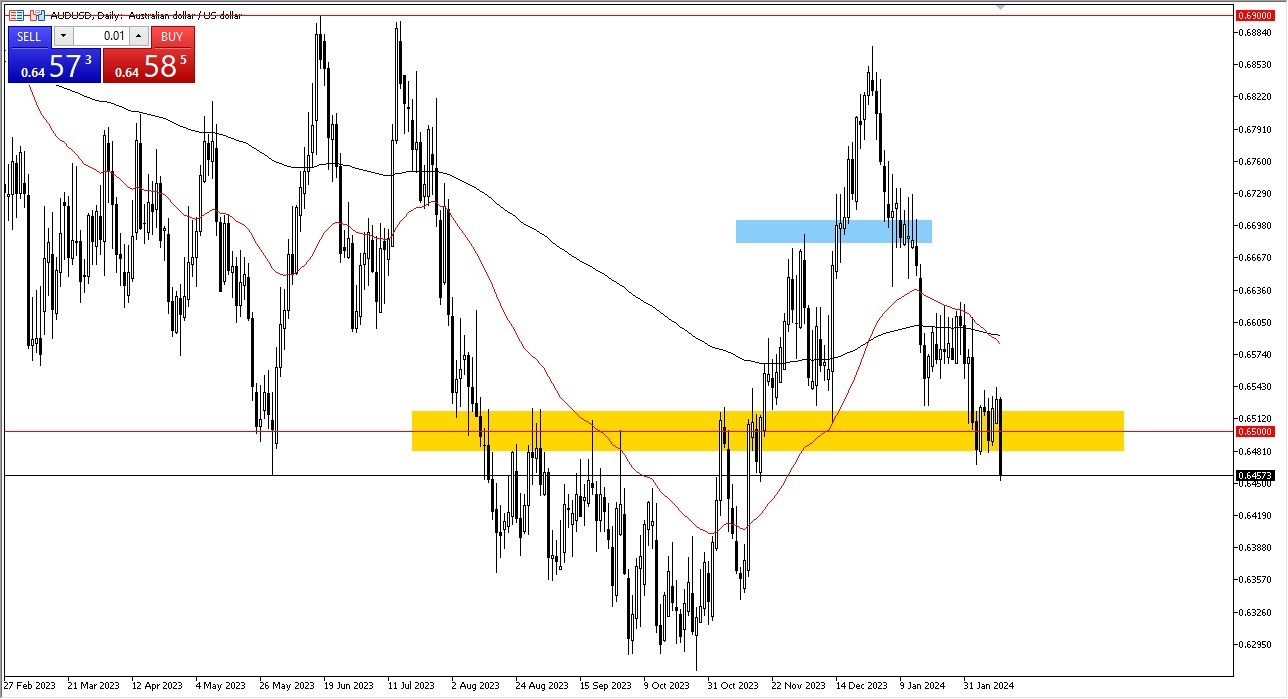

The 0.6450 Level

I’m looking at the 0.6450 level as an area that we need to pay close attention to, because if we close below that level, it opens up quite a bit of a trapdoor for this market, perhaps opening up the Australian dollar for a drop down to the 0.6350 level. One thing is for sure, the candlestick is very negative and therefore I think a lot of people will be paying close attention to it as a harbinger of further downward pressure.

Short-term rallies will end up being selling opportunities, with the 0.65 level being a major fulcrum for price. Furthermore, we have the 0.6550 level above there which has now proven itself to be massive resistance. That being said, if we were to break above that level it opens up the possibility of a move to the 50-Day EMA. The 50-Day EMA recently broke down below the 200-Day EMA, showing the so-called “death cross” that a lot of longer-term traders will pay attention to, as it determines a longer-term trend. That being said, it’s also a very noisy and unpredictable indication of what’s going on with the markets, so I think that given enough time, the reality is it’s just yet another thing to put in the back of your mind.

Ultimately, I still think that this market has support underneath, but the fact that we have plunged the way we have during the trading session on Tuesday opens up the possibility that we will continue to see a lot of negativity when it comes to risk appetite. Remember, the Australian dollar is highly sensitive to commodities and risk appetite in general, so a lot of this will come down to that function of the markets as well. Be cautious, but right now it looks like the sellers are starting to grab the market handles.

Ready to trade our daily Forex forecast? Here’s some of the top forex online trading Australia to check out.