- The Australian dollar, often referred to as the Aussie, appears to be facing some challenges in the current market conditions.

- On Tuesday, it became evident that the Aussie might be heading towards a potential decline.

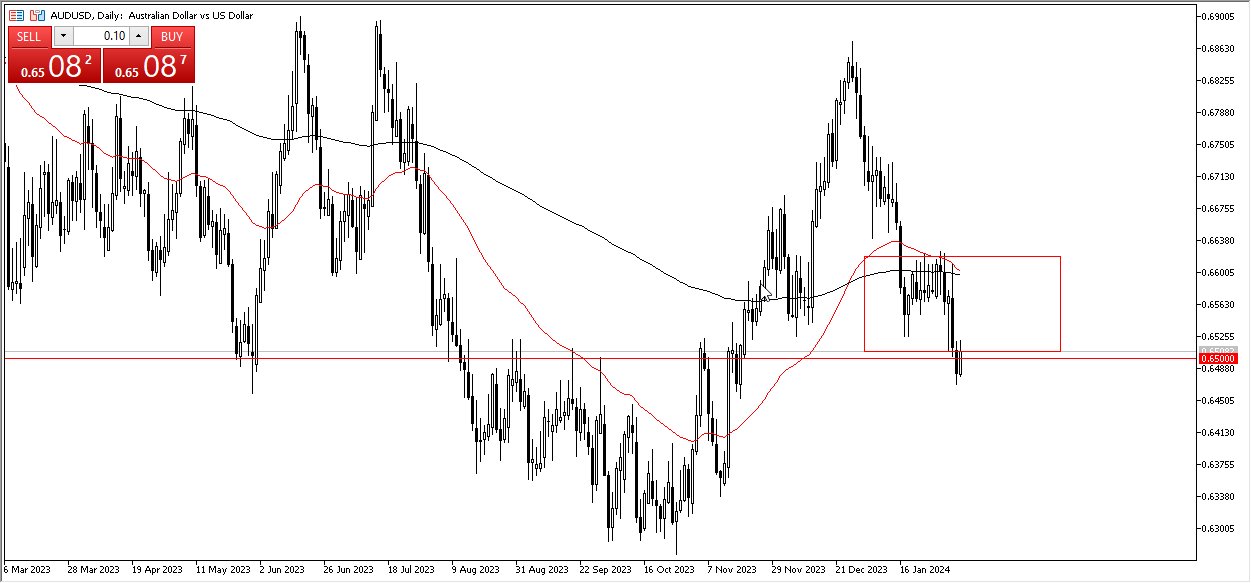

During the trading session on Tuesday, the AUD/USD pair initially attempted to rally but encountered resistance around the 0.65 level. This level has proven significant on several occasions in the past. The subsequent pullback from this point suggests that the Australian dollar could be in for a downward journey, potentially leading to an overall strengthening of the US dollar (USD) against other currencies.

USD Strength Everywhere

This shift towards USD strength is not isolated; the greenback has been gaining ground against most currencies, driven by a broader trend of risk aversion in the market. If the AUD/USD pair manages to break below the lows seen on Monday, it is likely to continue its descent towards the 0.6350 level. This level has seen significant trading activity before, indicating that historical market behavior might play a role if we drop to those levels again.

However, there is a glimmer of hope for the Aussie. If it manages to reverse its course and surpass the 0.6550 level, there could be an opportunity for it to climb towards the 0.6650 region. It is essential to note that the Australian dollar's performance is closely tied to the Asian economy, and recent underwhelming economic figures from China have not been favorable for its strength. Additionally, the Federal Reserve's reluctance to implement interest rate cuts puts further pressure on the Aussie against the USD.

Moreover, there are global geopolitical concerns that could potentially drive investors towards the US treasury market, thereby strengthening the US dollar. This interconnected web of factors suggests that the Australian dollar may face difficulties in the foreseeable future. Even if a rally were to occur, it is unlikely to breach the 0.6650 level. Traders may find opportunities to short the pair if signs of exhaustion emerge in that vicinity.

In the end, it appears that the US dollar is poised for a resurgence, at least in the short term. This aligns with the broader market sentiment, which favors safe-haven assets like the USD in times of uncertainty. The Australian dollar's performance is tethered to various economic and geopolitical factors, making it vulnerable to fluctuations in the global landscape. Investors and traders should carefully monitor these developments as they navigate the currency markets.

Ready to trade our Forex daily analysis and predictions? Here are the best currency trading platforms Australia to choose from.